Содержание

- 2. Lecture objectives What is the essence of the Keynesian doctrine? How can economic crises be explained

- 3. John Maynard Keynes (1883-1946) Model explaining causes of crises and suggesting methods of counteracting them. „The

- 4. The Keynesian perspective Aggregate demand as the cause of crises Government intervention as the remedy for

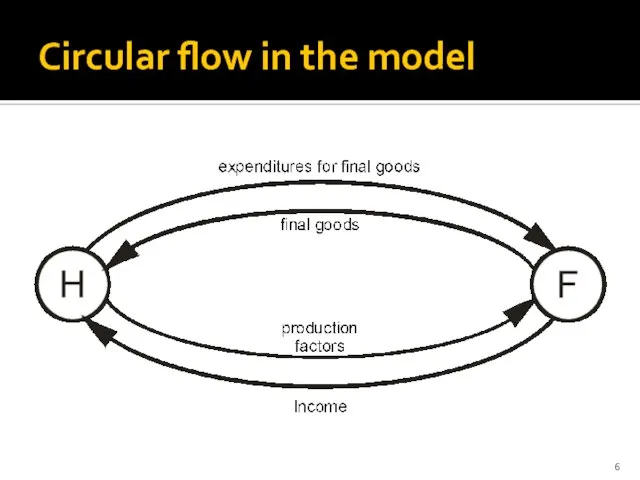

- 5. Model assumptions Two factor analysis: the only types of economic subjects are domestic households and firms

- 6. Circular flow in the model

- 7. The essence of aggregate demand Aggregate demand (AD): sum of expenditures for various goods and services

- 8. Consumption component of AD Two things concerning „C” must be noted: it is directly dependent on

- 9. Marginal propensity to consume Marginal propensity to consume (MPC): the fraction of the additional current income

- 10. Autonomous consumption Autonomous consumption (CA): the part of consumption that is not financed by current income

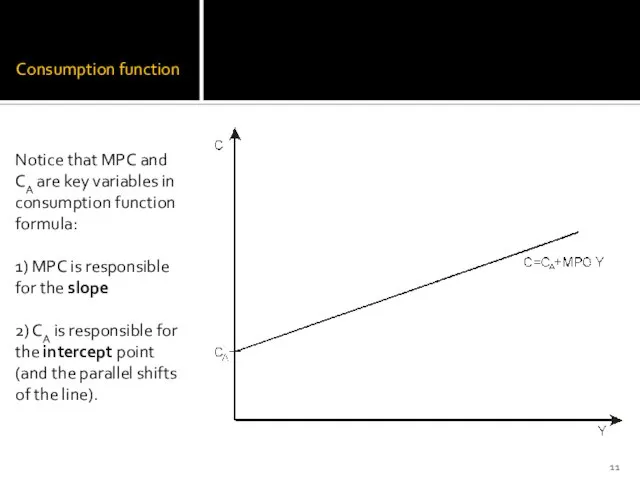

- 11. Consumption function Notice that MPC and CA are key variables in consumption function formula: 1) MPC

- 12. Technical note Changes in nouseholds’ current income result in shifts along the consumpion line. Changes in

- 13. Saving Saving means unconsumed income. Y = C + S C = MPC×Y + CA S

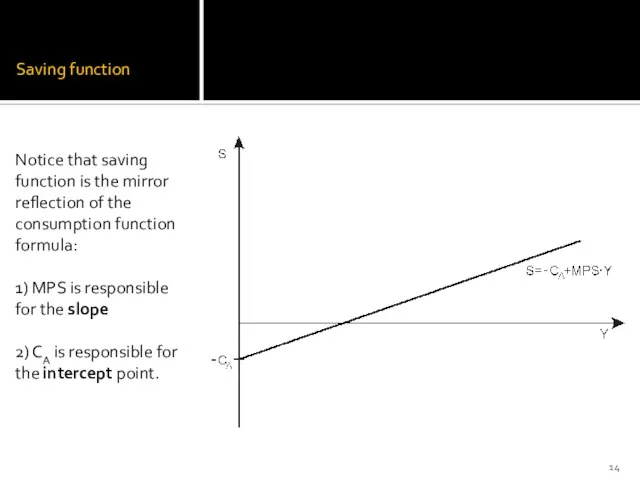

- 14. Saving function Notice that saving function is the mirror reflection of the consumption function formula: 1)

- 15. Investment component of AD Special status in the Keynesian doctrine Outstanding variability Independent of the current

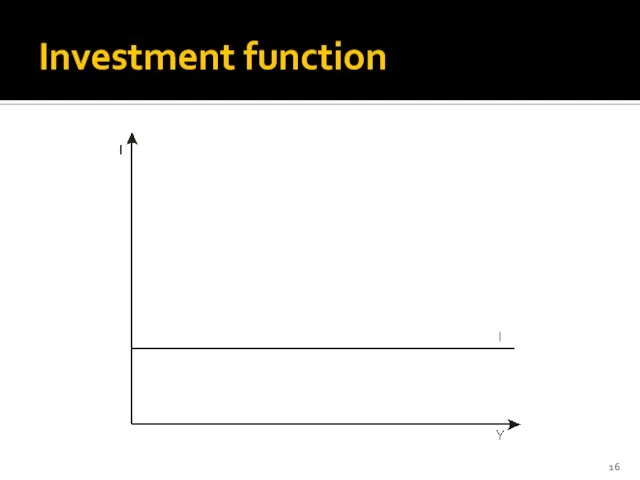

- 16. Investment function

- 17. Aggregate demand: recollection Aggregate demand: the sum of households’ and firms’ expenditures (for consumption and investments,

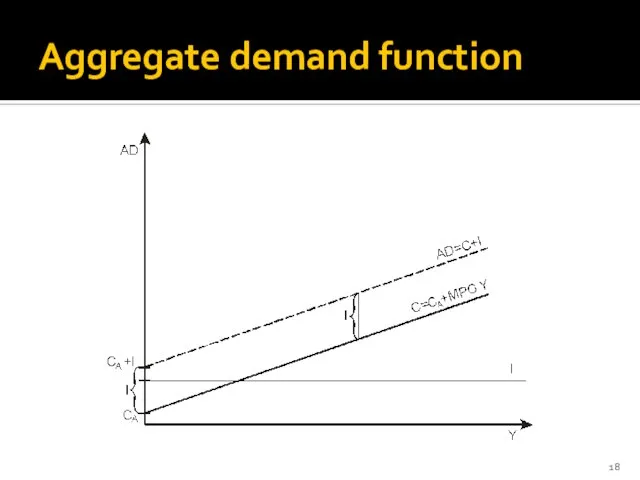

- 18. Aggregate demand function

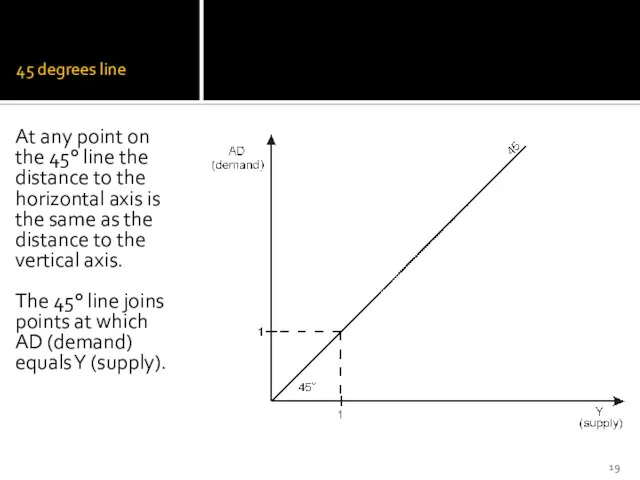

- 19. 45 degrees line At any point on the 45° line the distance to the horizontal axis

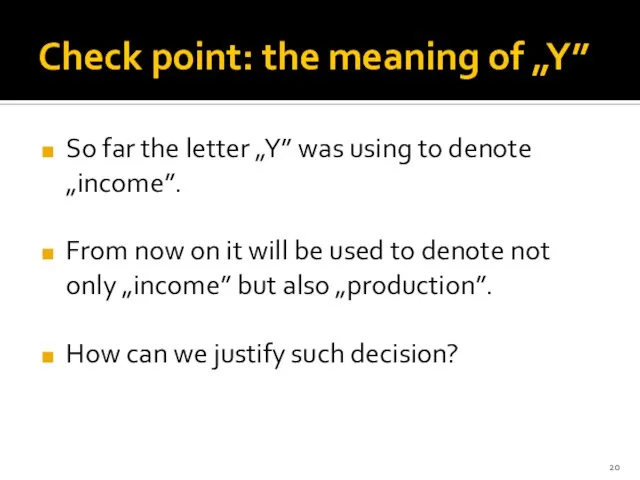

- 20. Check point: the meaning of „Y” So far the letter „Y” was using to denote „income”.

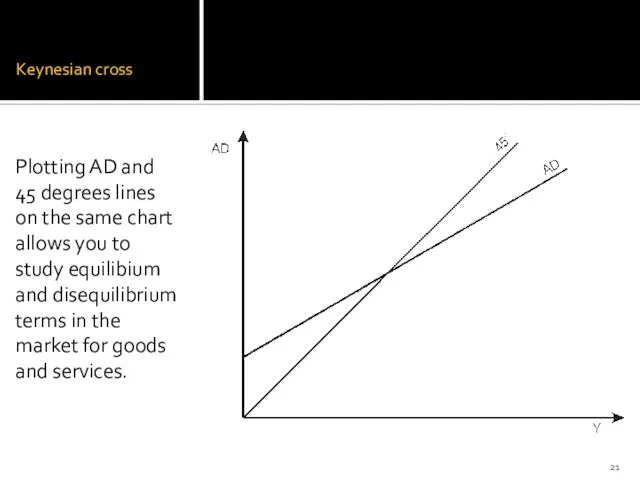

- 21. Keynesian cross Plotting AD and 45 degrees lines on the same chart allows you to study

- 22. Equilibrium & equilibrium output Equilibrium output (YE): the level of GDP at which the aggregate demand

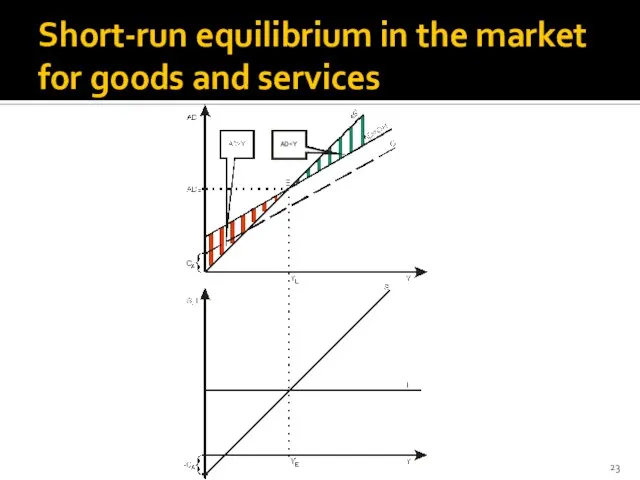

- 23. Short-run equilibrium in the market for goods and services

- 24. Equilibrium: numerical example (static analysis) C = 50 + 0,7×Y S = – 50 + 0,3×Y

- 25. Equilibrium: two approaches First approach: AD = Y 450 + 0,7×Y = Y YE = 1500

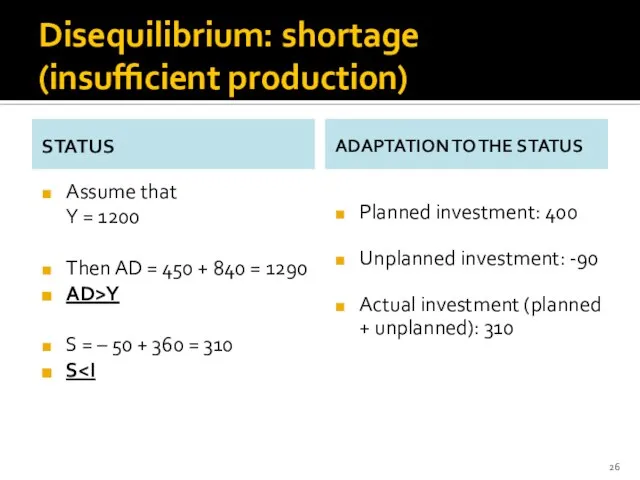

- 26. Disequilibrium: shortage (insufficient production) STATUS Assume that Y = 1200 Then AD = 450 + 840

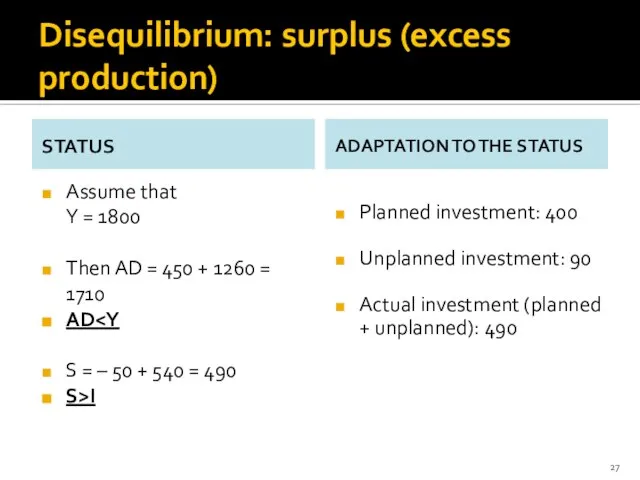

- 27. Disequilibrium: surplus (excess production) STATUS Assume that Y = 1800 Then AD = 450 + 1260

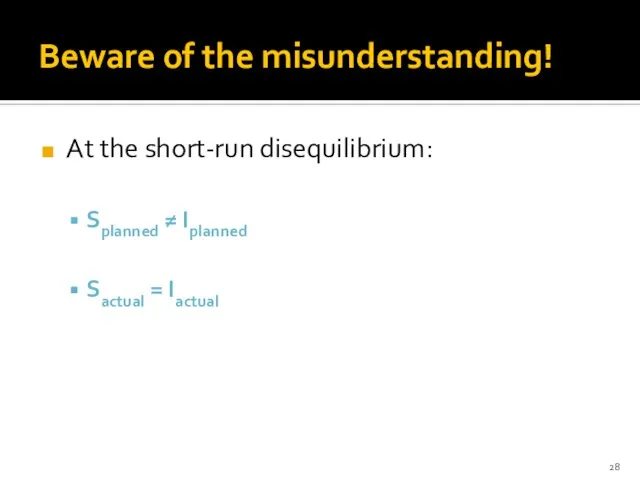

- 28. Beware of the misunderstanding! At the short-run disequilibrium: Splanned ≠ Iplanned Sactual = Iactual

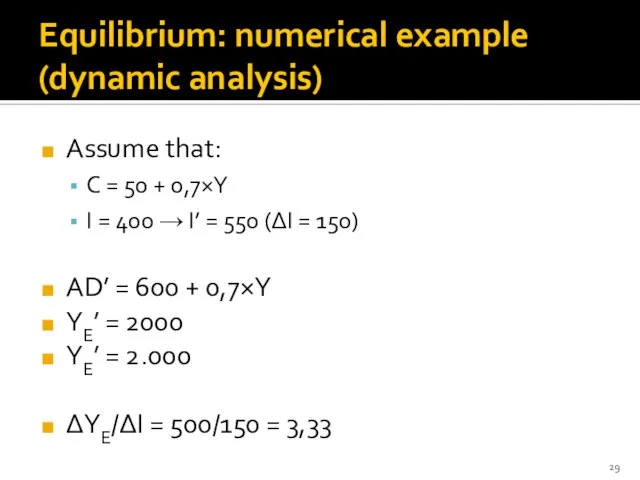

- 29. Equilibrium: numerical example (dynamic analysis) Assume that: C = 50 + 0,7×Y I = 400 →

- 30. Investment multiplier Investment multiplier: a measure that informs how many times the change in the equilibrium

- 31. Investment multiplier and economic cycles Higher multiplier >>> more volatile GDP Lower multiplier >>> less volatile

- 32. Check point: true / false test The Keynesian model assumes that the production is basically determined

- 33. Check point: true / false test (cont.) The relation of consumption planned by households to their

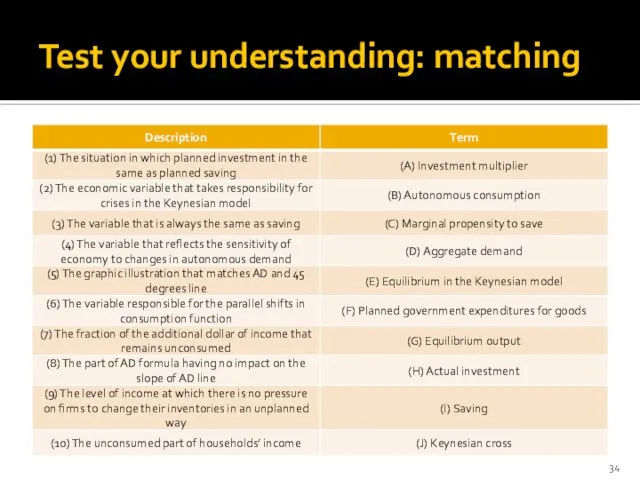

- 34. Test your understanding: matching

- 35. Lecture objectives What is the essence of the Keynesian doctrine? How can economic crises be explained

- 37. Скачать презентацию

Общественные блага и проблема «безбилетника» в экономике

Общественные блага и проблема «безбилетника» в экономике Интеграция мнения специалистов и субъектов производственных и рыночных процессов. Тема 7

Интеграция мнения специалистов и субъектов производственных и рыночных процессов. Тема 7 Равновесный анализ в экономической теории

Равновесный анализ в экономической теории Экономические взгляды Александра Васильевича Чаянова

Экономические взгляды Александра Васильевича Чаянова Национальный план развития конкуренции

Национальный план развития конкуренции Многовариантность общественного развития (типы обществ)

Многовариантность общественного развития (типы обществ) Стратегическое и тактическое планирование

Стратегическое и тактическое планирование Рыночная экономика

Рыночная экономика Марочный капитал и его активы

Марочный капитал и его активы Майнові ресурси (активи) торговельного підприємства. (Лекція 10)

Майнові ресурси (активи) торговельного підприємства. (Лекція 10) Энергосбережение. (6 класс)

Энергосбережение. (6 класс) Экономическая теория Адама Смита

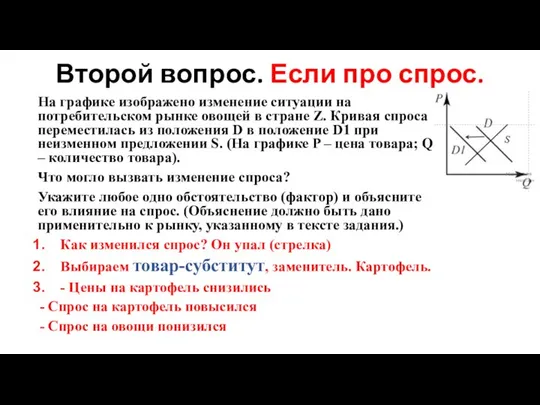

Экономическая теория Адама Смита Второй вопрос. Если про спрос

Второй вопрос. Если про спрос Организмический подход в экономике

Организмический подход в экономике Безработица. Население и рабочая сила. Измерение безработицы. Виды безработицы. Закон Оукена

Безработица. Население и рабочая сила. Измерение безработицы. Виды безработицы. Закон Оукена Экономические законы

Экономические законы Програма ЄС Підтримка політики регіонального розвитку України”. Агропромисловий комплекс Волині

Програма ЄС Підтримка політики регіонального розвитку України”. Агропромисловий комплекс Волині Становление теории инноватики и ее современные концепции

Становление теории инноватики и ее современные концепции Основные понятия в системе таможеннотарифного регулирования в РФ. Понятие, основные цели и элементы таможенного тарифа

Основные понятия в системе таможеннотарифного регулирования в РФ. Понятие, основные цели и элементы таможенного тарифа Нефтеперерабатывающий завод. “NPC GmbH”

Нефтеперерабатывающий завод. “NPC GmbH” Последовательность процентных расчетов при осуществлении банковских операций

Последовательность процентных расчетов при осуществлении банковских операций Инфляция и антиинфляционная политика

Инфляция и антиинфляционная политика Бюджетное ограничение. Равновесие потребителя

Бюджетное ограничение. Равновесие потребителя Обмен, торговля, реклама

Обмен, торговля, реклама Основы государственной культурной политики Российской Федерации

Основы государственной культурной политики Российской Федерации Введение в анализ логистической поддержки. Основные термины, определения и сокращения

Введение в анализ логистической поддержки. Основные термины, определения и сокращения Профессия экономиста-международника

Профессия экономиста-международника Основа экономики - производство. (8 класс)

Основа экономики - производство. (8 класс)