Содержание

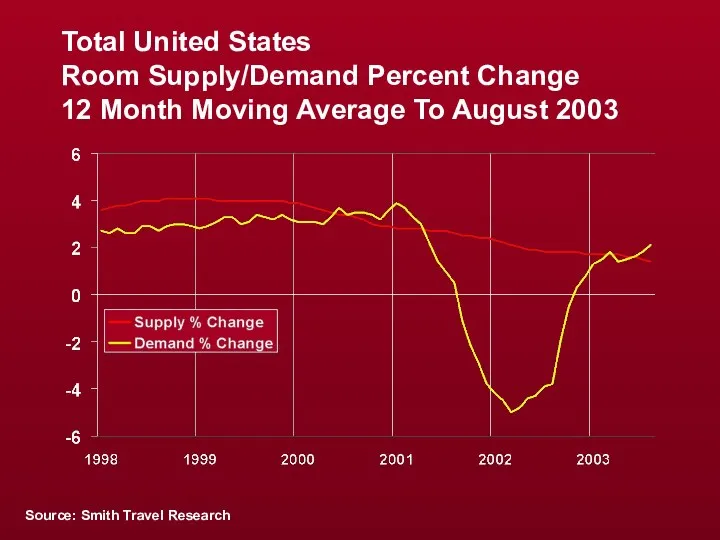

- 2. Total United States Room Supply/Demand Percent Change 12 Month Moving Average To August 2003 Source: Smith

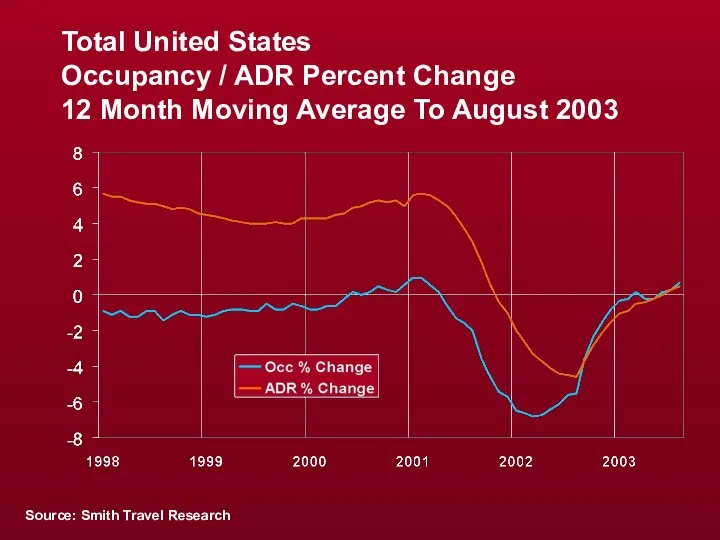

- 3. Total United States Occupancy / ADR Percent Change 12 Month Moving Average To August 2003 Source:

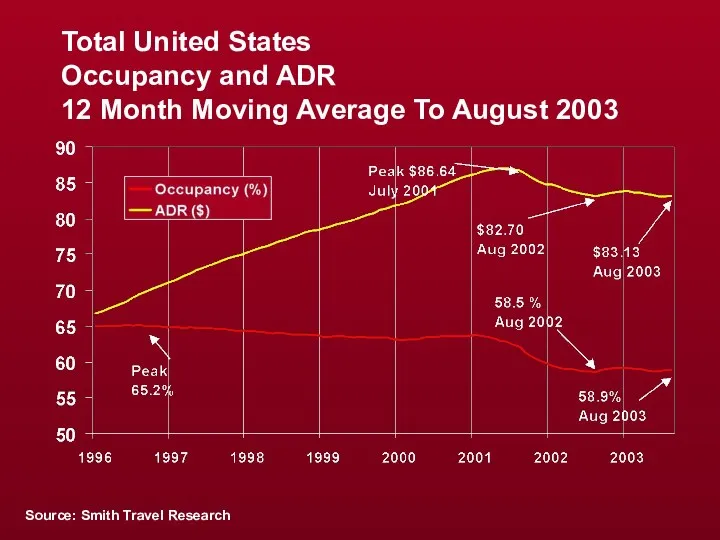

- 4. Total United States Occupancy and ADR 12 Month Moving Average To August 2003 Source: Smith Travel

- 5. Total U.S. Monthly Occupancy Year-Over-Year Aug 2001 – Aug 2003 Source: Smith Travel Research

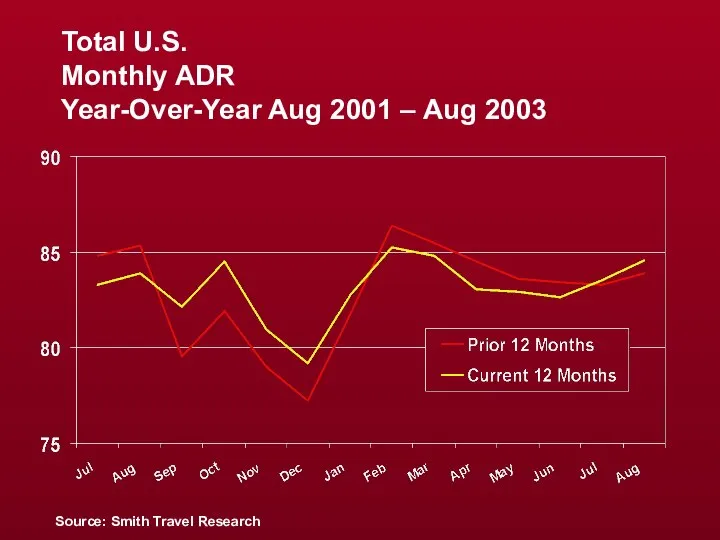

- 6. Total U.S. Monthly ADR Year-Over-Year Aug 2001 – Aug 2003 Source: Smith Travel Research

- 7. Total U.S. Monthly RevPar Year-Over-Year Aug 2001 – Aug 2003 Source: Smith Travel Research

- 8. Total U.S. Daily Occupancy* Sep 13 YTD 2000 - 2003 * Excluding Sunday

- 9. Total U.S. Average Daily Room Revenue (M) Sep 13 YTD 2000 - 2003 In Millions *

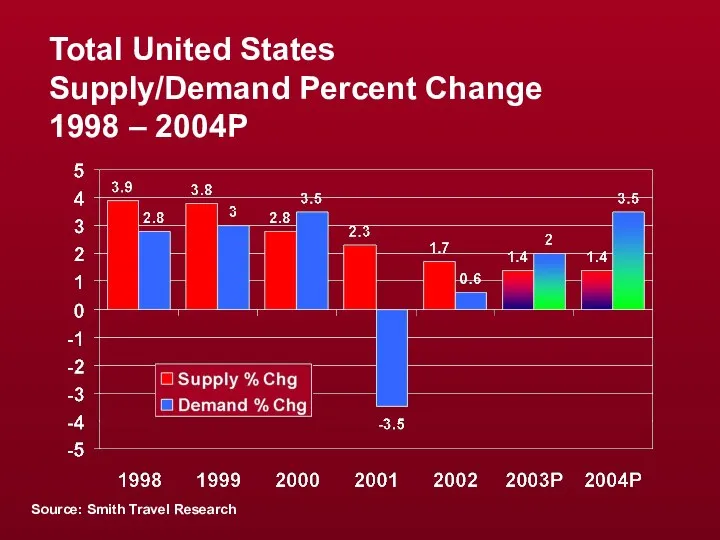

- 10. Total United States Supply/Demand Percent Change 1998 – 2004P Source: Smith Travel Research

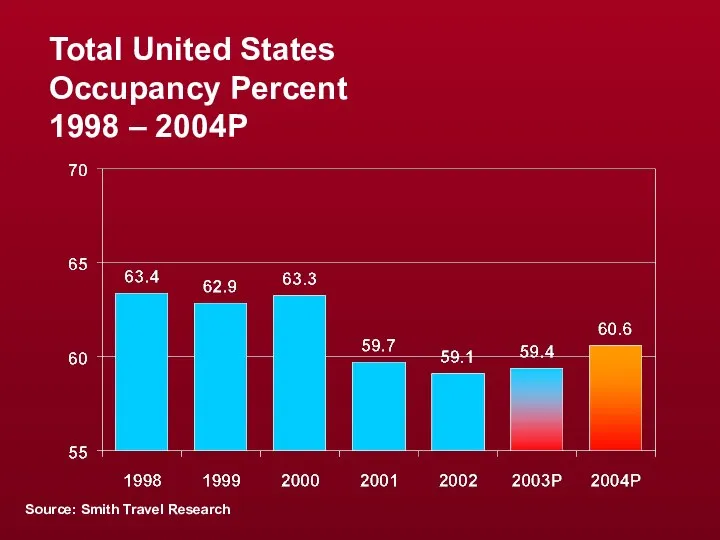

- 11. Total United States Occupancy Percent 1998 – 2004P Source: Smith Travel Research

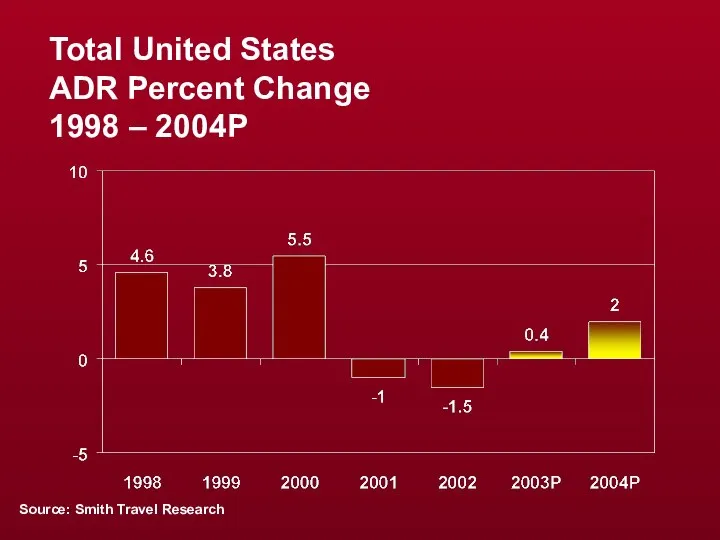

- 12. Total United States ADR Percent Change 1998 – 2004P Source: Smith Travel Research

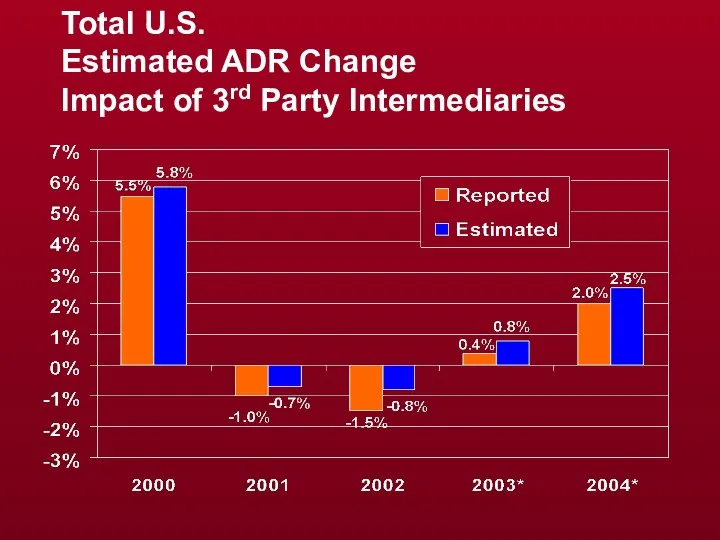

- 13. Total U.S. Estimated ADR Change Impact of 3rd Party Intermediaries

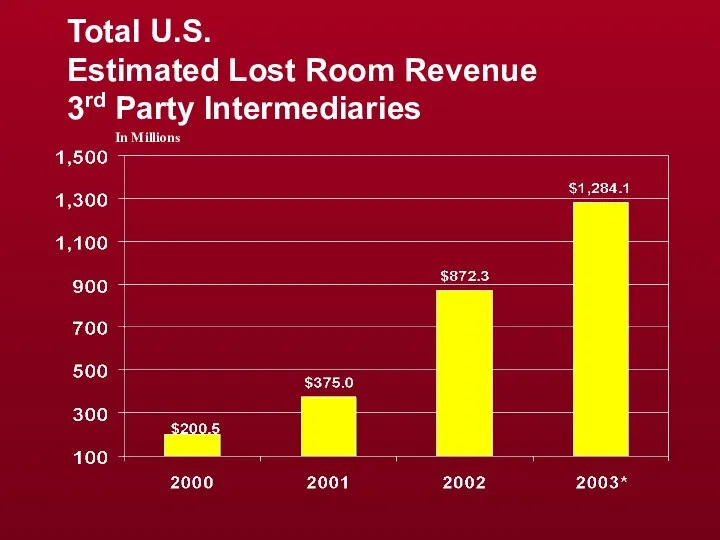

- 14. Total U.S. Estimated Lost Room Revenue 3rd Party Intermediaries In Millions

- 15. New England Lodging Market

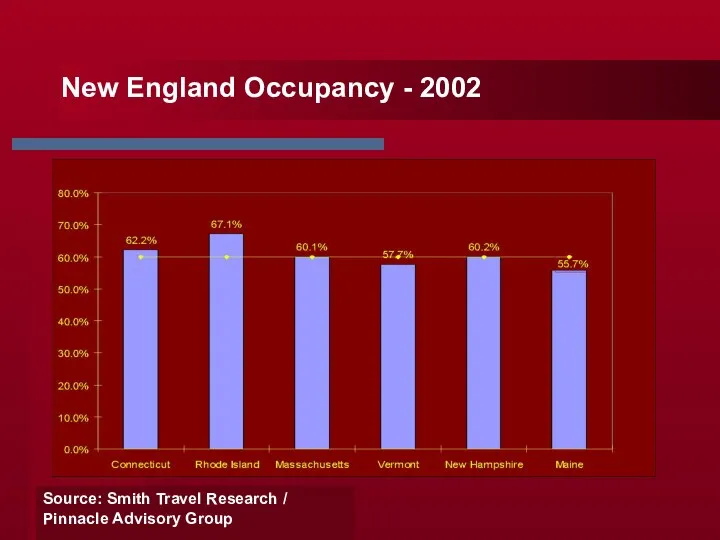

- 16. New England Occupancy - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

- 17. New England Average Daily Rate – 2002 Source: Smith Travel Research / Pinnacle Advisory Group

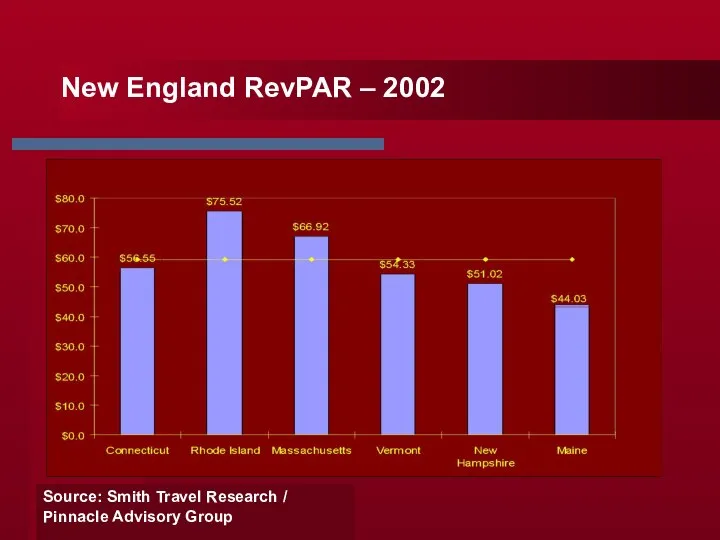

- 18. New England RevPAR – 2002 Source: Smith Travel Research / Pinnacle Advisory Group

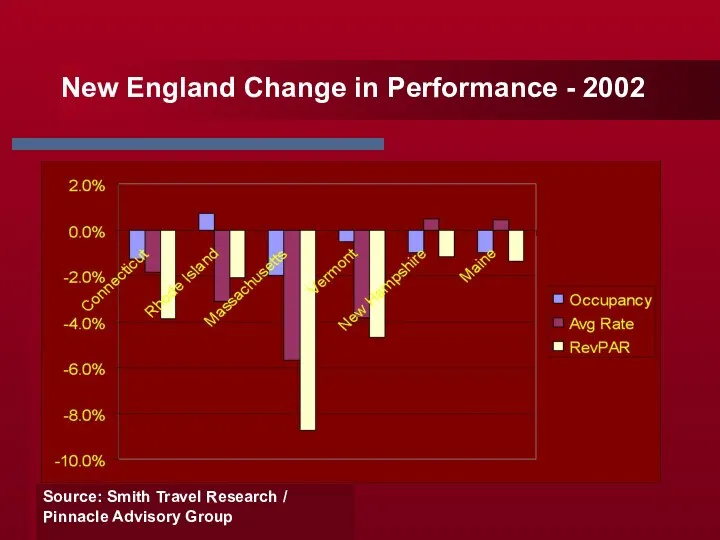

- 19. New England Change in Performance - 2002 Source: Smith Travel Research / Pinnacle Advisory Group

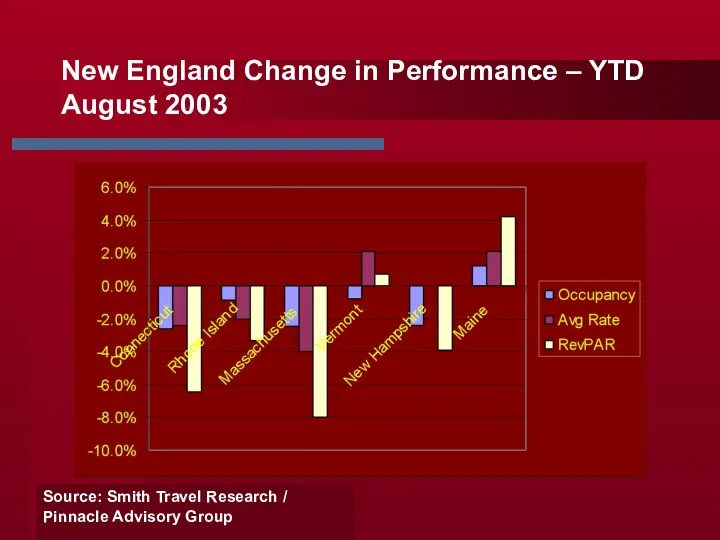

- 20. New England Change in Performance – YTD August 2003 Source: Smith Travel Research / Pinnacle Advisory

- 21. New Hampshire Lodging Market

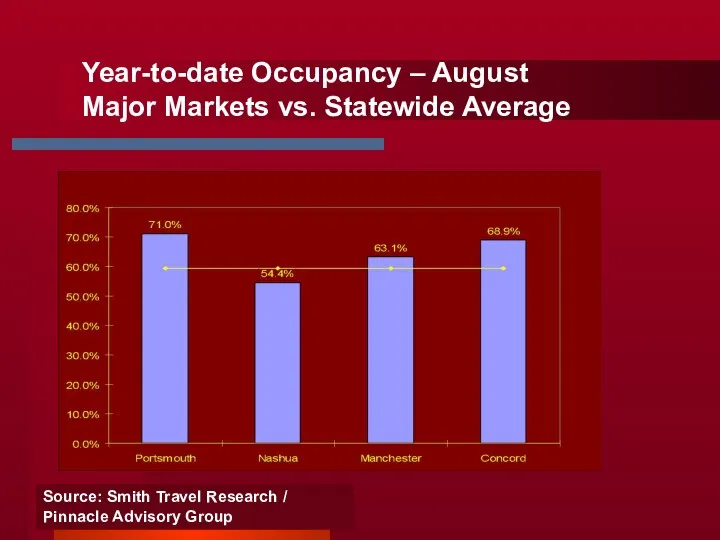

- 22. Year-to-date Occupancy – August Major Markets vs. Statewide Average Source: Smith Travel Research / Pinnacle Advisory

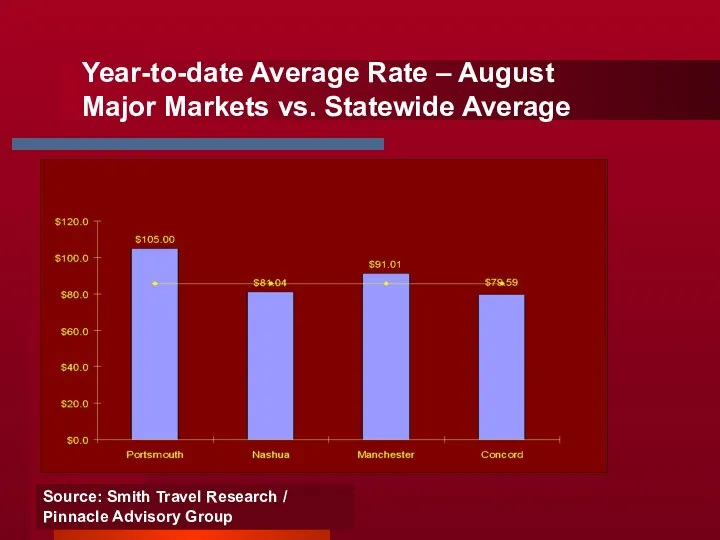

- 23. Year-to-date Average Rate – August Major Markets vs. Statewide Average Source: Smith Travel Research / Pinnacle

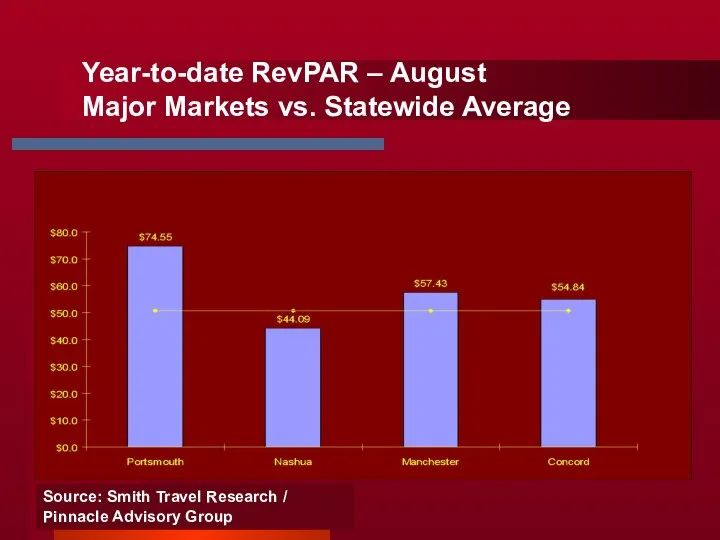

- 24. Year-to-date RevPAR – August Major Markets vs. Statewide Average Source: Smith Travel Research / Pinnacle Advisory

- 25. Change In Performance by Market YTD Aug 2003 Source: Smith Travel Research / Pinnacle Advisory Group

- 26. Portsmouth Lodging Market

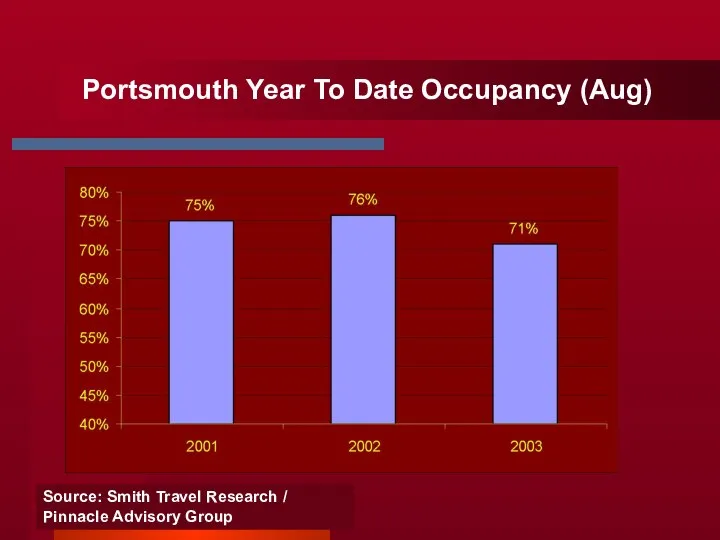

- 27. Portsmouth Year To Date Occupancy (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

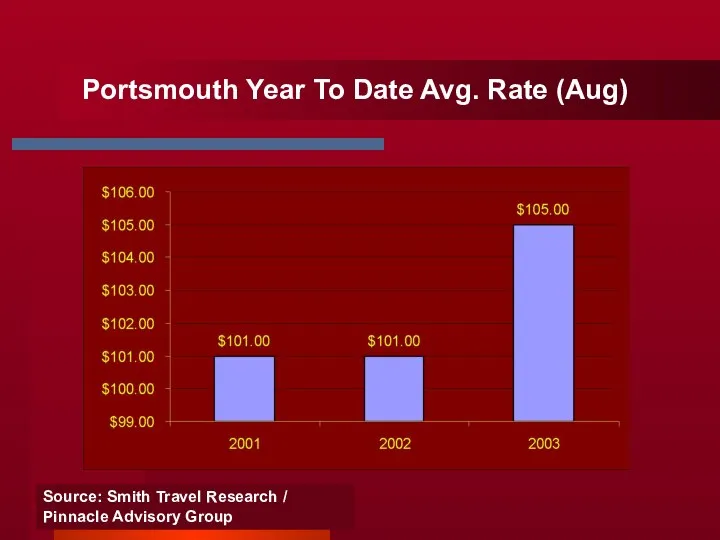

- 28. Portsmouth Year To Date Avg. Rate (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 29. Portsmouth Year To Date RevPAR (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

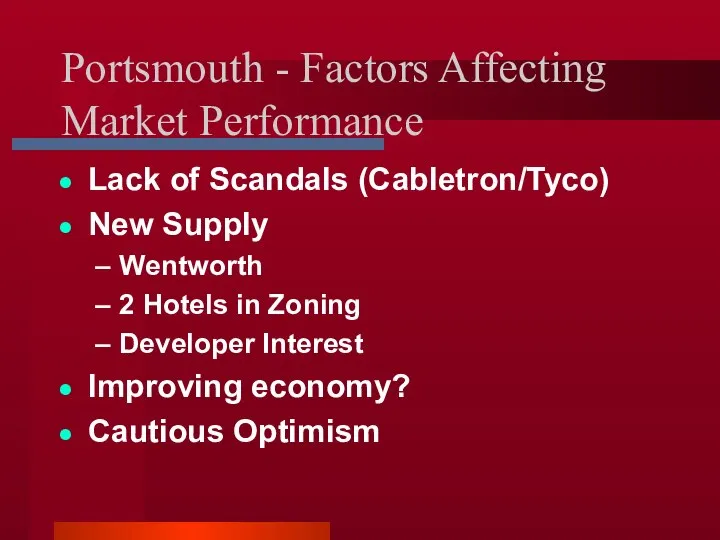

- 30. Portsmouth - Factors Affecting Market Performance Lack of Scandals (Cabletron/Tyco) New Supply Wentworth 2 Hotels in

- 31. Nashua / Merrimack Lodging Market

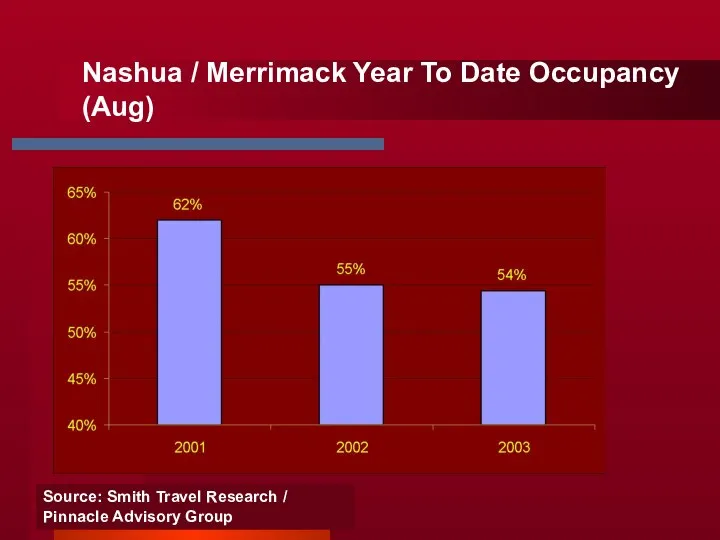

- 32. Nashua / Merrimack Year To Date Occupancy (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

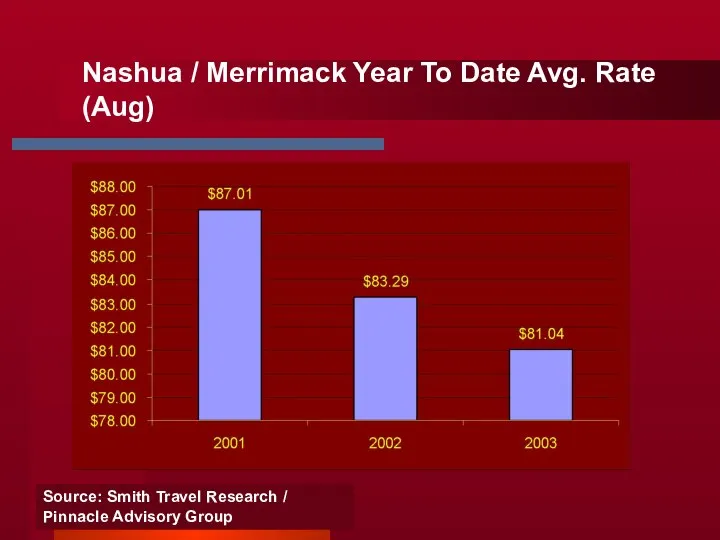

- 33. Nashua / Merrimack Year To Date Avg. Rate (Aug) Source: Smith Travel Research / Pinnacle Advisory

- 34. Nashua / Merrimack Year To Date RevPAR (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 35. Nashua - Factors Affecting Market Performance Improving Business Travel Increases in Group Demand No New Supply

- 36. Manchester Lodging Market

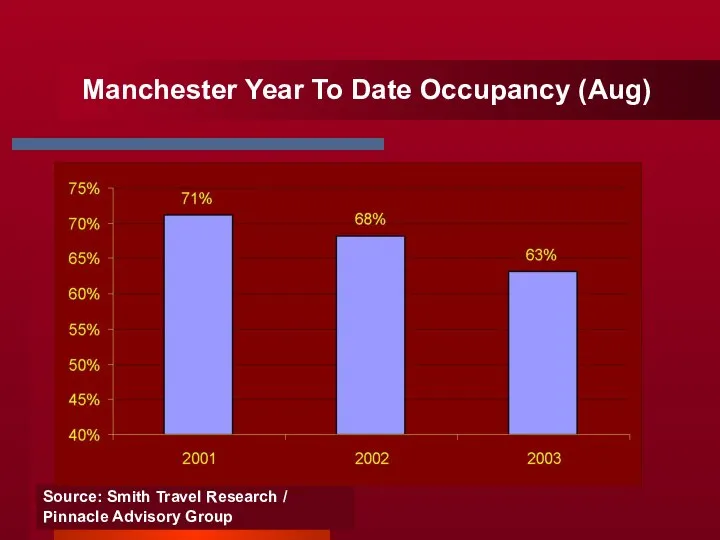

- 37. Manchester Year To Date Occupancy (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 38. Manchester Year To Date Avg. Rate (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 39. Manchester Year To Date RevPAR (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 40. Manchester - Factors Affecting Market Performance New Supply New Supply New Supply

- 41. Manchester – New Supply Springhill Suites – 3/02 Holiday Express – 3/03 Hampton Inn and Suites

- 42. Concord Lodging Market

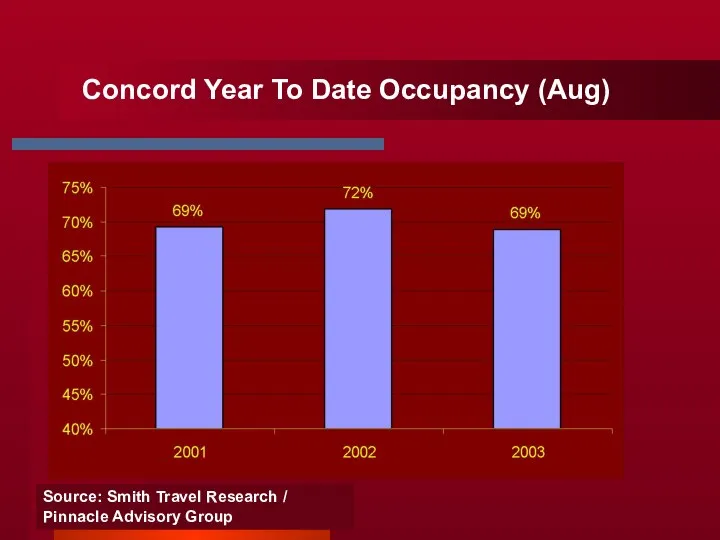

- 43. Concord Year To Date Occupancy (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 44. Concord Year To Date Avg. Rate (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 45. Concord Year To Date RevPAR (Aug) Source: Smith Travel Research / Pinnacle Advisory Group

- 46. Concord - Factors Affecting Market Performance No New Supply Changes at the Hampton Inn Bow Departure

- 47. White Mountains and Lakes Region

- 48. White Mountains and Lakes Region – Market Performance Rates are Up Occupancy is down Overall, markets

- 49. Conclusion / Summary Signs are positive for Most Markets Group Pace for 04 is ahead of

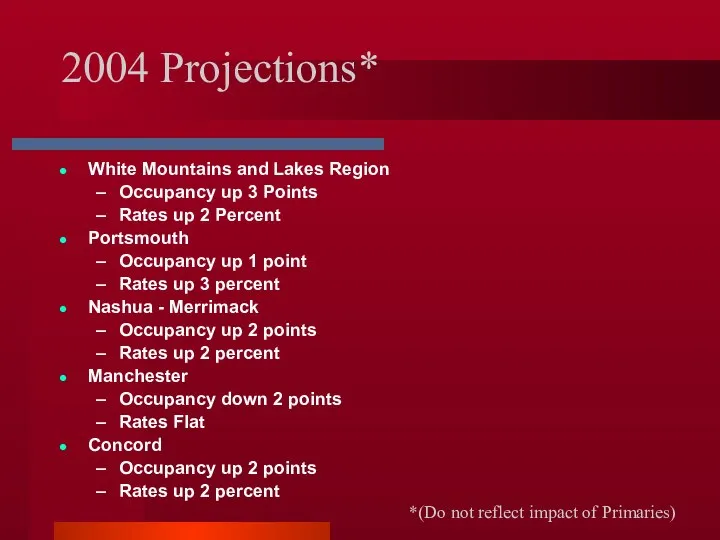

- 50. 2004 Projections* White Mountains and Lakes Region Occupancy up 3 Points Rates up 2 Percent Portsmouth

- 52. Скачать презентацию

схемы-201506

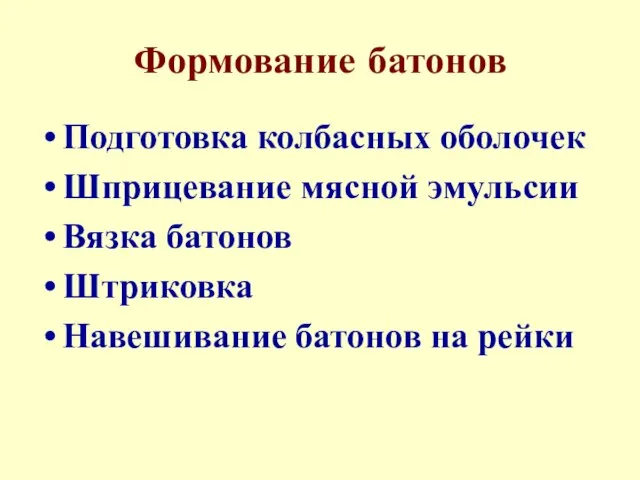

схемы-201506 Формование колбасных батонов

Формование колбасных батонов CAR_01

CAR_01 Технологическая карта

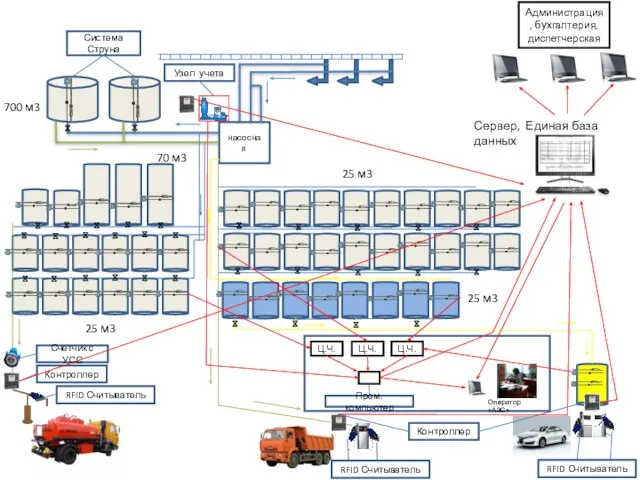

Технологическая карта Механизация приготовления кормов на свиноводческой откормочной ферме с разработкой автоматической герметизации емкости

Механизация приготовления кормов на свиноводческой откормочной ферме с разработкой автоматической герметизации емкости Производство тортов, пирожных, рулетов

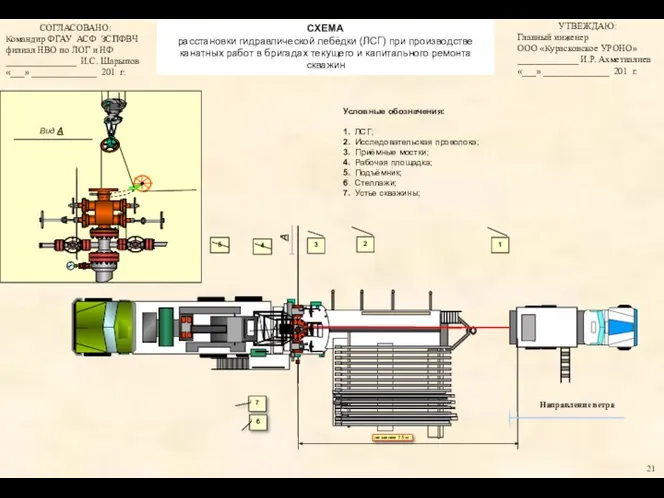

Производство тортов, пирожных, рулетов Схема расстановки гидравлической лебёдки при производстве канатных работ в бригадах текущего и капитального ремонта скважин

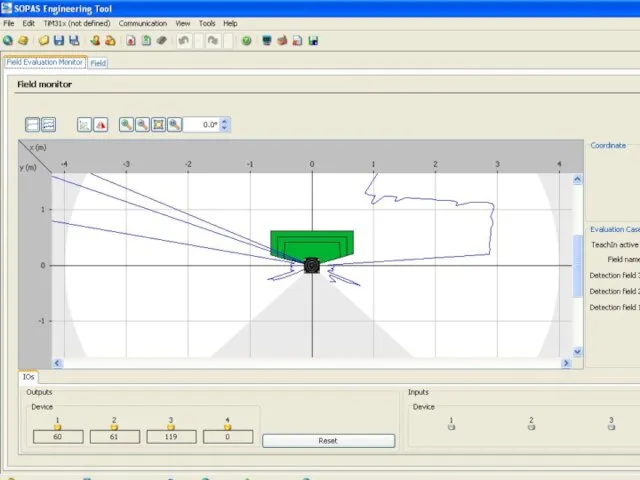

Схема расстановки гидравлической лебёдки при производстве канатных работ в бригадах текущего и капитального ремонта скважин Введение в Lego Mindstorms NXT

Введение в Lego Mindstorms NXT Отгадай мультфильм по кадру 1

Отгадай мультфильм по кадру 1 Лекция Химическое равновесие_вводная часть

Лекция Химическое равновесие_вводная часть Упаковка для мелочей

Упаковка для мелочей Техника художественной обработки ткани и текстильных материалов

Техника художественной обработки ткани и текстильных материалов Хиро́му Арака́ва (Hiromu Arakawa)

Хиро́му Арака́ва (Hiromu Arakawa) Forensic engineering

Forensic engineering Теор основы измерений - Баковец1

Теор основы измерений - Баковец1 Многоядерная модель К. Харриса и Е. Ульмана

Многоядерная модель К. Харриса и Е. Ульмана Система главного паропровода

Система главного паропровода Выпускникам БСШ - 2020

Выпускникам БСШ - 2020 Викторина к 8 марта для девочек

Викторина к 8 марта для девочек Разработка проекта дачного участка

Разработка проекта дачного участка Обнаружение липидов с помощью качественной реакции

Обнаружение липидов с помощью качественной реакции Предмет бытовой техники - пылесос

Предмет бытовой техники - пылесос Украинский язык

Украинский язык ЛЕТО

ЛЕТО Портфолио достижений студента

Портфолио достижений студента Правовое государство

Правовое государство Знакомство с искусством оригами

Знакомство с искусством оригами Презентація

Презентація