Содержание

- 2. Managing Financial Resources Chapter 13 © 2015 Flat World Knowledge

- 3. Chapter Objectives Identify the functions of money and describe the government’s measure of money supply. Identify

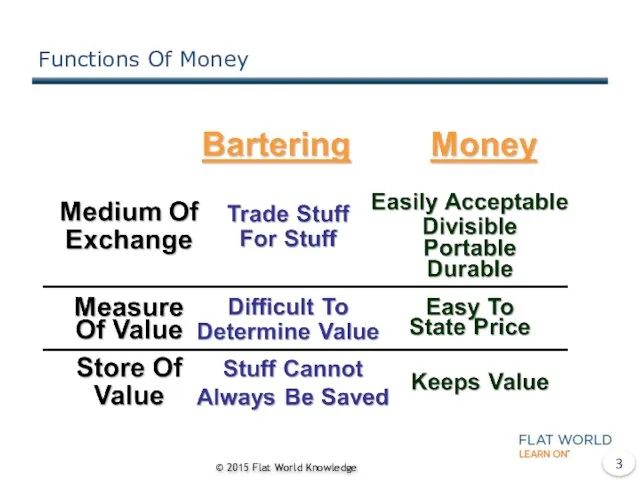

- 4. Functions Of Money © 2015 Flat World Knowledge

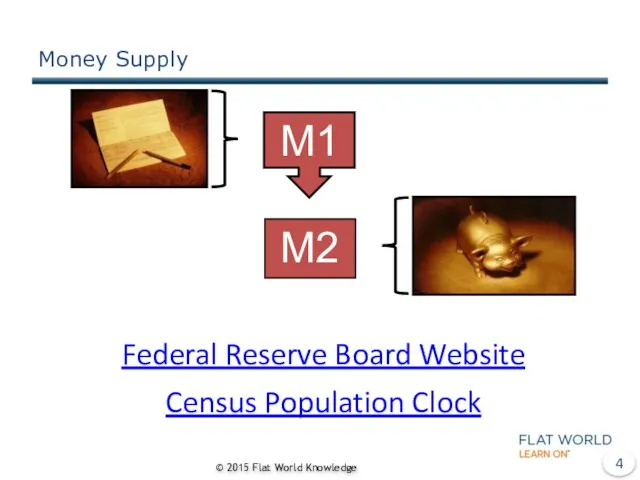

- 5. Money Supply © 2015 Flat World Knowledge

- 6. Depository Institutions Commercial Banks Savings Banks Credit Unions © 2015 Flat World Knowledge

- 7. Nondepository Institutions Finance Companies Insurance Companies Brokerage Firms © 2015 Flat World Knowledge

- 8. Financial Services Checking/Savings Accounts ATMs Credit/Debit Cards Loans Financial Advice Sells Financial Products Insurance Electronic Banking

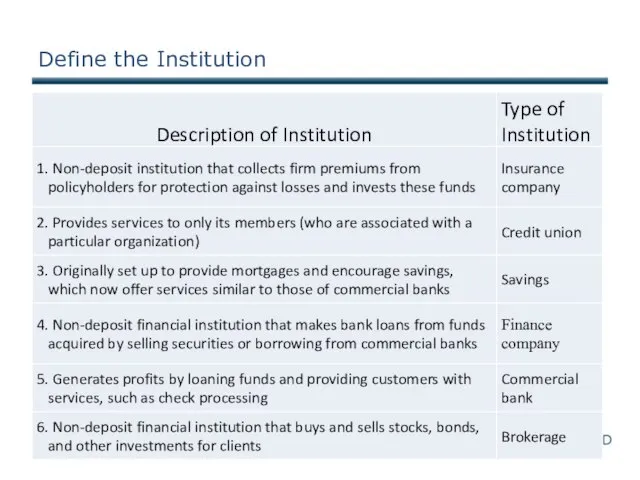

- 9. Define the Institution

- 10. Bank Regulation Federal Depository Insurance Corporation 1933 Insures Deposits Periodic Examinations Office of Thrift Supervision National

- 11. Crisis in the Financial Industry Risky (sub-prime) loans made for homes between 2001 and 2005 Easy

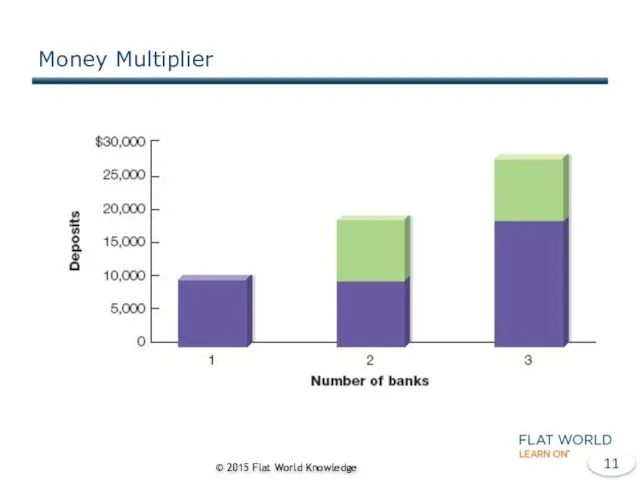

- 12. Money Multiplier © 2015 Flat World Knowledge

- 13. Fluctuating Reserve Rates You just won $10 million in the lottery and used the money to

- 14. Federal Reserve System Central Banking (1913) 12 Districts/Banks Board of Governors https://www.stlouisfed.org/in-plain-english/history-and-purpose-of-the-fed © 2015 Flat World

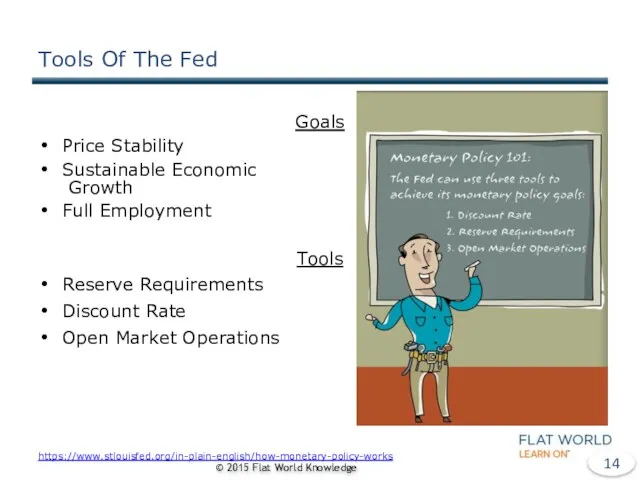

- 15. Tools Of The Fed Goals Price Stability Sustainable Economic Growth Full Employment Tools Reserve Requirements Discount

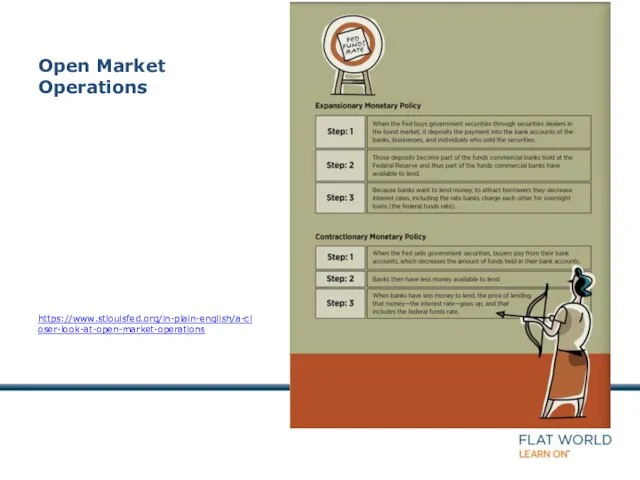

- 16. Open Market Operations https://www.stlouisfed.org/in-plain-english/a-closer-look-at-open-market-operations

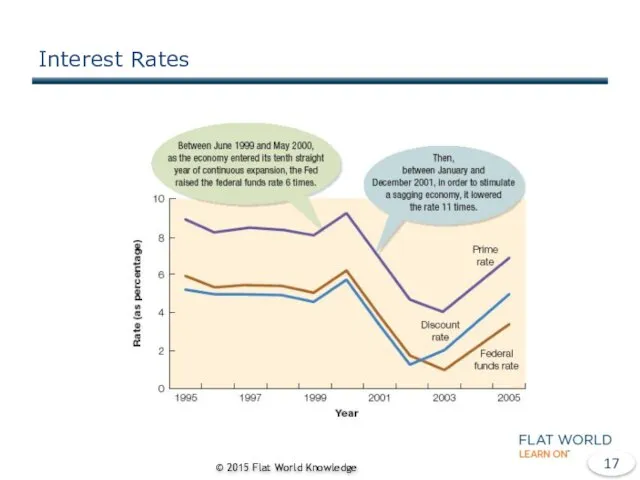

- 17. Federal Funds Rate Federal Funds (Discount Rate) Prime Rate © 2015 Flat World Knowledge

- 18. Interest Rates © 2015 Flat World Knowledge

- 19. Banker’s Bank & Government’s Banker Check Clearing U.S. Treasury’s Checking Account Paperwork in Government Securities Collect

- 20. Financial Manager “…finance is all of the activities involved in planning for, obtaining, and managing a

- 21. Developing A Financial Plan Estimating Sales Getting The Money Personal Assets Loans—Family/Friends Bank Loans Making The

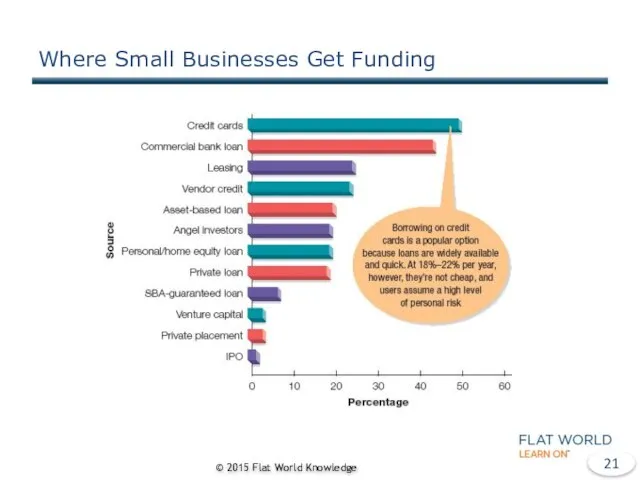

- 22. Where Small Businesses Get Funding © 2015 Flat World Knowledge

- 23. Loan Characteristics Maturity Short-Term Intermediate Long-Term Line of Credit Amortization Security Collateral Unsecured Interest © 2015

- 24. Growth Stage Financing Managing Cash Accounts Receivable Accounts Payable— Trade Credit Budgeting © 2015 Flat World

- 25. Sources Of Financing During Growth Stage Bank Additional Owners Private Investors © 2015 Flat World Knowledge

- 26. Investors Angels Venture Capitalists Going Public Initial Public Offering Investment Banking Firm © 2015 Flat World

- 27. Markets And Exchanges Markets Primary Secondary Organized Exchanges New York Stock Exchange American Stock Exchange Over-The-Counter

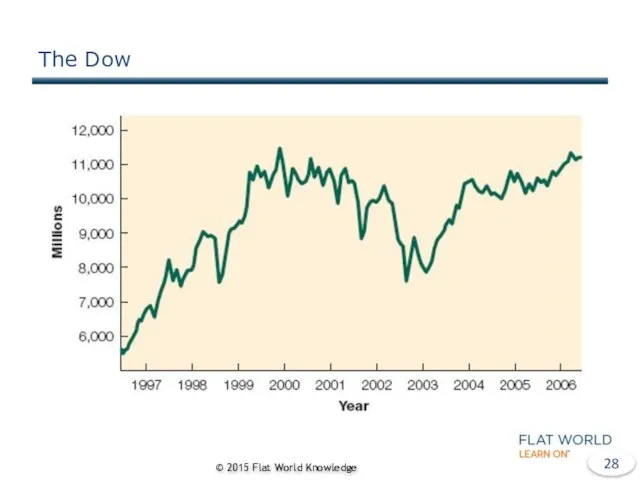

- 28. Regulating Securities Markets Securities and Exchange Commission (1934) Prospectus Insider Trading Market Indexes Dow Jones Industrial

- 29. The Dow © 2015 Flat World Knowledge

- 30. NASDAQ Index © 2015 Flat World Knowledge

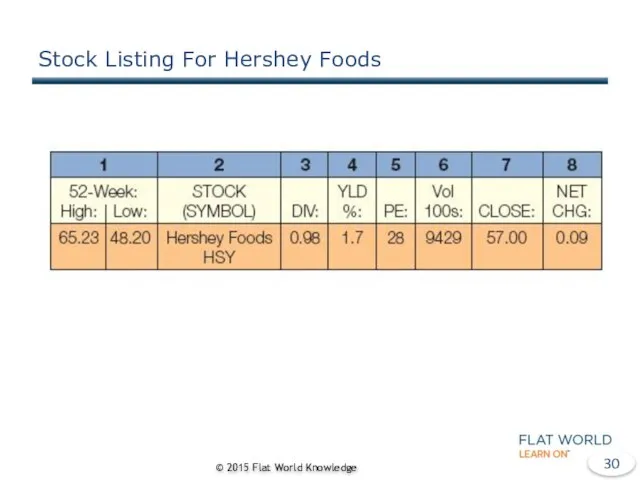

- 31. Stock Listing For Hershey Foods © 2015 Flat World Knowledge

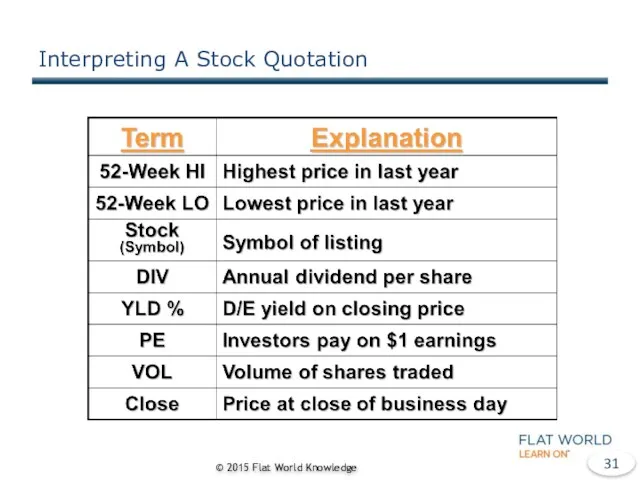

- 32. Interpreting A Stock Quotation © 2015 Flat World Knowledge

- 33. Learning to Quote Quotations Explain each item in the stock listing for Proctor & Gamble.

- 34. Financing The Going Concern © 2015 Flat World Knowledge Equity Financing Debt Financing

- 35. Stockholders’ Equity Risk/Reward Tradeoff Dividends Types of Stock Common Preferred Cumulative Convertible © 2015 Flat World

- 36. Bonds “…debt securities that obligate the issuer to make interest payments to bondholders and to repay

- 37. Financing a Multimillion Dollar Plant Expansion You’re the CFO for a large corporation. The CEO just

- 39. Скачать презентацию

Банковское дело

Банковское дело Коммерческие предложения. Бизнес-овердрафт

Коммерческие предложения. Бизнес-овердрафт Закон о деятельности аудиторских организаций

Закон о деятельности аудиторских организаций Организация бухгалтерского учета на предприятии

Организация бухгалтерского учета на предприятии Тема 5. Организационное построение Центрального банка РФ

Тема 5. Организационное построение Центрального банка РФ Вінницьке регіональне управління Держмолодьжитла

Вінницьке регіональне управління Держмолодьжитла Государственные внебюджетные фонды

Государственные внебюджетные фонды Учет материально-производственных запасов (на примере ООО Алтайтрансмашсервис)

Учет материально-производственных запасов (на примере ООО Алтайтрансмашсервис) Автоматизована система Передплата. Призначення

Автоматизована система Передплата. Призначення Финансовая система Российской Федерации

Финансовая система Российской Федерации Содействие в создании кадрового потенциала учителей, методистов образовательных организаций в области финансовой грамотности

Содействие в создании кадрового потенциала учителей, методистов образовательных организаций в области финансовой грамотности Завершение финансового года в соответствии с графиком совершения операций. УФК по Кемеровской области - Кузбассу

Завершение финансового года в соответствии с графиком совершения операций. УФК по Кемеровской области - Кузбассу Инвестиционная надбавка к базовому тарифу для потребителей (опыт МО Выборгское городское поселение)

Инвестиционная надбавка к базовому тарифу для потребителей (опыт МО Выборгское городское поселение) Тест по банковскому делу

Тест по банковскому делу Дополнительные мероприятия на рынке труда Ямало-Ненецкого автономного округа в 2020 году

Дополнительные мероприятия на рынке труда Ямало-Ненецкого автономного округа в 2020 году Equity Valuation

Equity Valuation Налог на добавленную стоимость

Налог на добавленную стоимость Stochastic oscillator

Stochastic oscillator Контроль качества аудита

Контроль качества аудита Введение системы декларирования для всех физических лиц

Введение системы декларирования для всех физических лиц Peļņa: Grāmatvedības, ekonomiskā un maksātnespēja

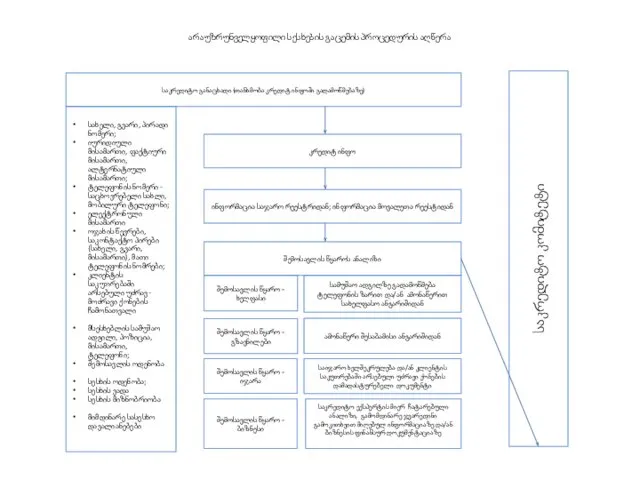

Peļņa: Grāmatvedības, ekonomiskā un maksātnespēja პროდუქტები და პროცედურები. არაუზრუნველყოფილი სესხების გაცემის პროცედურის აღწერა

პროდუქტები და პროცედურები. არაუზრუნველყოფილი სესხების გაცემის პროცედურის აღწერა Средство накопления

Средство накопления Памятка по продуктам TenderHelp

Памятка по продуктам TenderHelp Финансовый контроль

Финансовый контроль Коэффициент текущей ликвидности

Коэффициент текущей ликвидности Сложные случаи учета НДС в 1С:Бухгалтерии 8 на практических примерах

Сложные случаи учета НДС в 1С:Бухгалтерии 8 на практических примерах Инвестиционная политика корпорации

Инвестиционная политика корпорации