Содержание

- 2. Intro The term initial public offering (IPO) slipped into everyday speech during the tech bull market

- 3. Selling Stock An initial public offering, or IPO, is the first sale of stock by a

- 4. Private and public It usually isn't possible to buy shares in a private company. You can

- 5. Why Go Public? Going public raises cash, and usually a lot of it. Being publicly traded

- 6. Going public = sale The internet boom changed all this. Firms no longer needed strong financials

- 7. Going public = sale The internet boom changed all this. Firms no longer needed strong financials

- 8. Underwriting The Underwriting Process Getting a piece of a hot IPO is very difficult, if not

- 9. Negotiating The company and the investment bank will first meet to negotiate the deal. Items usually

- 10. Cooling off period Once all sides agree to a deal, the investment bank puts together a

- 11. Red herring and courtship During the cooling off period the underwriter puts together what is known

- 12. Finalization As the effective date approaches, the underwriter and company sit down and decide on the

- 13. Finalization As the effective date approaches, the underwriter and company sit down and decide on the

- 14. What is it for you? As you can see, the road to an IPO is a

- 15. What is it for you? As you can see, the road to an IPO is a

- 16. No History It's hard enough to analyze the stock of an established company. An IPO company

- 17. The Lock-Up Period If you look at the charts following many IPOs, you'll notice that after

- 18. Flipping Flipping is reselling a hot IPO stock in the first few days to earn a

- 19. Avoid the Hype It's important to understand that underwriters are salesmen. The whole underwriting process is

- 20. Tracking Stocks Tracking stocks appear when a large company spins off one of its divisions into

- 21. Tracking Stocks An initial public offering (IPO) is the first sale of stock by a company

- 22. Facebook Friday, May 18, 2012, was a big day for American tech giant Facebook. The social

- 23. AT&T Wireless AT&T Wireless, the mobile division of American telecommunications monolith AT&T, just barely squeaked in

- 24. Rosneft Always one to buck the global trend,Russia did it again when it took OAO Rosneft

- 25. The Bank of China The Bank of China (BOC) was a state-owned bank until it was

- 26. Deutsche Telekom When German telecommunications giant Deutsche Telekom AG issued its IPO on Nov. 17, 1996,

- 27. General Motors When do the taxpayers benefit from an IPO? When a company that owes its

- 28. Enel You may not have heard of Italian energy company Enel SpA, but you may have

- 29. VISA Ever since the consortium of banks that issued the first Visa card in 1977 became

- 30. NTT Mobile When NTT Mobile Communications, a giant in Japanese wireless phones, went public on the

- 32. Скачать презентацию

Intro

The term initial public offering (IPO) slipped into everyday speech during the tech bull

Intro

The term initial public offering (IPO) slipped into everyday speech during the tech bull

Selling Stock

An initial public offering, or IPO, is the first sale

Selling Stock

An initial public offering, or IPO, is the first sale

Private and public

It usually isn't possible to buy shares in a

Private and public

It usually isn't possible to buy shares in a

Why Go Public?

Going public raises cash, and usually a lot of

Why Go Public?

Going public raises cash, and usually a lot of

Because of the increased scrutiny, public companies can usually get better rates when they issue debt.

As long as there is market demand, a public company can always issue more stock. Thus,mergers and acquisitions are easier to do because stock can be issued as part of the deal.

Trading in the open markets means liquidity. This makes it possible to implement things likeemployee stock ownership plans, which help to attract top talent.

Being on a major stock exchange carries a considerable amount of prestige. In the past, only private companies with strong fundamentals could qualify for an IPO and it wasn't easy to get listed.

Going public = sale

The internet boom changed all this. Firms no

Going public = sale

The internet boom changed all this. Firms no

Going public = sale

The internet boom changed all this. Firms no

Going public = sale

The internet boom changed all this. Firms no

Underwriting

The Underwriting Process

Getting a piece of a hot IPO is very

Underwriting

The Underwriting Process

Getting a piece of a hot IPO is very

Negotiating

The company and the investment bank will first meet to negotiate

Negotiating

The company and the investment bank will first meet to negotiate

Cooling off period

Once all sides agree to a deal, the investment

Cooling off period

Once all sides agree to a deal, the investment

Red herring and courtship

During the cooling off period the underwriter puts

Red herring and courtship

During the cooling off period the underwriter puts

Finalization

As the effective date approaches, the underwriter and company sit down

Finalization

As the effective date approaches, the underwriter and company sit down

Finalization

As the effective date approaches, the underwriter and company sit down

Finalization

As the effective date approaches, the underwriter and company sit down

What is it for you?

As you can see, the road

What is it for you?

As you can see, the road

What is it for you?

As you can see, the road

What is it for you?

As you can see, the road

No History

It's hard enough to analyze the stock of an established

No History

It's hard enough to analyze the stock of an established

The Lock-Up Period

If you look at the charts following many IPOs,

The Lock-Up Period

If you look at the charts following many IPOs,

Flipping

Flipping is reselling a hot IPO stock in the first few days

Flipping

Flipping is reselling a hot IPO stock in the first few days

Avoid the Hype

It's important to understand that underwriters are salesmen. The

Avoid the Hype

It's important to understand that underwriters are salesmen. The

Tracking Stocks

Tracking stocks appear when a large company spins off one of its divisions

Tracking Stocks

Tracking stocks appear when a large company spins off one of its divisions

Tracking Stocks

An initial public offering (IPO) is the first sale of stock by

Tracking Stocks

An initial public offering (IPO) is the first sale of stock by

Broadly speaking, companies are either private or public. Going public means a company is switching from private ownership to public ownership.

Going public raises cash and provides many benefits for a company.

The dotcom boom lowered the bar for companies to do an IPO. Many startups went public without any profits and little more than a business plan.

Getting in on a hot IPO is very difficult, if not impossible.

The process of underwriting involves raising money from investors by issuing new securities.

Companies hire investment banks to underwrite an IPO.

The road to an IPO consists mainly of putting together the formal documents for the Securities and Exchange Commission (SEC) and selling the issue to institutional clients.

The only way for you to get shares in an IPO is to have a frequently traded account with one of the investment banks in the underwriting syndicate.

An IPO company is difficult to analyze because there isn't a lot of historical info.Lock-up periods prevent insiders from selling their shares for a certain period of time. The end of the lockup period can put strong downward pressure on a stock.

Flipping may get you blacklisted from future offerings.

Road shows and red herrings are marketing events meant to get as much attention as possible. Don't get sucked in by the hype.

A tracking stock is created when a company spins off one of its divisions into a separate entity through an IPO.

Don't consider tracking stocks to be the same as a normal IPO, as you are essentially a second-class shareholder.

Facebook

Friday, May 18, 2012, was a big day for American tech

Facebook

Friday, May 18, 2012, was a big day for American tech

AT&T Wireless

AT&T Wireless, the mobile division of American telecommunications monolith AT&T,

AT&T Wireless

AT&T Wireless, the mobile division of American telecommunications monolith AT&T,

The wireless division's affiliation with its well-known parent certainly didn't hurt its prospects. When trading began on the NYSE, AT&T Wireless released 360 million shares. Investors fell in step with underwriters' valuation of the stock, with shares opening at $30.12 and closing at $31.75; its pre-offer value was $29.50 [source: Portnoy and Jastrow].

By the time the bell rung to close the day on the exchange, AT&T Wireless had raked in $10.62 billion in new capital [source:BusinessWeek]. It set the record for the largest IPO in American history, a title the company would hold for six years.

Rosneft

Always one to buck the global trend,Russia did it again when it

Rosneft

Always one to buck the global trend,Russia did it again when it

A number of financiers balked at the IPO, considering it unethical. This didn't stop Russia from offering the stock -- and other investors on the Moscow and London exchanges from buying it. When OAO Rosneft went public on July 13, 2006, it attracted $10.65 billion in capital, with shares underwritten by bankers like JPMorgan and Morgan Stanley [source: BusninessWeek].

OAO Rosneft released 1.38 billion shares of itself, valued at $7.55 apiece [source: Bloomberg]. The IPO fell about $1 billion short of the company's hope to raise $11.6 billion.

The Bank of China

The Bank of China (BOC) was a state-owned bank until it was

The Bank of China

The Bank of China (BOC) was a state-owned bank until it was

The bank issued 25.57 billion shares, comprising just 10.5 percent of the BOC, at the equivalent of about 38 cents apiece [source: Lague]. The shares sold rapidly, despite reports of 75 cases of fraud and corruption among the bank's leaders the year before. All told, Bank of China's IPO was the biggest offering in six years.

Deutsche Telekom

When German telecommunications giant Deutsche Telekom AG issued its IPO on Nov.

Deutsche Telekom

When German telecommunications giant Deutsche Telekom AG issued its IPO on Nov.

Trading on the European exchange began on Nov. 17, 1996, and raised the value of the stock to $22.45. Investors who bought the stock as trading began and sold it an hour later made a 19 percent profit for their trouble [source: Ascarelli].

Trading of what came to be one of the hottest telecom stocks in Europe at the beginning of the dot-com bubble was heavy. It was so heavy, in fact, that the European exchange extended their daily trading hours until 7 p.m. for a full week following Deutsche Telekom's IPO [source: Ascarelli].

General Motors

When do the taxpayers benefit from an IPO? When a

General Motors

When do the taxpayers benefit from an IPO? When a

In December 2008, President George W. Bush threw a $50 billion lifeline to General Motors, which had been struggling (along with other American automakers) in the wake of the global economic downturn that started in 2007. Unfortunately, that assistance didn't do much to keep GM from filing for Chapter 11 bankruptcy in June 2009. As part of the company restructuring that usually follows a Chapter 11 filing, the U.S. Treasury Department agreed to loan the company another $30 billion -- in exchange for a 60-percent stake in the company once it got back on its feet [source: ProPublica]. By the following month, the newly reformed GM was ready to start operations once more.

By the following year, GM was one of the hottest companies on the planet. Investors couldn't wait to buy their way in -- and the company knew it: Less than a week before its November 2010 IPO, the company's shareholders raised the estimated share price from between $26 and $29 per share to between $32 and $33 a share [source:Isidore]. When GM finally went public on Nov. 19, 2010, the automaker raised a staggering $15.8 billion, making it the second-largest IPO in U.S. history. That cash infusion helped GM repay nearly half of its initial $50 billion bailout, which resulted in nearly $700 billion in federal revenue [source: ProPublica]. That should make the taxpayers very, very happy.

Enel

You may not have heard of Italian energy company Enel SpA,

Enel

You may not have heard of Italian energy company Enel SpA,

It seems that none of this was lost on investors when Enel SpA went public on Nov. 2, 1999. The formerly state-owned company was privatized just ahead of Italy's move to adopt the euro as its currency. Its IPO of 31.7 percent of the publicly traded company (3.8 billion shares) raised $16.58 billion in capital for the firm, representing 10 percent of the value of the Milan-30 blue chip business index [source: BusinessWeek].

VISA

Ever since the consortium of banks that issued the first Visa card in

VISA

Ever since the consortium of banks that issued the first Visa card in

On Tuesday, March 18, 2008, Visa made its initial public offering on the New York Stock Exchange. Despite going public amid the beginning of the global financial crisis, Visa managed to rack up $17.9 billion in capital. By the end of the day, the company's stock traded at $44 a share [source: Benner]. The following day, it traded at $66 [source: Kaufman].

One reason Visa's IPO was so successful was the scrupulousness with which underwriters JPMorgan and Goldman Sachs eyed buyers. The bankers vetted out investors who might have flipped the shares they bought. Quick resales would have harmed the company's capital accumulation, since the market could have become flooded with already-purchased stocks.

Visa's IPO marked the largest in U.S. history at the time, demolishing AT&T's six-year-old record of $10.6 billion.

NTT Mobile

When NTT Mobile Communications, a giant in Japanese wireless phones, went

NTT Mobile

When NTT Mobile Communications, a giant in Japanese wireless phones, went

The initial pre-offering value for shares in the company was 3.9 million yen; by the end of the day, they had risen to a close of 4.65 million yen. By the time the bell had rung to end the day on the Nikkei, NTT Mobile had amassed $18.4 billion in capital -- in one day. It was the largest IPO in world history [source: NYSE].

Not a bad stock to purchase considering just over a decade earlier NTT Mobile's parent company, Nippon Telegraph and Telephone, had managed to raise more than $13 billion during its own IPO in 1986.

Доходный подход в оценке земельных участков (часть 2)

Доходный подход в оценке земельных участков (часть 2) Внедрение практики инициативного бюджетирования в Новгородской области. Проект поддержки местных инициатив

Внедрение практики инициативного бюджетирования в Новгородской области. Проект поддержки местных инициатив Финансирование деятельности по управлению рисками

Финансирование деятельности по управлению рисками Основные налоги с юридических и физических лиц. Акцизы

Основные налоги с юридических и физических лиц. Акцизы Накопительная пенсия

Накопительная пенсия Презентация Основы аудита дополненная

Презентация Основы аудита дополненная Установление финансовой организацией необоснованно высокой цены или необоснованно низкой цены финансовых услуг

Установление финансовой организацией необоснованно высокой цены или необоснованно низкой цены финансовых услуг Себестоимость производства

Себестоимость производства Иностранные инвестиции в экономику РФ. Защита иностранных инвесторов

Иностранные инвестиции в экономику РФ. Защита иностранных инвесторов Финансовая система

Финансовая система Совершенствование экономико-правового механизма функционирования коммерческого банка

Совершенствование экономико-правового механизма функционирования коммерческого банка Назначение и принципы бухгалтерского учета. Тема 1

Назначение и принципы бухгалтерского учета. Тема 1 Вартісне вимірювання об’єктів бухгалтерського обліку: оцінка і калькулювання

Вартісне вимірювання об’єктів бухгалтерського обліку: оцінка і калькулювання Развитие индустриальных парков и технопарков

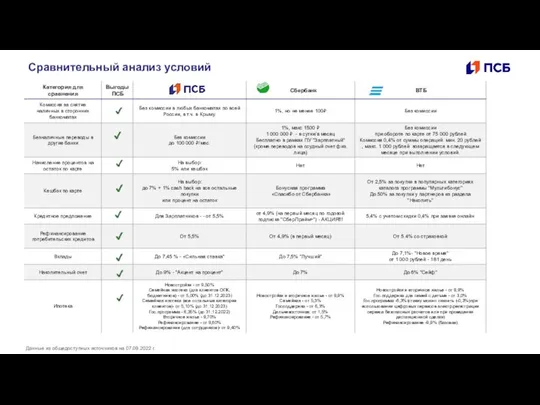

Развитие индустриальных парков и технопарков 2_5246750770556050592

2_5246750770556050592 Анализ локального рынка цен жилой недвижимости в г. Кисловодск

Анализ локального рынка цен жилой недвижимости в г. Кисловодск Бухгалтерский учет. Курс лекции

Бухгалтерский учет. Курс лекции Деньги инфляция

Деньги инфляция Защита должников. Законодательство РФ в сфере кредитования

Защита должников. Законодательство РФ в сфере кредитования Двусторонние инструменты защиты и стимулирования инвестиций

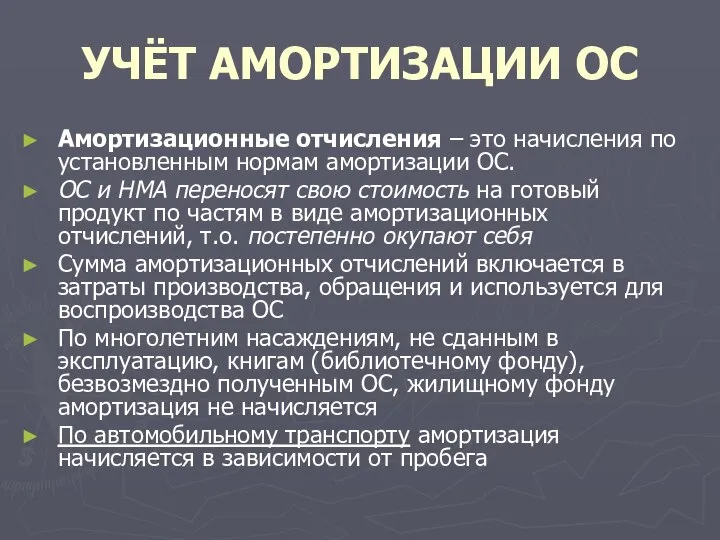

Двусторонние инструменты защиты и стимулирования инвестиций Амортизационные отчисления

Амортизационные отчисления Домовой классический : описание продукта, основные понятия, тарифы. Лекция 3

Домовой классический : описание продукта, основные понятия, тарифы. Лекция 3 Налоги по способу взимания, по субъектам, по характеру налоговых ставок

Налоги по способу взимания, по субъектам, по характеру налоговых ставок Основы финансовой и бюджетной системы в Российской Федерации, применительно к закупкам

Основы финансовой и бюджетной системы в Российской Федерации, применительно к закупкам Личное страхование. Лекция 6

Личное страхование. Лекция 6 Центральный банк России

Центральный банк России Инвестиции. Венчурное финансирование

Инвестиции. Венчурное финансирование Государственная поддержка животноводства

Государственная поддержка животноводства