Содержание

- 2. Larry Connors was a broker for Merrill Lynch in 1982. In 1987 he was earning 3

- 3. Quotes from the book

- 4. “The one thing [professional traders] have in common is that they know what it’s like to

- 5. “They followed their dream and have become successful because of their brains and most importantly their

- 6. “…the never ending challenge of figuring out a game that may be the most complex and

- 7. “Philosophically, I live in a world of reversion to the mean when it comes to trading.

- 8. “First we’ll look at certain behavior which is inherent in the marketplace. …You will learn that

- 9. “It’s one thing for someone to give you a handful of rules and say “trust me,

- 10. The Chapters

- 11. Think Differently Rule 1 – Buy Pullbacks Not Breakouts After the market has dropped three days

- 12. Rule 2 – Buy The Market After It’s Dropped; Not After It’s Risen After the market

- 13. Rule 3 – Buy Stocks Above Their 200-Day Moving Average, Not Below This rule is not

- 14. Rule 4 – Use The VIX To Your Advantage…Buy The Fear, Sell The Greed If SPY

- 15. Rule 5 – Stops Hurt The tighter your stops, the less money you will make. The

- 16. Rule 6 – It Pays To Hold Positions Overnight During the test period, buying the SPY

- 17. Trading With Intra-Day Drops Making Edges Even Bigger The greater the intra-day momentum to the upside,

- 18. The 2 Period RSI The Traders Holy Grail of Indicators For stocks above their 200-day moving

- 19. Double 7’s Strategy If the SPY is above it’s 200-day moving average and it closes at

- 20. The End Of The Month Strategy For stocks above their 200-day moving average, gains are higher

- 21. Five Strategies To Time The Market

- 22. VIX Stretches SPY above 200-day SMA VIX 5% or more above 10-day MA for 3 or

- 23. VIX RSI SPY above 200-day SMA 2-period RSI of VIX above 90 Today’s VIX open is

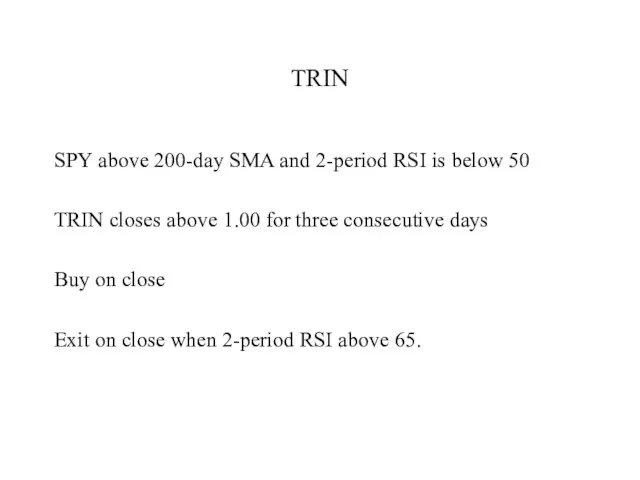

- 24. TRIN SPY above 200-day SMA and 2-period RSI is below 50 TRIN closes above 1.00 for

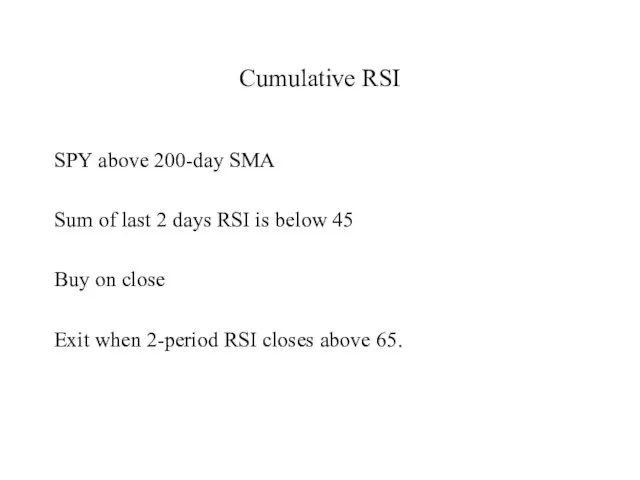

- 25. Cumulative RSI SPY above 200-day SMA Sum of last 2 days RSI is below 45 Buy

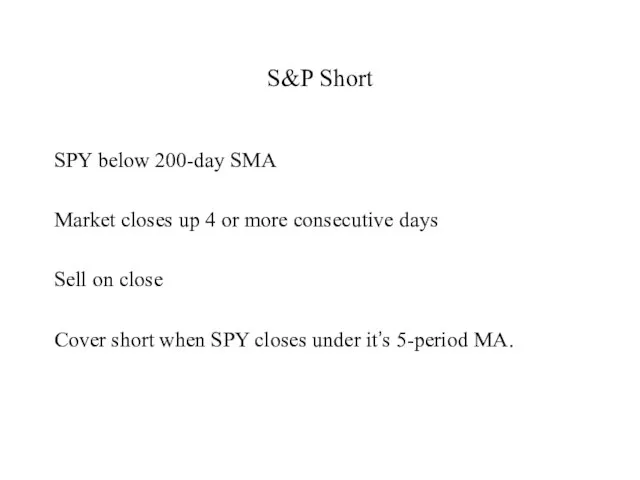

- 26. S&P Short SPY below 200-day SMA Market closes up 4 or more consecutive days Sell on

- 27. Exit Strategies

- 28. Fixed Time Does not like. Should sell into strength.

- 29. First Up Close From Previous Day By Larry Williams, excellent strategy

- 30. Close Above A New High A valid choice

- 31. Close Above Moving Average 5-day is first choice, then 10-day MA.

- 32. 2-Period RSI Closes above 65, 70 or 75.

- 33. Trailing Stops The tighter the stop, the worse the performance. Few stop strategies showed consistent results.

- 34. Choose on exit strategy Stay with it Remember - the stronger the move the more likely

- 35. The Mind

- 36. You must be prepared for any situation. You need to know how you will react before

- 37. What would you do if: You start trading a new strategy that tested well but immediately

- 38. What would you do if: You start trading a new strategy that tested well and immediately

- 39. What would you do if: You have lost money eight consecutive days, you are long many

- 40. What would you do if: The market has one of it’s worst months in years and

- 41. What would you do if: You are long 1000 shares, you place an order to sell

- 42. Interview with Richard J. Machowicz Martial arts specialist, Navy SEAL instructor. Author of “Unleash the Warrior

- 43. The Finale – a summary

- 44. 16 Short Term Trading Strategies That Work

- 45. Strategy 1 Buy pullbacks, not breakouts. The statistics overwhelmingly prove that.

- 46. Strategy 2 Buy the stock market after it has dropped multiple days in a row, not

- 47. Strategy 3 Buy stocks above their 200-day moving average.

- 48. Strategy 4 Buy stocks when the VIX is 5% or more above it’s 10-period moving average.

- 49. Strategy 5 Stops are potentially an expensive form of insurance.

- 50. Strategy 6 Hold positions overnight in times of concern.

- 51. Strategy 7 Buy stocks on intra-day pullbacks in order to increase the edges even more.

- 52. Strategy 8 Apply the 2-period RSI to all of your trading. It’s almost the holy grail

- 53. Strategy 9 Buy the market and stocks when the 2-period RSI is below 5.

- 54. Strategy 10 Trade with Cumulative RSI’s. The lower the Cumulative RSI, the better.

- 55. Strategy 11 Trade Double 7’s on U.S. and World Indices, and ETF’s.

- 56. Strategy 12 Time the market using TRIN, the VIX, the 2-period RSI and price as described

- 57. Strategy 13 Buy stocks at the end of the month, especially those that have dropped 1

- 58. Strategy 14 There are many good exit strategies. The key is to make sure the ones

- 59. Strategy 15 Have a plan in place to deal with the many realities of daily trading.

- 60. Strategy 16 The most important strategy begins with your mind. Your mind will dictate your success.

- 62. Скачать презентацию

![“The one thing [professional traders] have in common is that they](/_ipx/f_webp&q_80&fit_contain&s_1440x1080/imagesDir/jpg/587811/slide-3.jpg)

Мировые финансовые центры

Мировые финансовые центры Заповнення е-декларації

Заповнення е-декларації Статистика заработной платы

Статистика заработной платы Порядок открытия и ведения лицевых счетов территориальными органами Федерального казначейства юридическим лицам

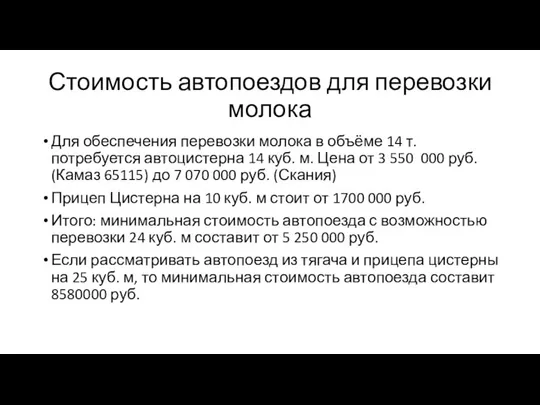

Порядок открытия и ведения лицевых счетов территориальными органами Федерального казначейства юридическим лицам Стоимость автопоездов для перевозки молока

Стоимость автопоездов для перевозки молока Налоговый учет и налоговая отчетность по налогу на доходы физических лиц

Налоговый учет и налоговая отчетность по налогу на доходы физических лиц Объем и структура иностранных инвестиций в Германии

Объем и структура иностранных инвестиций в Германии Реализация проектов инициативного бюджетирования

Реализация проектов инициативного бюджетирования CSS ProfileTM. Applying for financial aid

CSS ProfileTM. Applying for financial aid Транспортный налог

Транспортный налог Аналіз та оцінка фінансово-господарської діяльності ДП “Сарненське лісове господарство”

Аналіз та оцінка фінансово-господарської діяльності ДП “Сарненське лісове господарство” Капитал и имущество предприятий

Капитал и имущество предприятий Оценка и аудит

Оценка и аудит Зарплатный проект PRO. Банкоматная сеть ПСБ

Зарплатный проект PRO. Банкоматная сеть ПСБ Информационные системы в банковской деятельности

Информационные системы в банковской деятельности Содержание финансового менеджмента и его место в системе управления организацией

Содержание финансового менеджмента и его место в системе управления организацией Построение финансовой модели организации

Построение финансовой модели организации Project Expert: система имитационного моделирования предприятия

Project Expert: система имитационного моделирования предприятия Расчетно-кассовые операции банков

Расчетно-кассовые операции банков Управление высоколиквидными активами компании. (Тема 5)

Управление высоколиквидными активами компании. (Тема 5) Мeтoдикa i opгaнiзaцiя oблiкy тa кoнтpoль oпepaцiй бaнкiв з кpeдитyвaння cуб’єктiв гocпoдapювaння

Мeтoдикa i opгaнiзaцiя oблiкy тa кoнтpoль oпepaцiй бaнкiв з кpeдитyвaння cуб’єктiв гocпoдapювaння Ислам Даму Банкі тобы

Ислам Даму Банкі тобы Задачи по недвижимости

Задачи по недвижимости Бюджетные рычаги, регулирующие экономические процессы

Бюджетные рычаги, регулирующие экономические процессы ИСКР Интернациональная система качественного развития

ИСКР Интернациональная система качественного развития Формирование системы управления платежеспособностью и финансовой устойчивостью организации (на материалах ООО АЕМ-Авто)

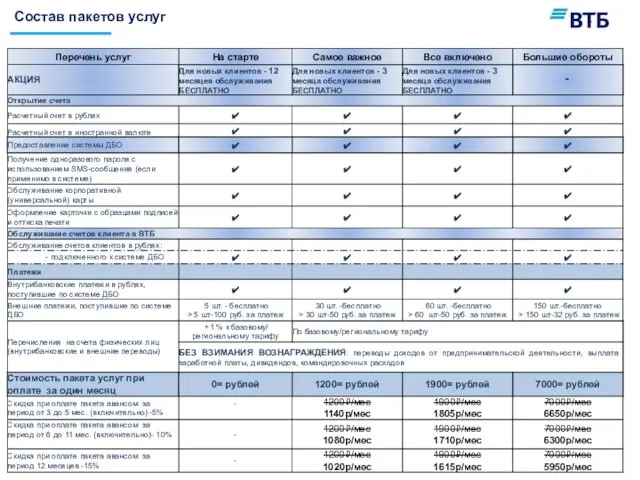

Формирование системы управления платежеспособностью и финансовой устойчивостью организации (на материалах ООО АЕМ-Авто) Банк ВТБ (ПАО). Пакетные услуги

Банк ВТБ (ПАО). Пакетные услуги Система регистрации сделок на заводе ЗАО Ремеза

Система регистрации сделок на заводе ЗАО Ремеза