Содержание

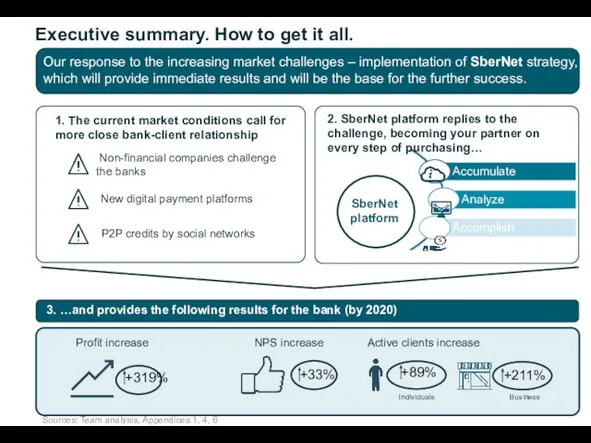

- 2. Executive summary. How to get it all. Our response to the increasing market challenges – implementation

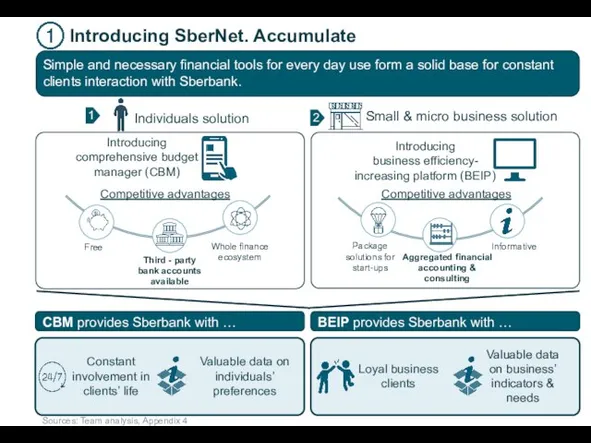

- 3. Introducing SberNet. Accumulate . Simple and necessary financial tools for every day use form a solid

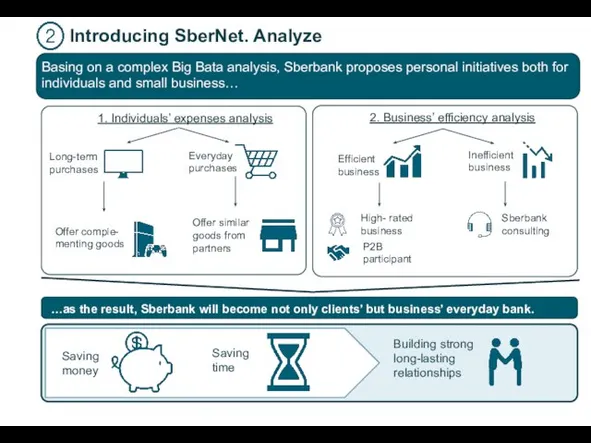

- 4. Introducing SberNet. Analyze Basing on a complex Big Bata analysis, Sberbank proposes personal initiatives both for

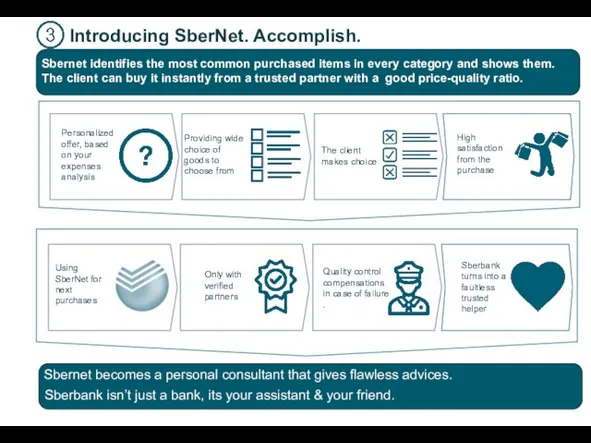

- 5. Introducing SberNet. Accomplish. Sbernet becomes a personal consultant that gives flawless advices. Sbernet identifies the most

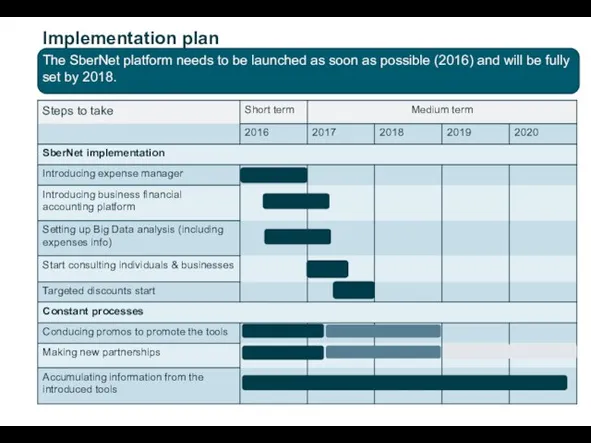

- 6. Implementation plan The SberNet platform needs to be launched as soon as possible (2016) and will

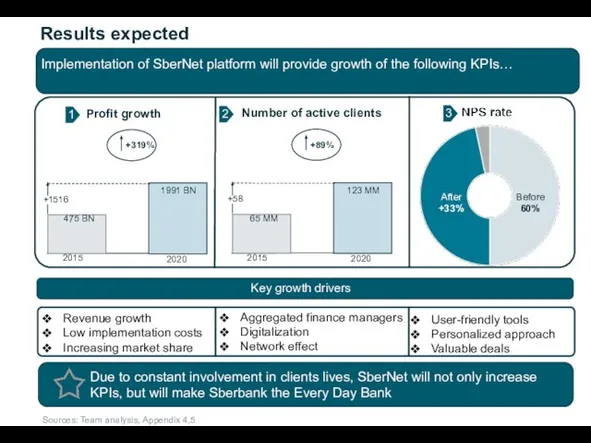

- 7. Results expected Implementation of SberNet platform will provide growth of the following KPIs… +58 123 MM

- 8. Masters Team Bobov Petr Burobin Maxim Voronova Olga Lobkovskaya Daria

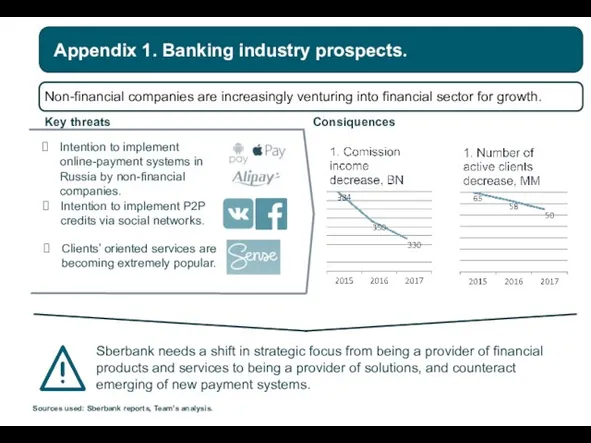

- 9. Appendix 1. Banking industry prospects. Non-financial companies are increasingly venturing into financial sector for growth. Intention

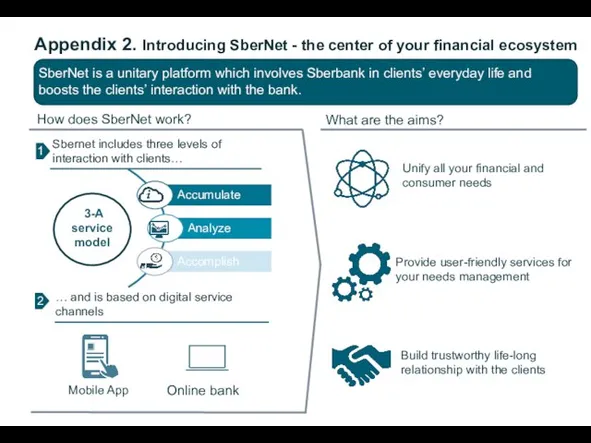

- 10. Appendix 2. Introducing SberNet - the center of your financial ecosystem SberNet is a unitary platform

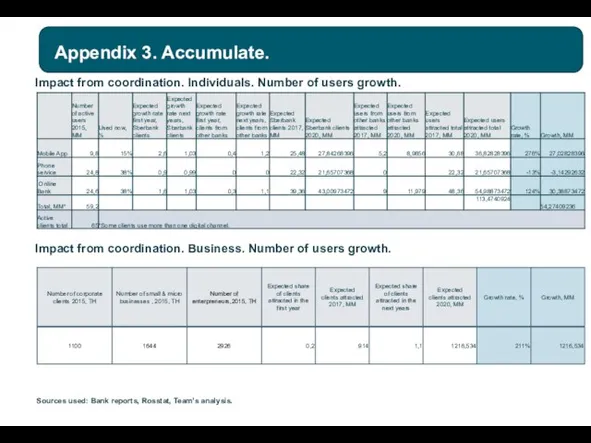

- 11. Impact from coordination. Individuals. Number of users growth. Impact from coordination. Business. Number of users growth.

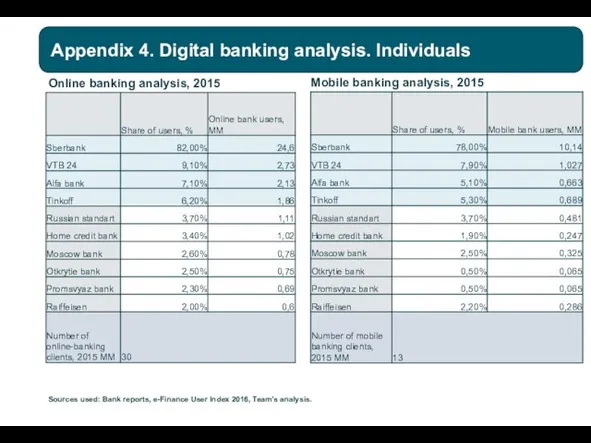

- 12. Sources used: Bank reports, e-Finance User Index 2016, Team’s analysis. Online banking analysis, 2015 Mobile banking

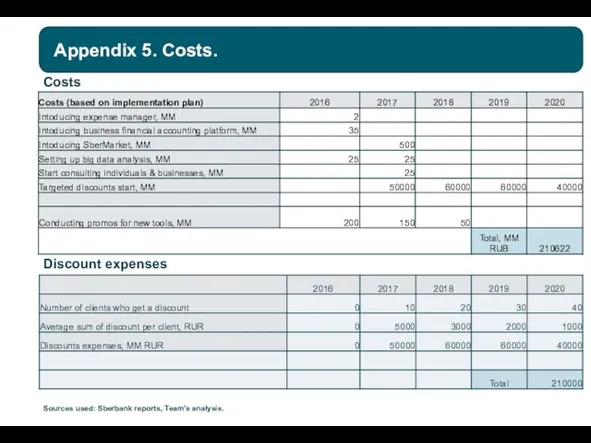

- 13. Appendix 5. Costs. Sources used: Sberbank reports, Team’s analysis. Discount expenses Costs

- 14. Sources used: Sberbank reports, Rosstat, Team’s analysis. Appendix 6. Profit & KPIs. KPIs Profit

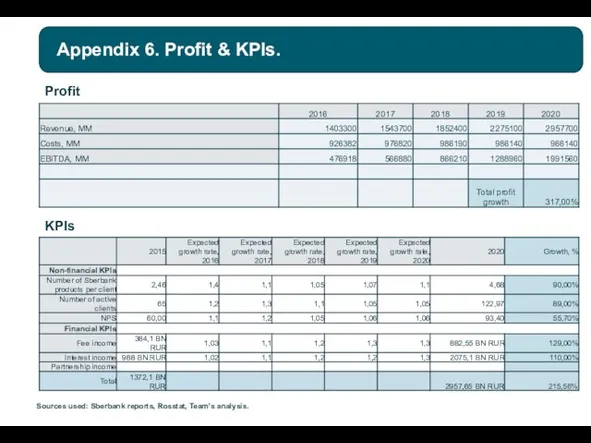

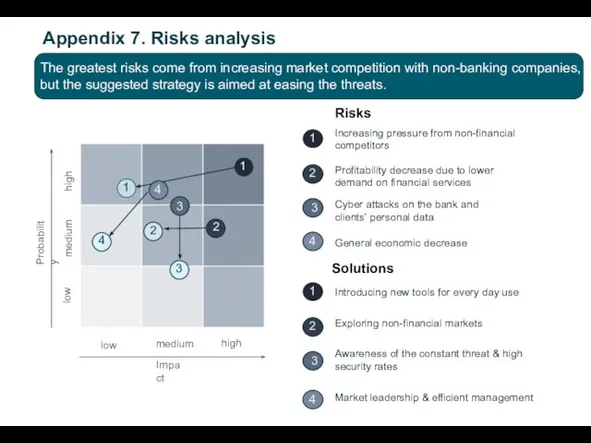

- 15. The greatest risks come from increasing market competition with non-banking companies, but the suggested strategy is

- 17. Скачать презентацию

Корпоративная система мотивации труда

Корпоративная система мотивации труда Бюджетна система

Бюджетна система Земельный налог (глава 31 НК РФ)

Земельный налог (глава 31 НК РФ) Финансы в экономике

Финансы в экономике Финансы организации

Финансы организации Денежный рынок и денежно-кредитная политика государства

Денежный рынок и денежно-кредитная политика государства Учет материально-производственных запасов

Учет материально-производственных запасов Содержание, условия реализации бюджетирования, организация бюджетного управления в организациях бюджетного сектора

Содержание, условия реализации бюджетирования, организация бюджетного управления в организациях бюджетного сектора Учет и анализ хозяйственной деятельности предприятия. Структура и состав балансового отчета

Учет и анализ хозяйственной деятельности предприятия. Структура и состав балансового отчета Модели, системы и механизмы корпоративного управления

Модели, системы и механизмы корпоративного управления Представление финансовой отчетности

Представление финансовой отчетности Banking

Banking Доходный подход в оценке собственности

Доходный подход в оценке собственности Фонд социального страхования РФ

Фонд социального страхования РФ Особенности ссудного капитала

Особенности ссудного капитала Продукт добровольного страхования жизни Премиум

Продукт добровольного страхования жизни Премиум Презентация по программе МСК+

Презентация по программе МСК+ Добровольное медицинское страхование

Добровольное медицинское страхование Стратегия продвижения банковского продукта. Отделение банковского дела

Стратегия продвижения банковского продукта. Отделение банковского дела Возникновение и развитие налогообложения

Возникновение и развитие налогообложения Акционерное общество Таврический

Акционерное общество Таврический Благоустройство сквера

Благоустройство сквера Бюджет для граждан города Ставрополя на 2015 год

Бюджет для граждан города Ставрополя на 2015 год РАСЧЕТ норм затрат-25.08.2022

РАСЧЕТ норм затрат-25.08.2022 Налоговые проверки

Налоговые проверки Основы оценки нематериальных активов. Специфика НМА

Основы оценки нематериальных активов. Специфика НМА Обзор точек зрения на сущность денег в мировой экономической литературе

Обзор точек зрения на сущность денег в мировой экономической литературе Особенности пенсионного обеспечения лиц, пострадавших от радиационных и техногенных катастроф

Особенности пенсионного обеспечения лиц, пострадавших от радиационных и техногенных катастроф