Содержание

- 2. Basic info Lecturers and Tutors Lecturers Michal Mejstřík Magda Pečená Petr Teplý Tutors Karolína Vozková Matěj

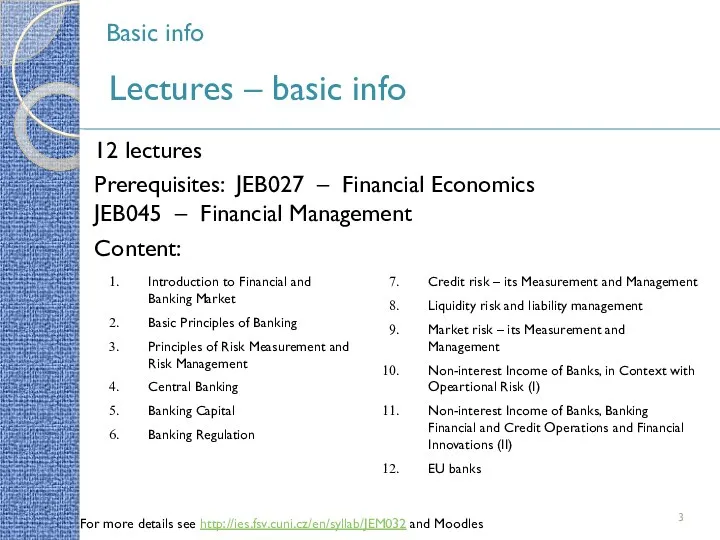

- 3. Basic info Lectures – basic info 12 lectures Prerequisites: JEB027 – Financial Economics JEB045 – Financial

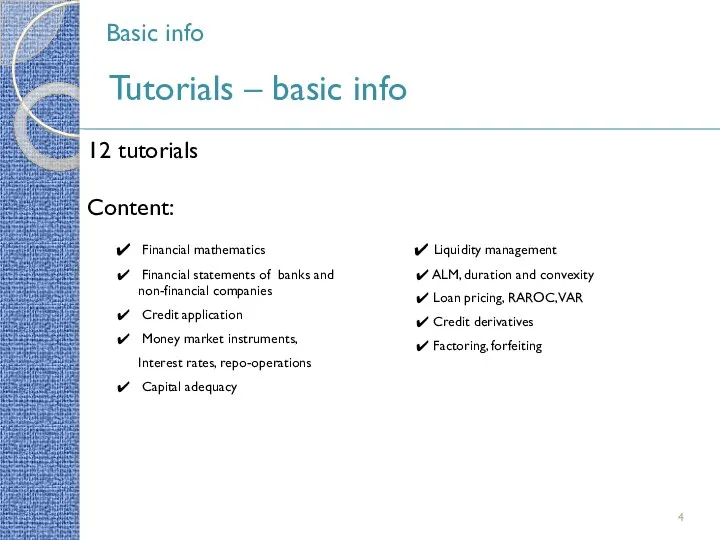

- 4. Basic info Tutorials – basic info 12 tutorials Content: Financial mathematics Financial statements of banks and

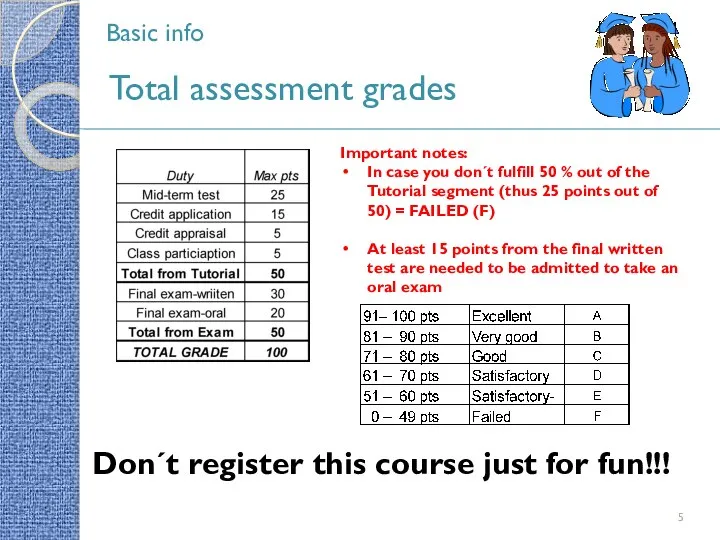

- 5. Basic info Total assessment grades Important notes: In case you don´t fulfill 50 % out of

- 6. Basic info Tutorial prerequisites Prerequisites: JEB027 – Financial Economics JEB045 – Financial Management Background in finance

- 7. Basic info Prerequisite: JEB027 - Economics fo Finance or equivalent course in finance

- 8. Basic info Tutorial requirements Mid-term test (25 pts) Credit application (15 pts) - teamwork Credit appraisal

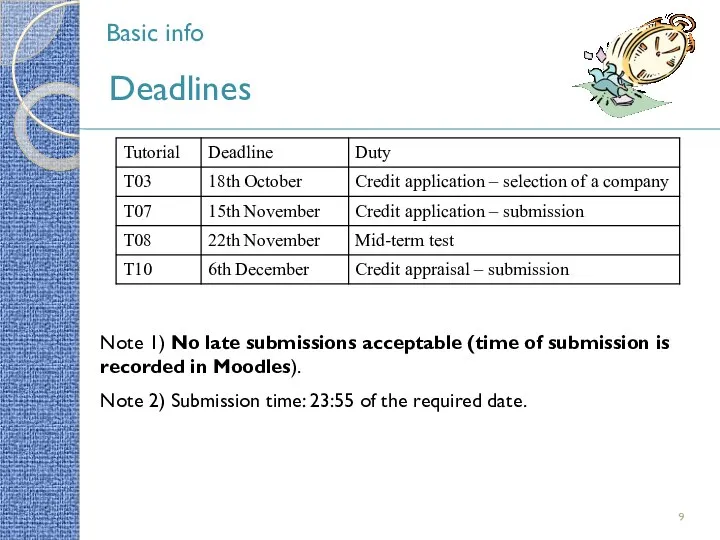

- 9. Basic info Deadlines Note 1) No late submissions acceptable (time of submission is recorded in Moodles).

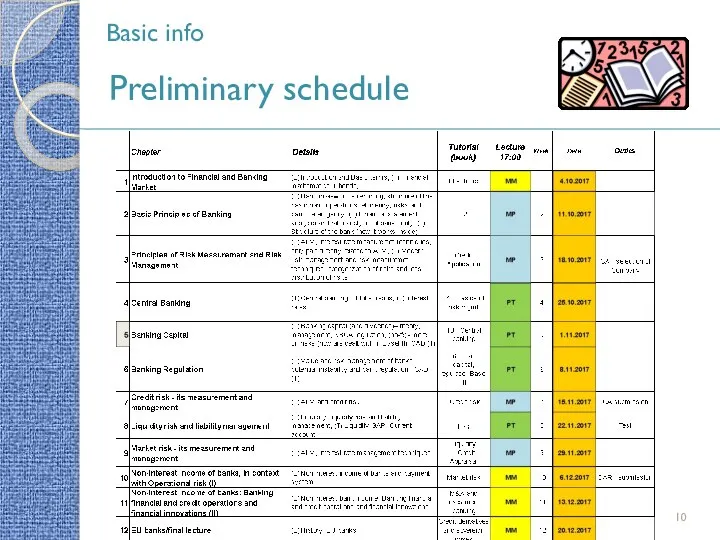

- 10. Basic info Preliminary schedule

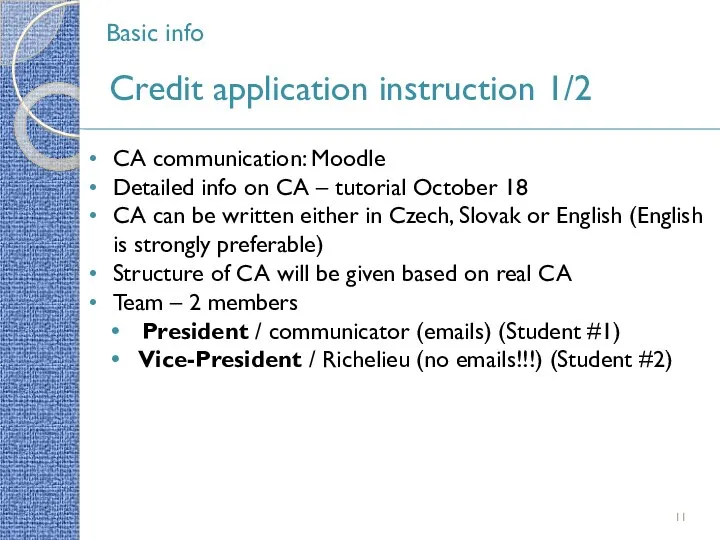

- 11. Basic info Credit application instruction 1/2 CA communication: Moodle Detailed info on CA – tutorial October

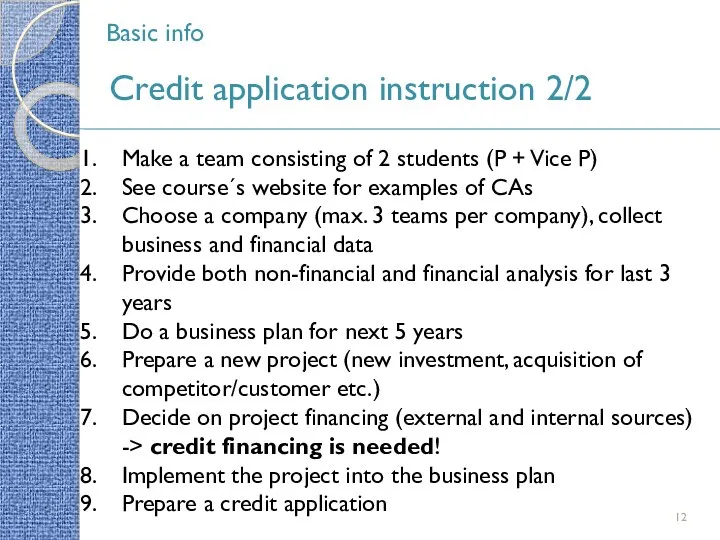

- 12. Basic info Credit application instruction 2/2 Make a team consisting of 2 students (P + Vice

- 13. Basic info Contacts FSVbanking@gmail.com Only questions that were not answered during the lecture, seminar or in

- 14. Basic info Communication rules Please always put a subject to your email Banking – credit application

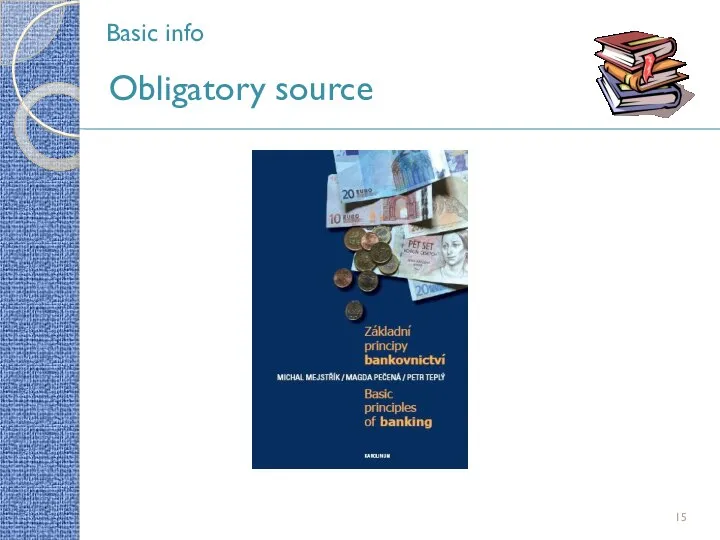

- 15. Basic info Obligatory source

- 16. Basic info Tutorials - warning Not for beginners Hard work Active participation required Strict policies on

- 17. Basic info If you are coming next time, here is your homework: Find your teammate for

- 19. Скачать презентацию

Вопросы применения процессуальных норм законодательства при установлении пенсий

Вопросы применения процессуальных норм законодательства при установлении пенсий Сутність грошей. Види грошей. Грошова маса та її показники

Сутність грошей. Види грошей. Грошова маса та її показники Банковское сопровождение

Банковское сопровождение Управление муниципальными финансами в регионе

Управление муниципальными финансами в регионе Регулювання ринку цінних паперів

Регулювання ринку цінних паперів Точка. Онлайн банк для предпринимателей

Точка. Онлайн банк для предпринимателей Audit Cup 2020

Audit Cup 2020 Услуги аутсорсинга бухгалтерии

Услуги аутсорсинга бухгалтерии თურქეთი,როგორც საქართველოს ბიზნეს პარტნიორი.,საგადასახადო. სისტემის თავისებურებები

თურქეთი,როგორც საქართველოს ბიზნეს პარტნიორი.,საგადასახადო. სისტემის თავისებურებები Актуальные проблемы личной финансовой безопасности

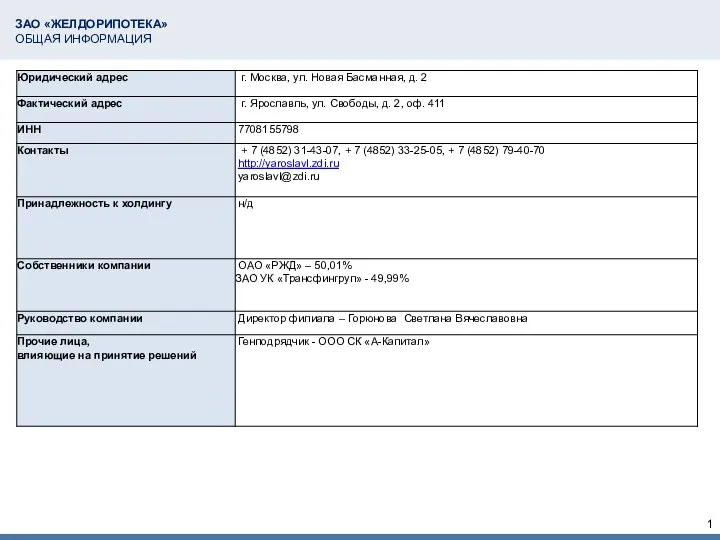

Актуальные проблемы личной финансовой безопасности ЗАО Желдорипотека. Общая информация

ЗАО Желдорипотека. Общая информация Банковские карты

Банковские карты Банк Возрождение. Программы финансирования для субъектов малого и среднего предпринимательства

Банк Возрождение. Программы финансирования для субъектов малого и среднего предпринимательства Инвентаризация: назначение и порядок ее проведения на примере ООО ОЛЕС

Инвентаризация: назначение и порядок ее проведения на примере ООО ОЛЕС Финансовые решения GAC final

Финансовые решения GAC final Рынок ценных бумаг. Облигации

Рынок ценных бумаг. Облигации Денежная система и инфляция

Денежная система и инфляция Денежно-кредитная политика: основные направления, инструменты, проблемы

Денежно-кредитная политика: основные направления, инструменты, проблемы Правовое регулирование отношений с иностранным элементом

Правовое регулирование отношений с иностранным элементом Aureus Nummus

Aureus Nummus Новое в отчете о деятельности КПК (кредитный потребительский кооператив) и в расчете финансовых нормативов

Новое в отчете о деятельности КПК (кредитный потребительский кооператив) и в расчете финансовых нормативов Дебиторская задолженность в деятельности предприятия

Дебиторская задолженность в деятельности предприятия Налоговая политика в РФ

Налоговая политика в РФ Концепция создания парка спорта Зенитка

Концепция создания парка спорта Зенитка Программа Стандарт АО Страховая компания МетЛайф

Программа Стандарт АО Страховая компания МетЛайф Решения фирмы 1С для финансового директора

Решения фирмы 1С для финансового директора Анализ использования трудовых ресурсов предприятия и фонда заработной платы

Анализ использования трудовых ресурсов предприятия и фонда заработной платы Акцизы

Акцизы