Содержание

- 2. Agenda What Me Save? Guide Saving for Retirement Understanding Your Group Plan Developing Your Investment Strategy

- 3. Saving For Retirement

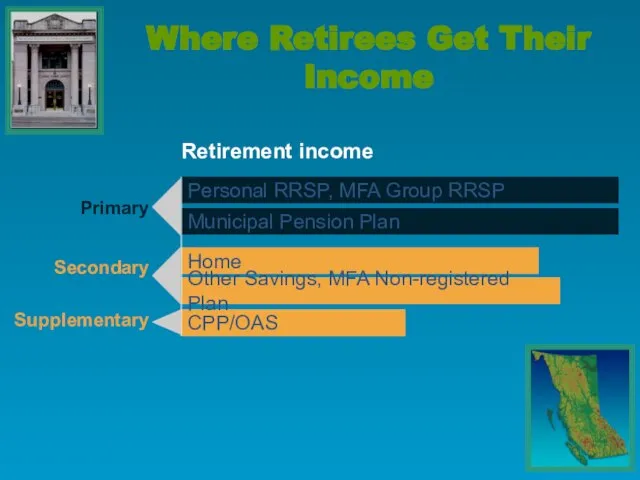

- 4. Where Retirees Get Their Income Retirement income Primary Secondary Supplementary CPP/OAS Home Other Savings, MFA Non-registered

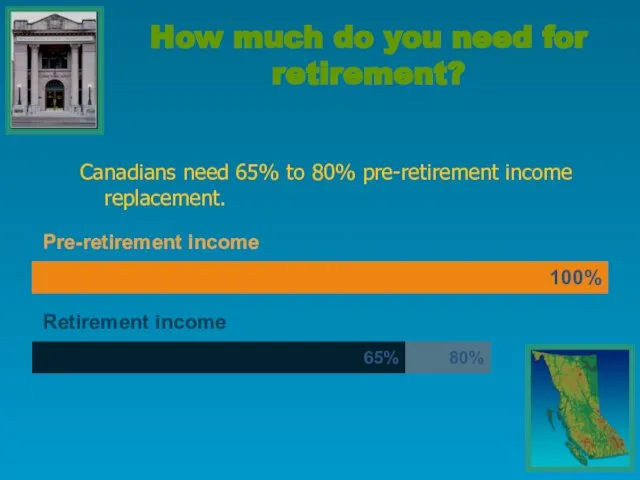

- 5. How much do you need for retirement? Canadians need 65% to 80% pre-retirement income replacement. Pre-retirement

- 6. What? Me Save?

- 7. Retirement savings worksheet Hardcopy or online

- 8. Making the most of your plan

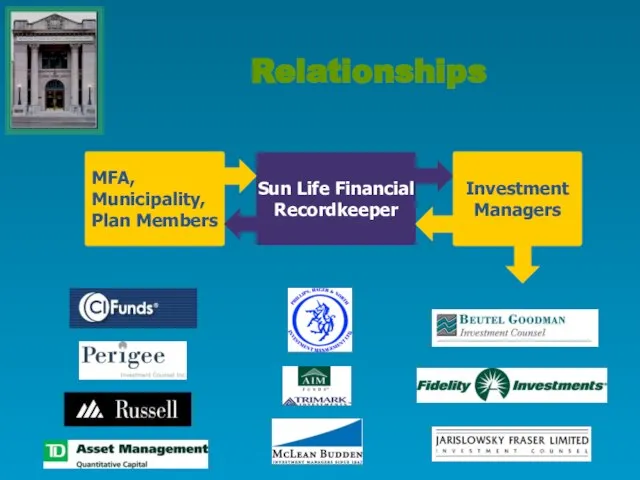

- 9. Relationships MFA, Municipality, Plan Members Sun Life Financial Recordkeeper Investment Managers

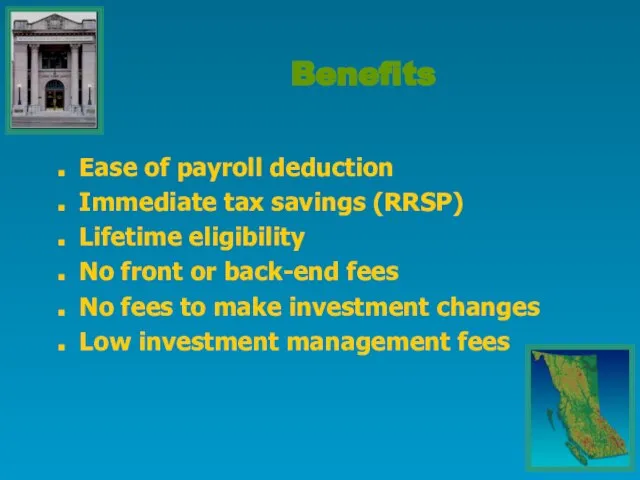

- 10. Ease of payroll deduction Immediate tax savings (RRSP) Lifetime eligibility No front or back-end fees No

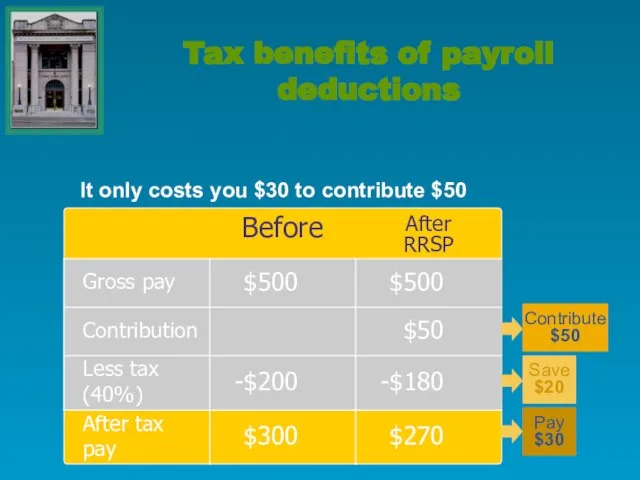

- 11. Tax benefits of payroll deductions It only costs you $30 to contribute $50 Save $20 Contribute

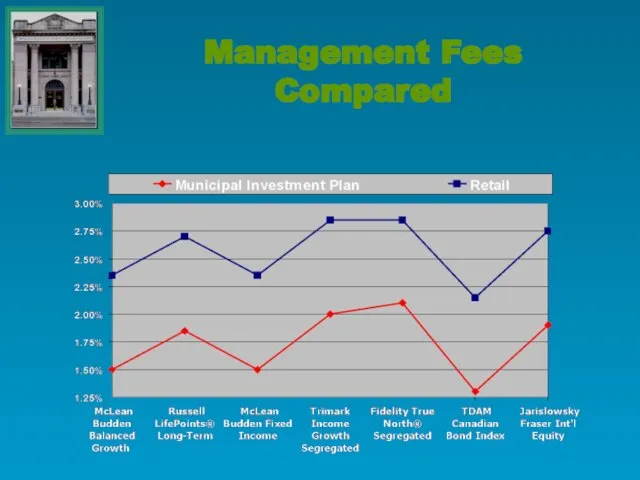

- 12. Management Fees Compared

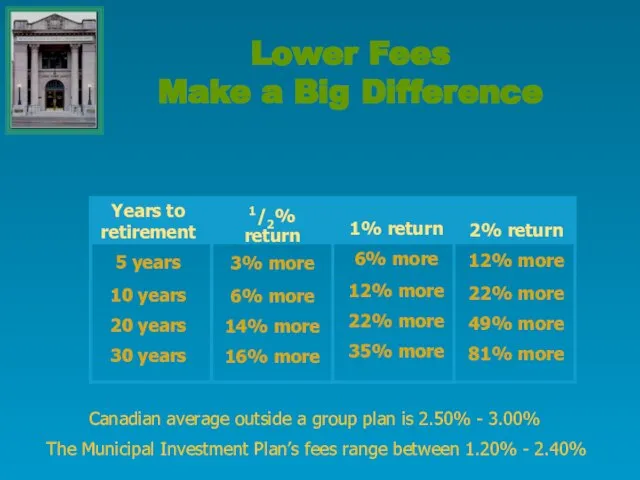

- 13. The Municipal Investment Plan’s fees range between 1.20% - 2.40% Lower Fees Make a Big Difference

- 14. Useful for employees with no RRSP room No maximum contribution limits Foreign content limit does not

- 15. You make the contributions You receive the tax deduction Your spouse owns the plan and directs

- 16. RRSP Spousal Account = Income Splitting Reasons for spousal account Your spouse is in lower tax

- 17. Things you should know…. Lump Sum Contributions and Transfers In Allowed Lifetime eligibility (even if your

- 18. Payroll deduction (if municipality opts in) Lump sum payments Monthly contributions through the MFA Transfer in

- 19. Developing Your Investment Strategy

- 20. Investment Types (Asset Classes) Equities (Stocks) Ownership in company Share in company profits Canadian or foreign

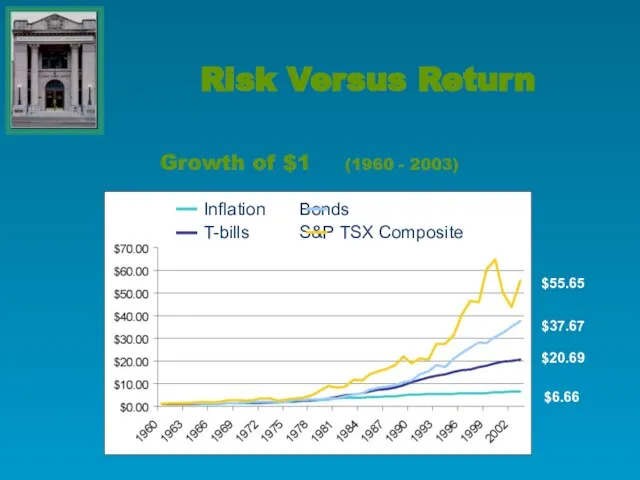

- 21. Growth of $1 (1960 - 2003) Risk Versus Return

- 22. Source: Westcore Funds / Denver Investment Advisers LLC, 1998 The Cycle of Market Emotions

- 23. Timing the Market

- 24. Objective to produce returns that replicate a particular index (e.g. S&P 500) No surprises, consistent with

- 25. Value Manager looking for a bargain when buying stocks May take some time to prove their

- 26. Buys stock in companies that tend to grow faster than others Technology companies were “growth” stocks

- 27. Specialty Funds Beutel Goodman Small Cap

- 28. Select ONE balanced fund best suited to your objectives Rebalancing and foreign content monitored for you

- 29. Russell LifePoints ® Conservative Moderate Aggressive

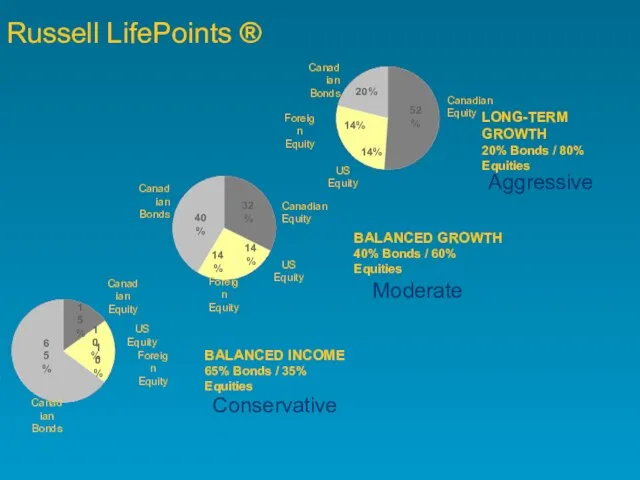

- 30. Investment Risk Questionnaire Hardcopy or online

- 31. Choosing and Monitoring your investments

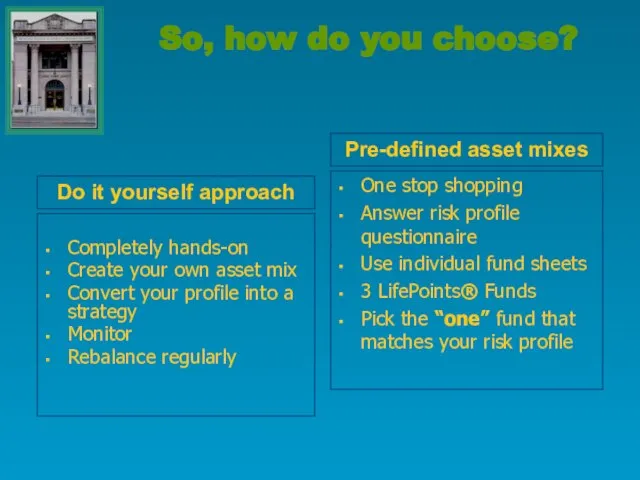

- 32. So, how do you choose? Completely hands-on Create your own asset mix Convert your profile into

- 33. Monitor Your Investments Revisit your strategy periodically Will change over time Rebalance your portfolio OR choose

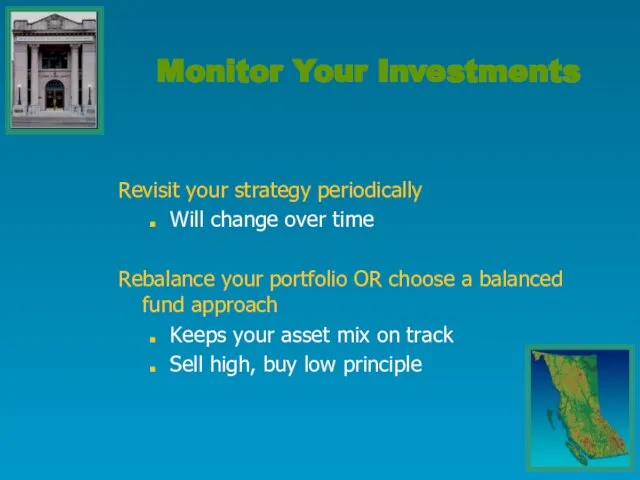

- 34. Stay Informed – Personal Statements Semi-Annual Easy to read Personal rates of return Transaction history Plan

- 35. Customer Care Centre 1-866-733-8613 Account balances Rates of return Transfer between funds Market information Enrolment assistance

- 36. Your Next Steps Complete the Investor Risk Profile - What? Me Save? Guide (Pages 20-23) Review

- 38. Скачать презентацию

Бухгалтерский учет и анализ отчетности малых предприятий на примере ООО Индустрия М

Бухгалтерский учет и анализ отчетности малых предприятий на примере ООО Индустрия М Биржевая торговля. Понятие организованного рынка

Биржевая торговля. Понятие организованного рынка Продажа квартиры государству

Продажа квартиры государству Российский коммерческий банк Сберба́нк

Российский коммерческий банк Сберба́нк Понятие счетной палаты РФ

Понятие счетной палаты РФ Что такое налоги. Виды налогов

Что такое налоги. Виды налогов Методы оценки эффективности инвестиционного проекта

Методы оценки эффективности инвестиционного проекта Инвестиции в криптовалюту

Инвестиции в криптовалюту Пенсия военнослужащих за выслугу лет

Пенсия военнослужащих за выслугу лет Государственная поддержка субъектов малого и среднего предпринимательства на территории Омской области в 2016 году

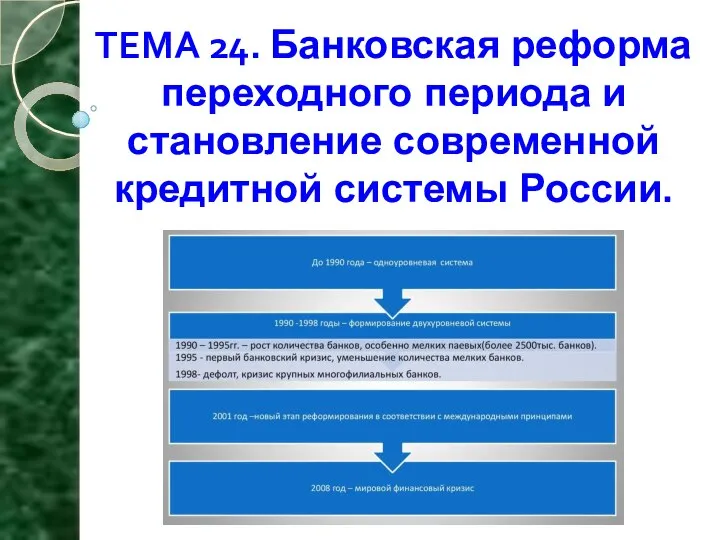

Государственная поддержка субъектов малого и среднего предпринимательства на территории Омской области в 2016 году Банковская реформа переходного периода и становление современной кредитной системы России

Банковская реформа переходного периода и становление современной кредитной системы России Исправление ошибок в документах

Исправление ошибок в документах Повышение исполнительской дисциплины по соблюдению нормативных требований предоставления жилищно-коммунальных услуг

Повышение исполнительской дисциплины по соблюдению нормативных требований предоставления жилищно-коммунальных услуг Инвестиции вам не нужны, или презентация проектов инвесторам

Инвестиции вам не нужны, или презентация проектов инвесторам Нематериальные активы предприятия

Нематериальные активы предприятия Долгосрочная финансовая политика

Долгосрочная финансовая политика 私校退休自主投資 理財說明會

私校退休自主投資 理財說明會 Экономика современной семьи

Экономика современной семьи Обеспечение реализации прав граждан в сфере пенсионного обеспечения и социальной защиты

Обеспечение реализации прав граждан в сфере пенсионного обеспечения и социальной защиты Финансовая политика государства

Финансовая политика государства План счетов

План счетов Учет оптовых закупок

Учет оптовых закупок Резервы по сомнительным долгам

Резервы по сомнительным долгам Формирование транспортно-распорядительной логистической инфраструктуры. Терминальнологистические центры (ТРЦ). (Лекция 3)

Формирование транспортно-распорядительной логистической инфраструктуры. Терминальнологистические центры (ТРЦ). (Лекция 3) Страхование от перерывов в производстве

Страхование от перерывов в производстве Себестоимость

Себестоимость Инвестиционный проект: строительство ЦБК Сегежа Запад

Инвестиционный проект: строительство ЦБК Сегежа Запад Рынок ценных бумаг

Рынок ценных бумаг