Содержание

- 2. Necessary For a Forex Trader The Four M Man (You) Material (Money for Capital) Machine (PC,

- 3. WHAT IS FOREX? The Foreign Exchange market (also referred to as the Forex or FX market)

- 4. WHAT IS FOREX? Unlike other financial markets that operate at a centralized location (i.e., the stock

- 5. FOREX Trading Advantage A 24-hour market High Liquidity Low Transaction Cost Uncorrelated to the Stock Market

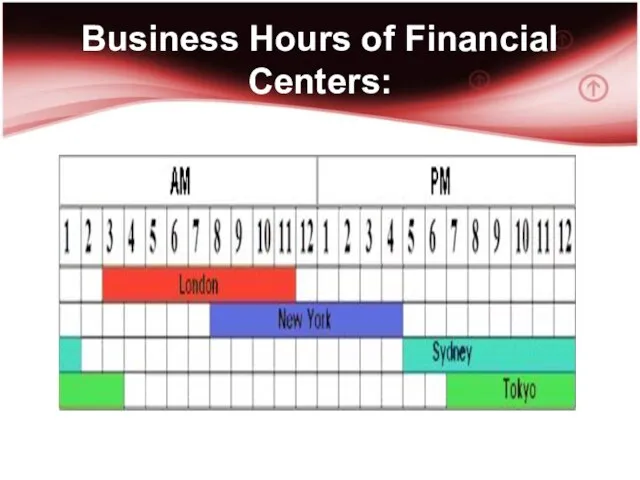

- 6. Major Dealer Centers The major dealer centers and time zones are that of Sydney, Tokyo, London,

- 7. Business Hours of Financial Centers:

- 8. Forex, unlike other financial markets, is not tied to an actual stock exchange. Forex is an

- 9. Background Traditionally, Forex has been dominated by inter-world investment and commercial banks, money portfolio managers, money

- 10. HOW THE CURRENCY VALUE IS DETERMINED? The exchange rate is determined through the interaction of market

- 11. Factors Affecting Supply and Demand Two primary factors that affect supply and demand are interest rates

- 12. Operation The 8 Major Currencies: 1. U.S. Dollar ($), 2. European Currency Unit (€), 3. Japanese

- 13. Example of Listed Currency Pairs The FOUR majors EUR/USD USD/JPY USD/CHF GBP/USD Other majors AUD/USD USD/CAD

- 14. How a Currency Trade Works? Reading a currency quote : GBP/USD ; USD/CHF ; EUR/USD -

- 15. FOREX Market Participants Central Banks They play an important role by keeping inflation low and steady

- 16. FOREX Market Participants Banks Interbank market provides commercial turnover and huge amounts of speculative trading on

- 17. FOREX Market Participants Interbank Brokers - Before large FOREX broker facilitate interbank trading and matching for

- 18. FOREX Market Participants Investors and Speculators It’s estimated that the largest portion of the FOREX daily

- 19. FOREX Market Participants Hedge Funds Managers This is a manage Investment where the fund manager is

- 20. THE TRADE Buy Sell Traders generate profits, or losses, by speculating whether a currency will rise

- 21. TWO (2) ASPECTS OF TRADING Fundamental analysis Focuses on what ought to happen in a market

- 22. Fundamental Analysis Thorough analysis of economic and political data with the goal of determining future movements

- 23. The Importance of Fundamental Analysis A nation's political condition, along with its inflation and interest rates,

- 24. Technical Analysis Traders use these technical factors to identify buying and selling opportunities. Over long historical

- 25. How Trading Works So how does the actual trading work? A complete transaction is the buying

- 27. Скачать презентацию

Теории и модели организационных изменений. Типы и формы организационных изменений

Теории и модели организационных изменений. Типы и формы организационных изменений Школьные музеи. Человек с большой буквы

Школьные музеи. Человек с большой буквы Презентация "Яндекс. Постконтекстная реклама" - скачать презентации по Экономике

Презентация "Яндекс. Постконтекстная реклама" - скачать презентации по Экономике Переменные, операции и выражения. Лекция 3

Переменные, операции и выражения. Лекция 3 Найти памятники архитектуры XVIII-XIX вв. Найти памятники архитектуры XVIII-XIX вв.

Найти памятники архитектуры XVIII-XIX вв. Найти памятники архитектуры XVIII-XIX вв. Презентация "«Экономические системы»" - скачать презентации по Экономике_

Презентация "«Экономические системы»" - скачать презентации по Экономике_ Пневматическая подвеска HINO 500

Пневматическая подвеска HINO 500 The nativity story. A baby is born

The nativity story. A baby is born Бемби - презентация для начальной школы

Бемби - презентация для начальной школы Plural schreiben

Plural schreiben Сущность и содержание теории управления 1. Категориальный аппарат теории управления. 2. Цели теории управления. 3. Эволюция управл

Сущность и содержание теории управления 1. Категориальный аппарат теории управления. 2. Цели теории управления. 3. Эволюция управл Цетробанк и ДКР

Цетробанк и ДКР Капроновые чудеса

Капроновые чудеса Презентация Характеристика и содержание делового общения

Презентация Характеристика и содержание делового общения Определение корпоративной культуры

Определение корпоративной культуры пищеблок по гигиене

пищеблок по гигиене Стили и направления зарубежного изобразительного искусства

Стили и направления зарубежного изобразительного искусства  Искусство XVIII века. Италия и Испания

Искусство XVIII века. Италия и Испания Концепции формирования нового типа общества. Глобализация: социокультурный подход. Художественная культура ХХ в.

Концепции формирования нового типа общества. Глобализация: социокультурный подход. Художественная культура ХХ в. Функции технического заказчика в проектах внедрения Информационных технологий на предприятии ООО «Системный подход» Безуглый

Функции технического заказчика в проектах внедрения Информационных технологий на предприятии ООО «Системный подход» Безуглый  Реклама

Реклама Презентация "Мировая торговля: Австралия и Канада"

Презентация "Мировая торговля: Австралия и Канада" Презентация на тему "УПРАВЛЕНИЕ ЗДРАВООХРАНЕНИЕМ" - скачать презентации по Медицине

Презентация на тему "УПРАВЛЕНИЕ ЗДРАВООХРАНЕНИЕМ" - скачать презентации по Медицине Предложения по обновлению "Родной партии". Деятельность. Устройство. Экономика

Предложения по обновлению "Родной партии". Деятельность. Устройство. Экономика Общие сведения о принципе передачи цветного изображения

Общие сведения о принципе передачи цветного изображения Зеленая долина-1

Зеленая долина-1 Защита от антигенов.Иммунитет

Защита от антигенов.Иммунитет Линия Сomfort Сlassic

Линия Сomfort Сlassic