Содержание

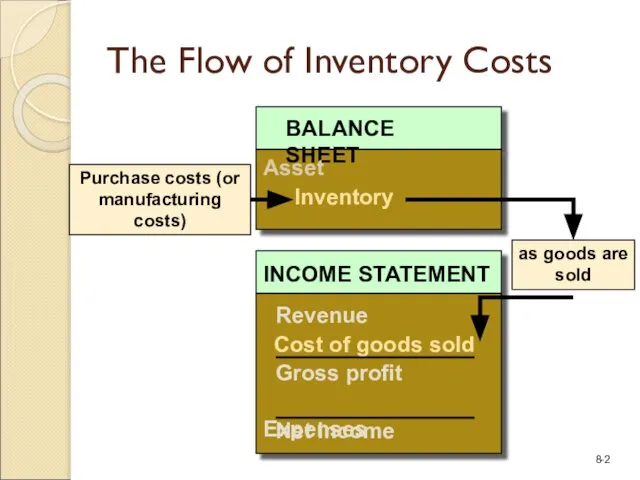

- 2. as goods are sold The Flow of Inventory Costs

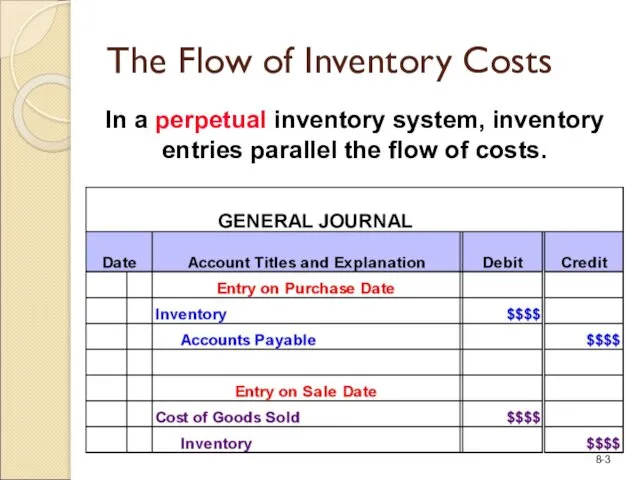

- 3. In a perpetual inventory system, inventory entries parallel the flow of costs. The Flow of Inventory

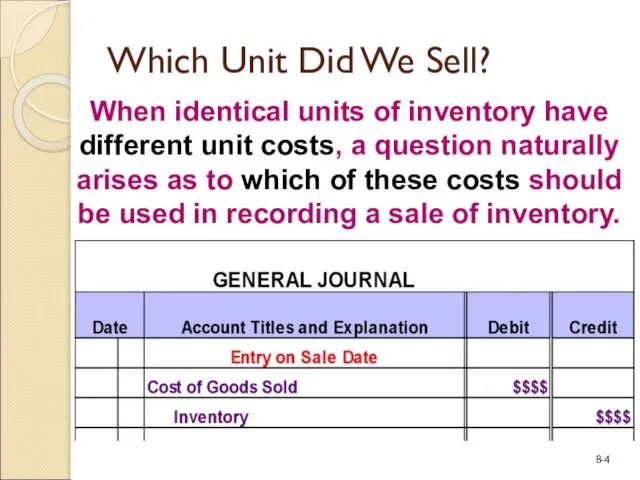

- 4. When identical units of inventory have different unit costs, a question naturally arises as to which

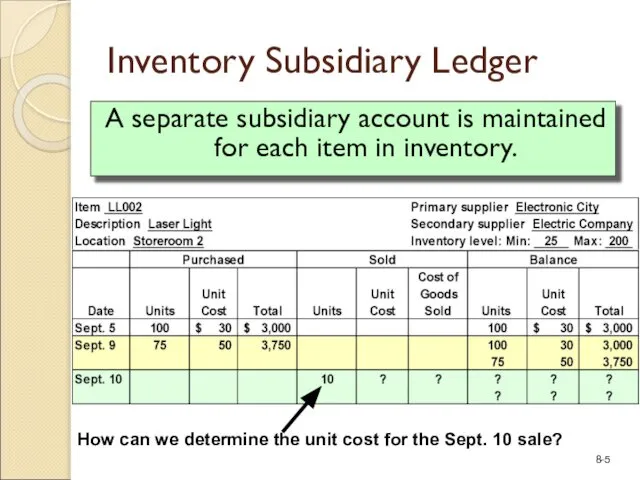

- 5. Inventory Subsidiary Ledger A separate subsidiary account is maintained for each item in inventory. How can

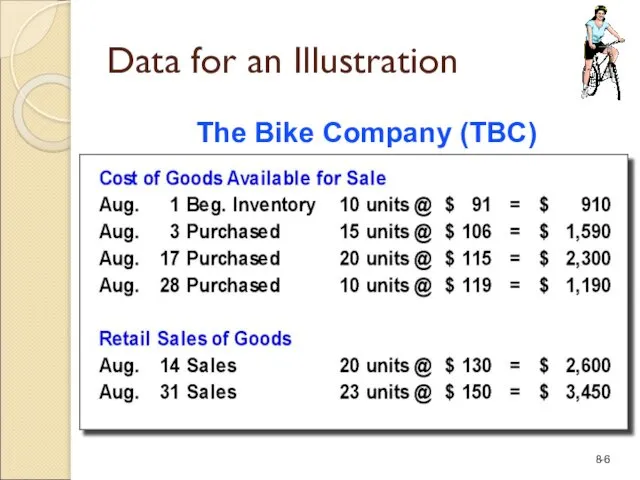

- 6. The Bike Company (TBC) Data for an Illustration

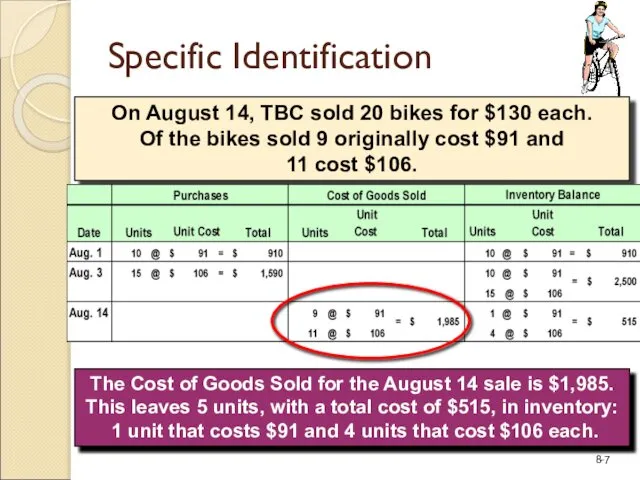

- 7. On August 14, TBC sold 20 bikes for $130 each. Of the bikes sold 9 originally

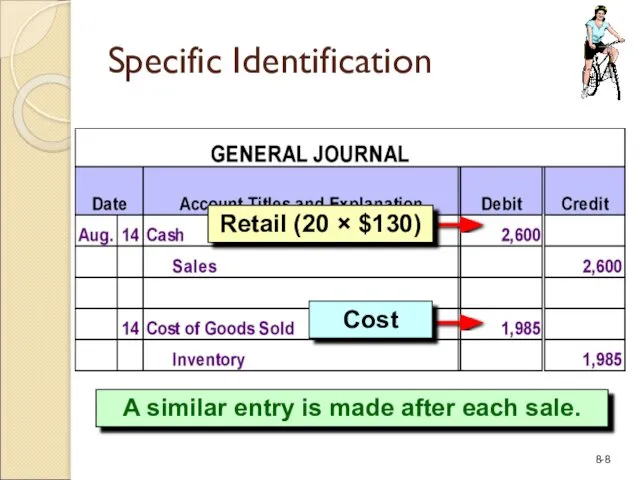

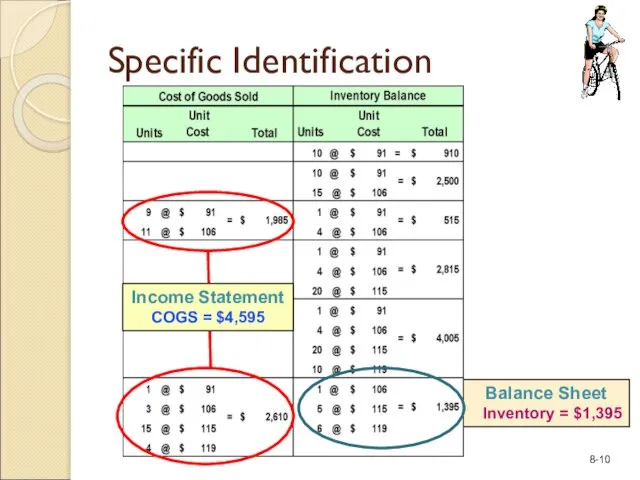

- 8. A similar entry is made after each sale. Specific Identification

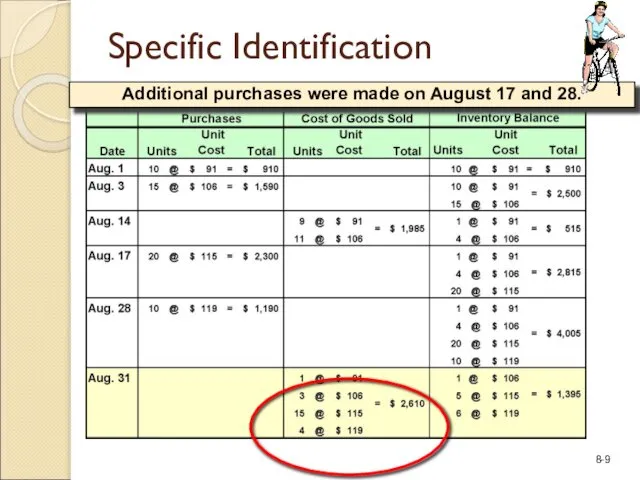

- 9. Additional purchases were made on August 17 and 28. Specific Identification

- 10. Balance Sheet Inventory = $1,395 Specific Identification Income Statement COGS = $4,595

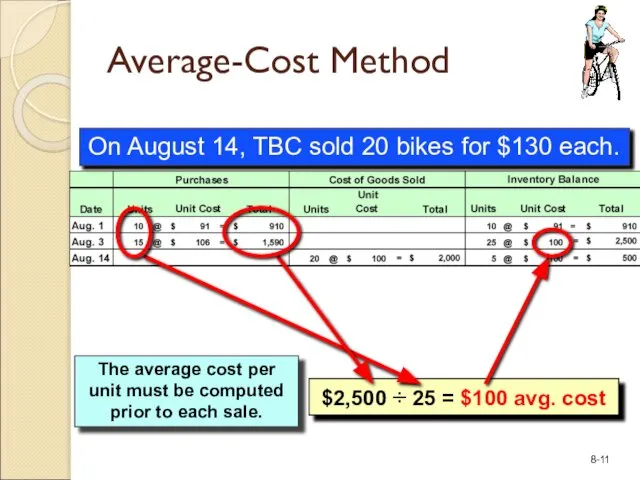

- 11. Average-Cost Method The average cost per unit must be computed prior to each sale. On August

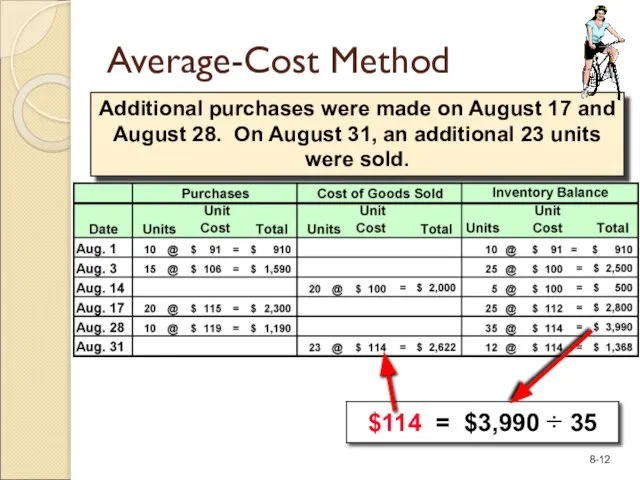

- 12. Average-Cost Method Additional purchases were made on August 17 and August 28. On August 31, an

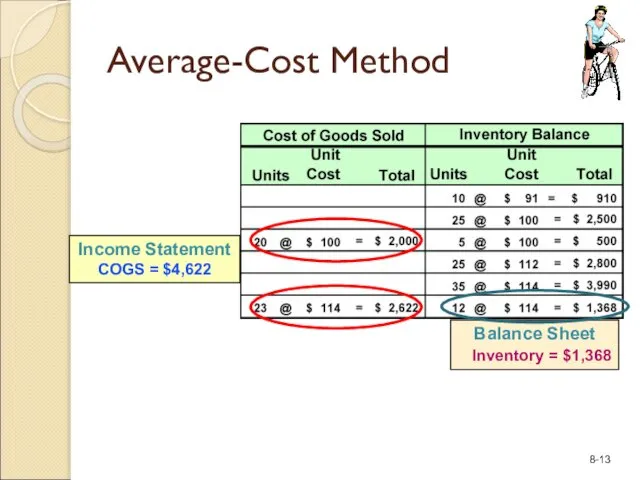

- 13. Income Statement COGS = $4,622 Balance Sheet Inventory = $1,368 Average-Cost Method

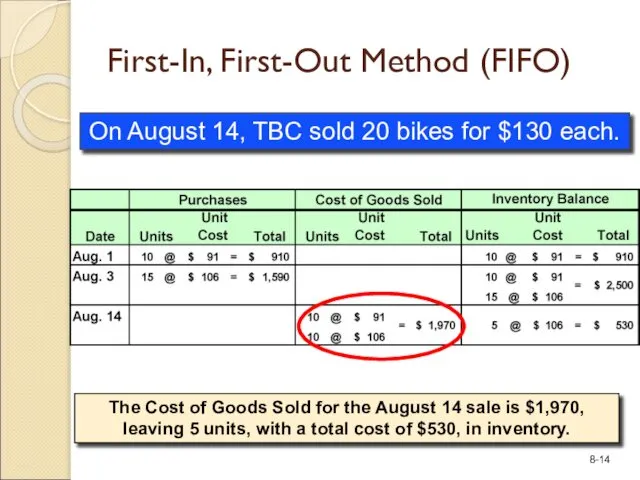

- 14. On August 14, TBC sold 20 bikes for $130 each. First-In, First-Out Method (FIFO)

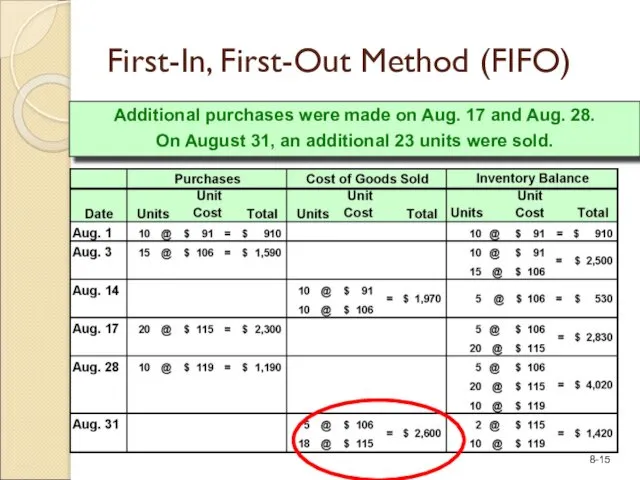

- 15. Additional purchases were made on Aug. 17 and Aug. 28. On August 31, an additional 23

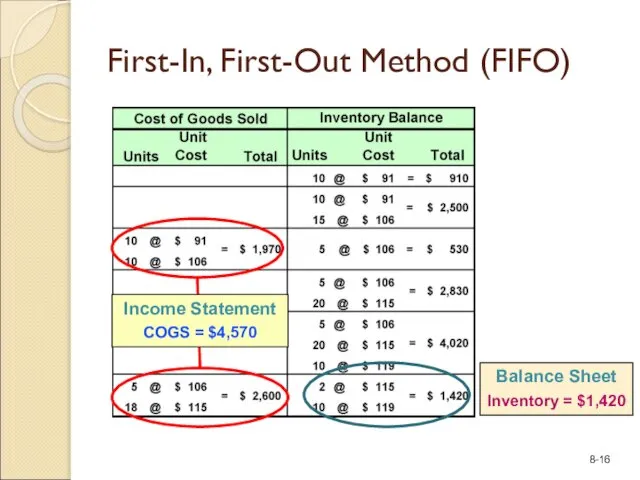

- 16. First-In, First-Out Method (FIFO) Balance Sheet Inventory = $1,420 Income Statement COGS = $4,570

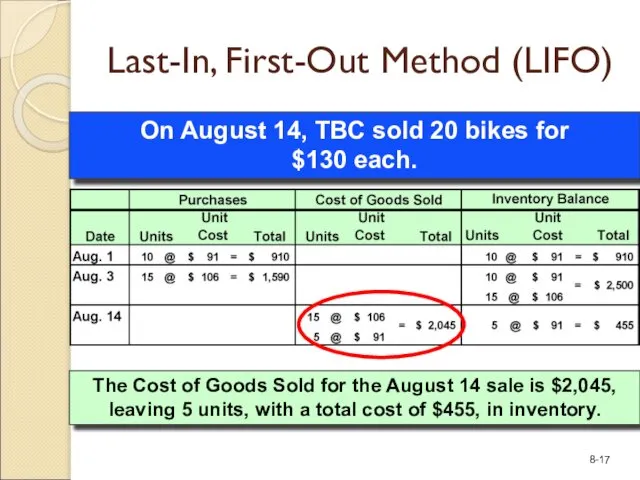

- 17. On August 14, TBC sold 20 bikes for $130 each. Last-In, First-Out Method (LIFO) The Cost

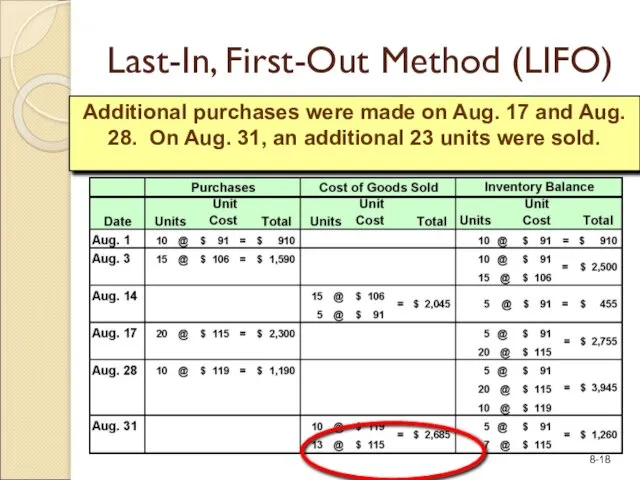

- 18. Last-In, First-Out Method (LIFO) Additional purchases were made on Aug. 17 and Aug. 28. On Aug.

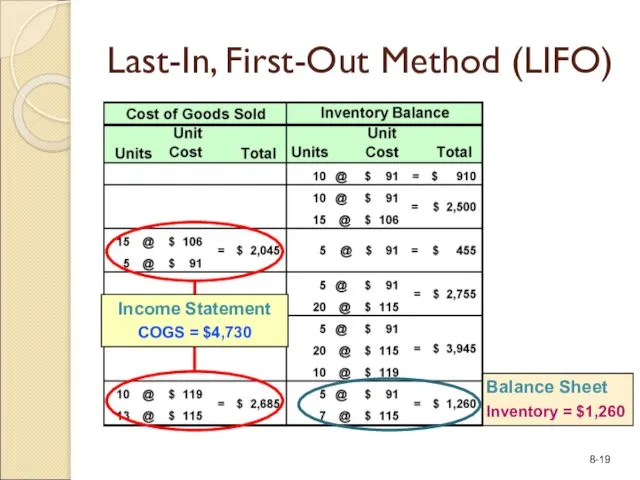

- 19. Balance Sheet Inventory = $1,260 Last-In, First-Out Method (LIFO) Income Statement COGS = $4,730

- 21. Once a company has adopted a particular accounting method, it should follow that method consistently rather

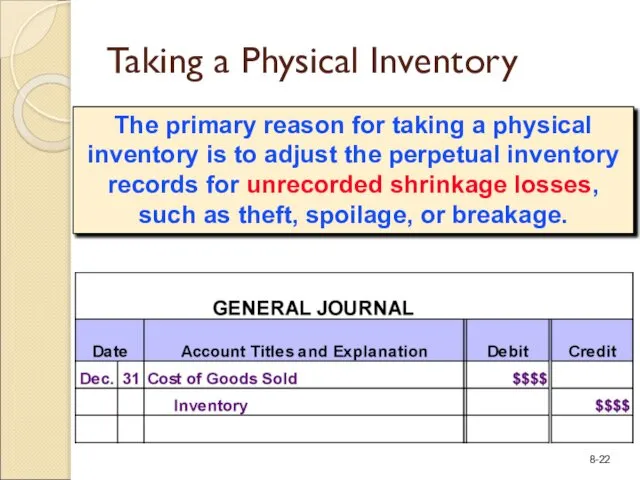

- 22. The primary reason for taking a physical inventory is to adjust the perpetual inventory records for

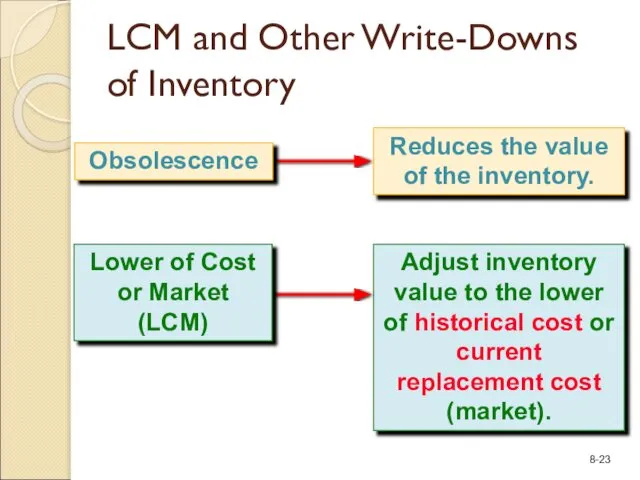

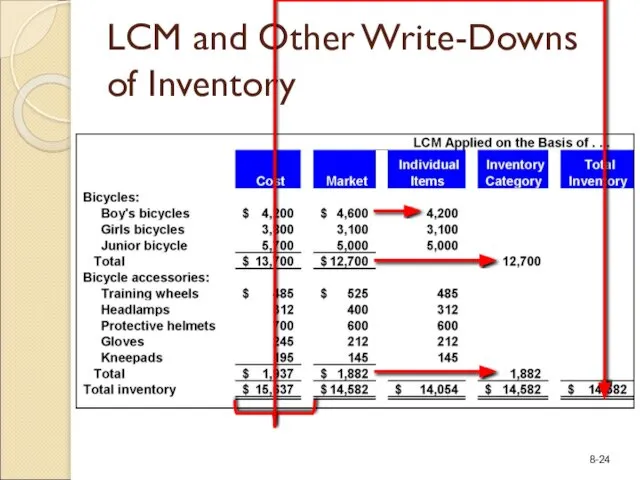

- 23. LCM and Other Write-Downs of Inventory

- 24. LCM and Other Write-Downs of Inventory

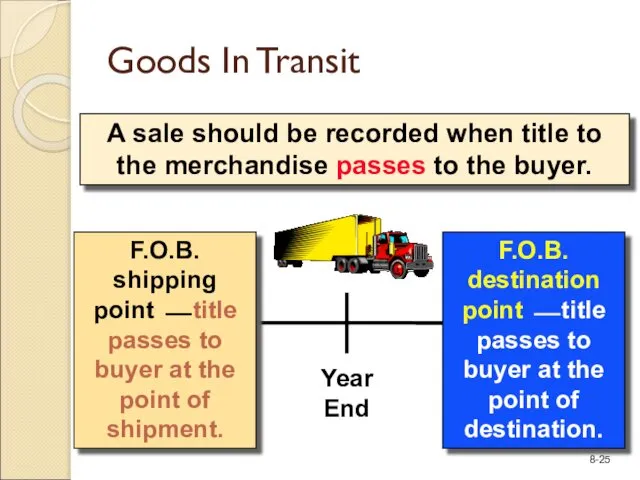

- 25. Year End A sale should be recorded when title to the merchandise passes to the buyer.

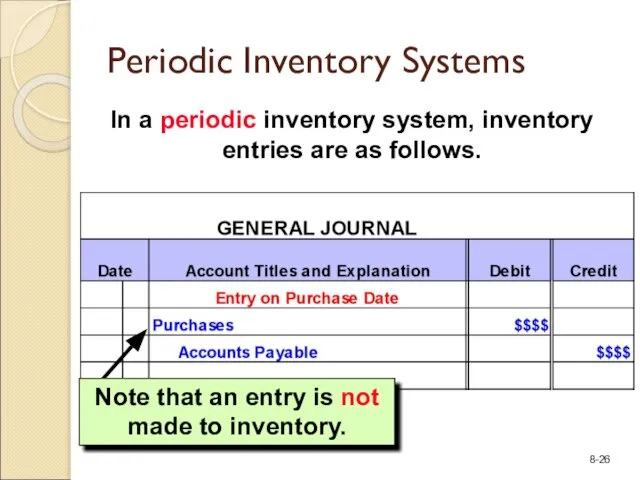

- 26. In a periodic inventory system, inventory entries are as follows. Note that an entry is not

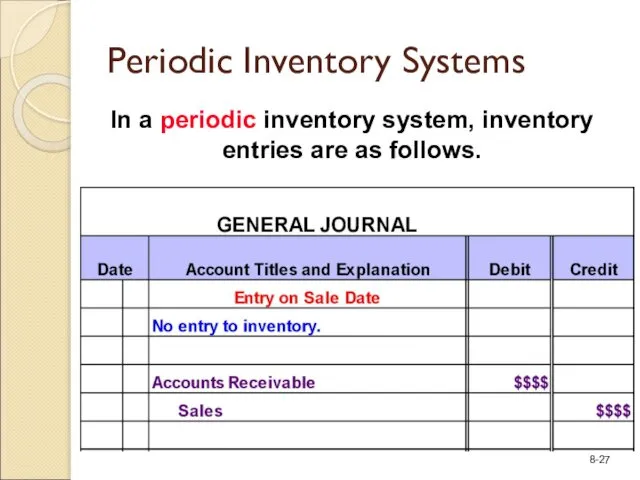

- 27. In a periodic inventory system, inventory entries are as follows. Periodic Inventory Systems

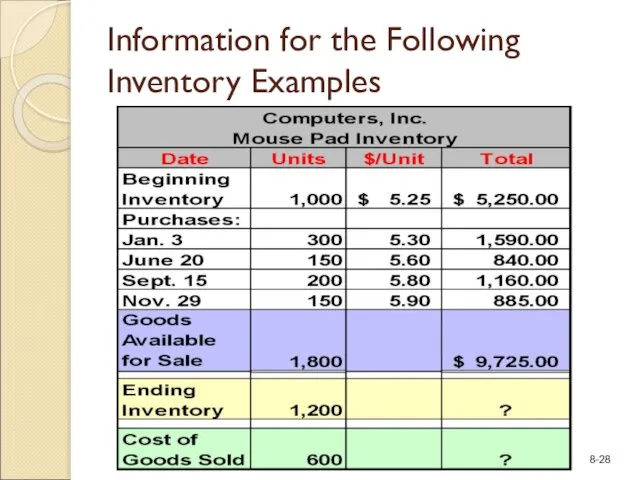

- 28. Information for the Following Inventory Examples

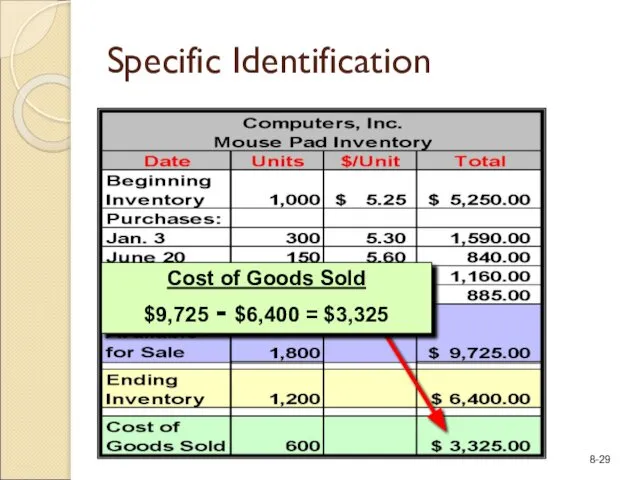

- 29. Specific Identification

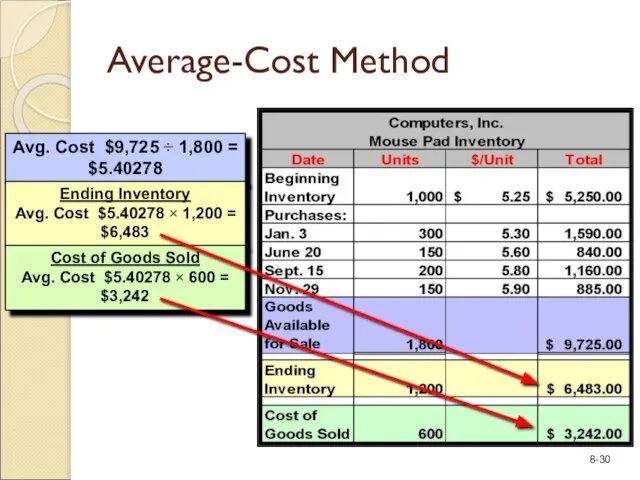

- 30. Avg. Cost $9,725 ÷ 1,800 = $5.40278 Average-Cost Method Ending Inventory Avg. Cost $5.40278 × 1,200

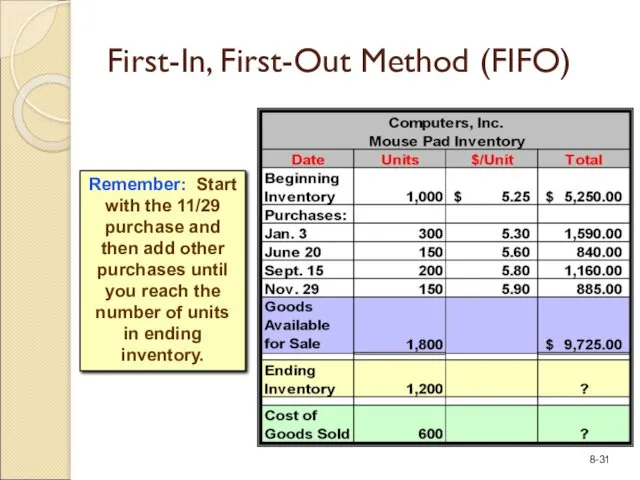

- 31. Remember: Start with the 11/29 purchase and then add other purchases until you reach the number

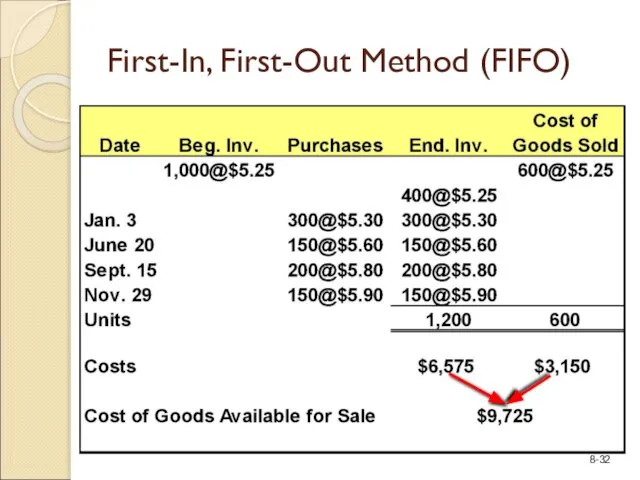

- 32. Now, let’s complete the table. First-In, First-Out Method (FIFO) Now, we have allocated the cost to

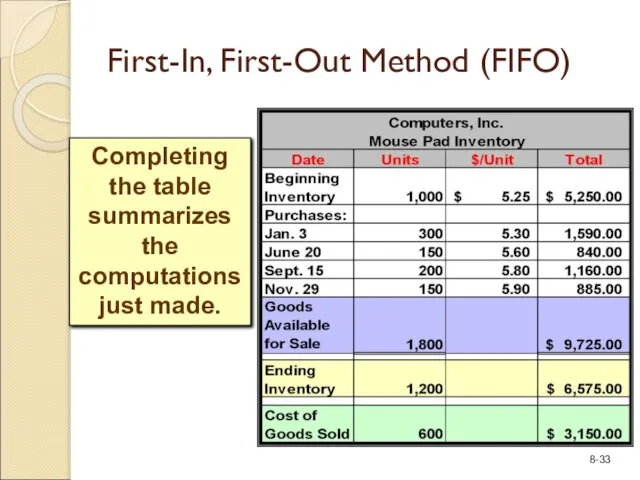

- 33. Completing the table summarizes the computations just made. First-In, First-Out Method (FIFO)

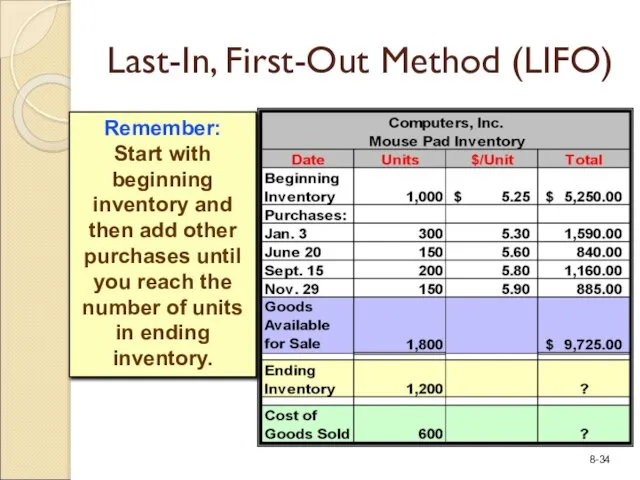

- 34. Remember: Start with beginning inventory and then add other purchases until you reach the number of

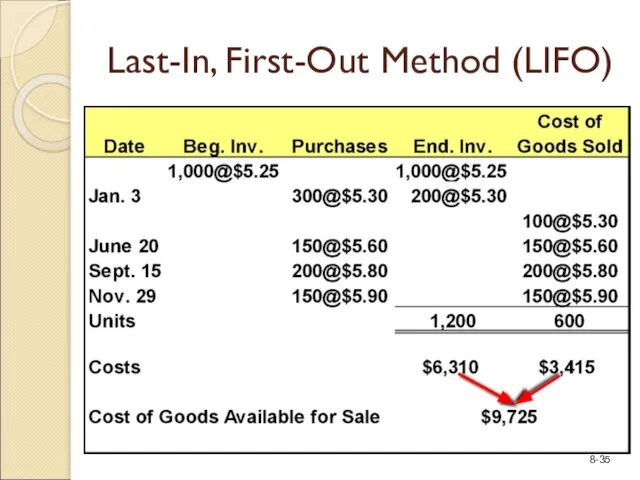

- 35. Last-In, First-Out Method (LIFO) Now, we have allocated the cost to all 1,200 units in ending

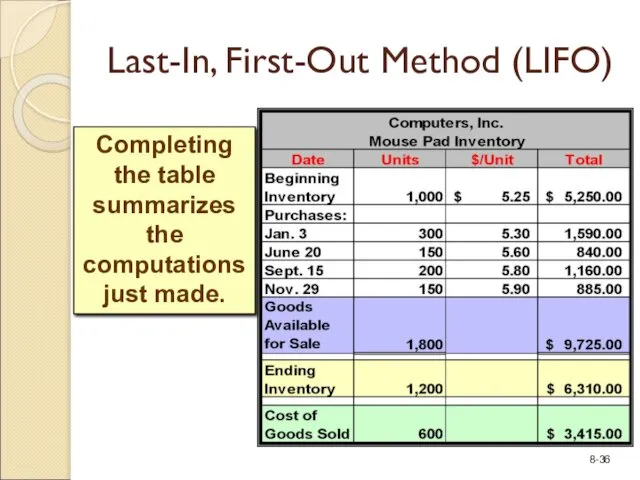

- 36. Completing the table summarizes the computations just made. Last-In, First-Out Method (LIFO)

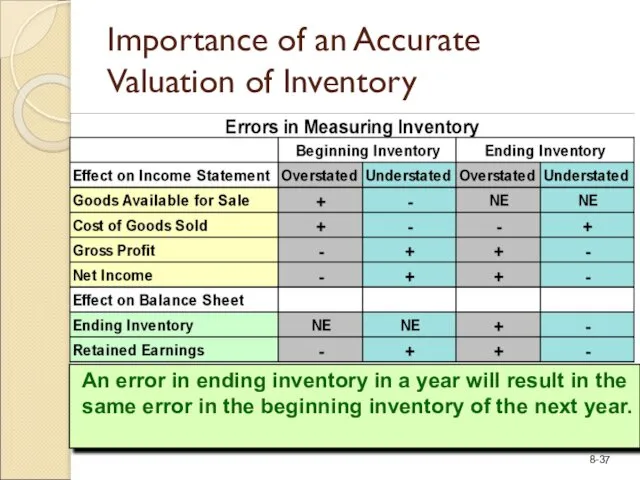

- 37. An error in ending inventory in a year will result in the same error in the

- 38. The Gross Profit Method Determine cost of goods available for sale. Estimate cost of goods sold

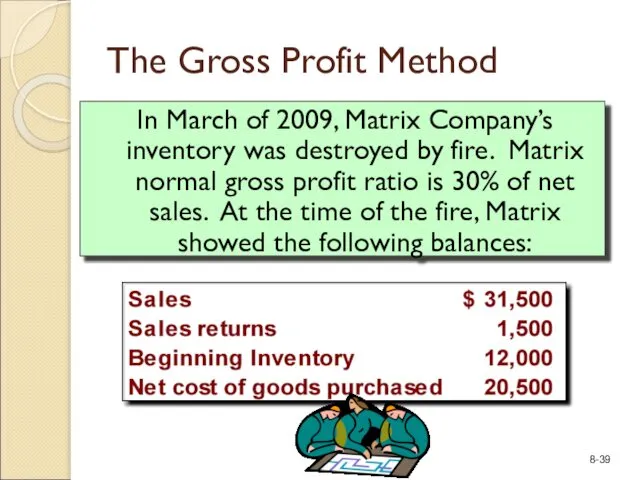

- 39. The Gross Profit Method In March of 2009, Matrix Company’s inventory was destroyed by fire. Matrix

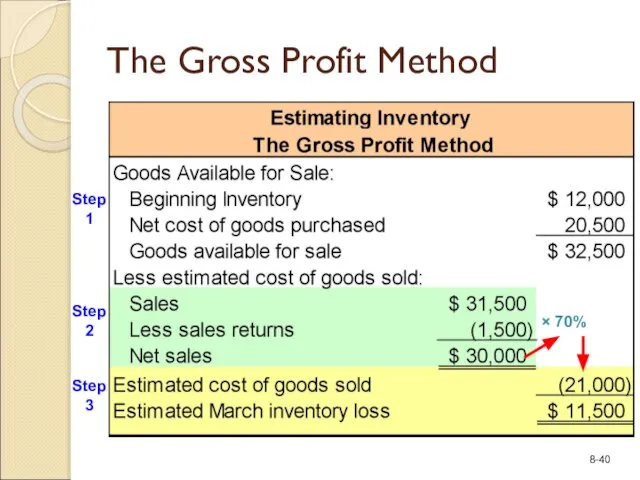

- 40. The Gross Profit Method Step 1 Step 2 Step 3

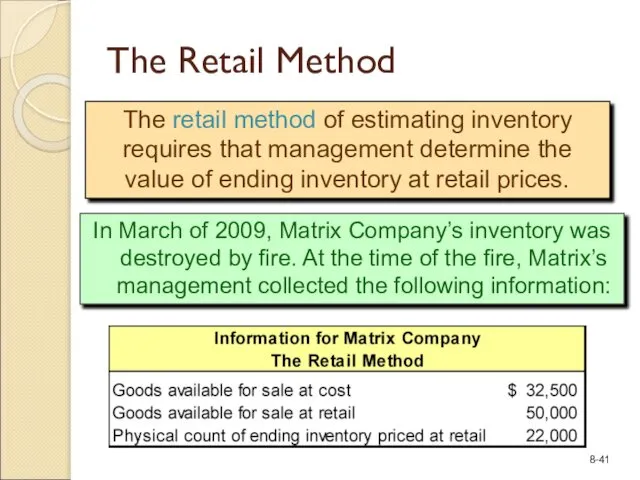

- 41. The Retail Method The retail method of estimating inventory requires that management determine the value of

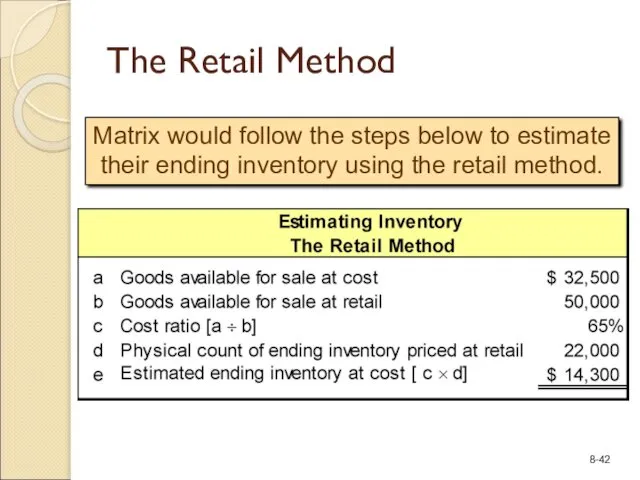

- 42. The Retail Method Matrix would follow the steps below to estimate their ending inventory using the

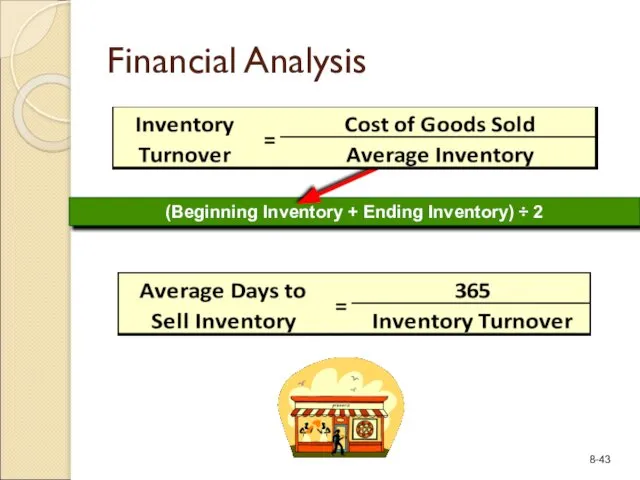

- 43. (Beginning Inventory + Ending Inventory) ÷ 2 Financial Analysis

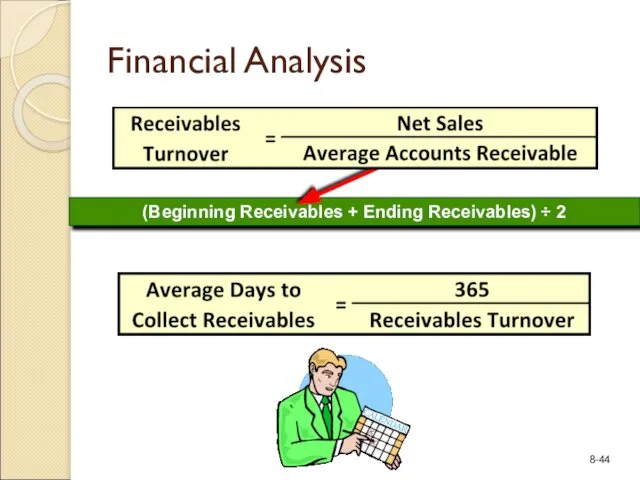

- 44. Financial Analysis (Beginning Receivables + Ending Receivables) ÷ 2

- 46. Скачать презентацию

Фінансова стратегія: поняття, еволюція, концепції

Фінансова стратегія: поняття, еволюція, концепції Коррупция как болезнь современной России

Коррупция как болезнь современной России Венчурный фонд

Венчурный фонд Оплата труда в организации. Формы и системы оплаты труда

Оплата труда в организации. Формы и системы оплаты труда Финансовые результаты предприятия

Финансовые результаты предприятия Проценты по вкладу: большие и маленькие. Финансовая грамотность, 10 класс

Проценты по вкладу: большие и маленькие. Финансовая грамотность, 10 класс Счета бухгалтерского учета

Счета бухгалтерского учета О мерах по повышению заработной платы учителей

О мерах по повышению заработной платы учителей Основы построения страховых тарифов (Тема 2)

Основы построения страховых тарифов (Тема 2) Организация учета готовой продукции и расчетов с покупателями и заказчиками. ООО Омский завод плавленых сыров

Организация учета готовой продукции и расчетов с покупателями и заказчиками. ООО Омский завод плавленых сыров Подготовка информации, необходимой для оценки бизнеса

Подготовка информации, необходимой для оценки бизнеса Финансы и деньги

Финансы и деньги Современные проблемы мировой финансовой системы. Четвертая промышленная революция и проблема труда

Современные проблемы мировой финансовой системы. Четвертая промышленная революция и проблема труда Конференция попечительского совета

Конференция попечительского совета Сущность и состав финансовых ресурсов: новые реалии

Сущность и состав финансовых ресурсов: новые реалии Предмет и метод бухгалтерского учета

Предмет и метод бухгалтерского учета Органы финансово-экономического контроля

Органы финансово-экономического контроля Упрощённая система налогообложения

Упрощённая система налогообложения Аудит магазина, анализ конкурентов. Точки масштабирования бренда

Аудит магазина, анализ конкурентов. Точки масштабирования бренда 20171007_o7-15

20171007_o7-15 Налоговый вычет в 2020 году

Налоговый вычет в 2020 году Frendex - закрытый инвестиционный клуб

Frendex - закрытый инвестиционный клуб Финансы, банки, ценные бумаги (подготовка к ГИА по обществознанию)

Финансы, банки, ценные бумаги (подготовка к ГИА по обществознанию) Инфляция. Причины инфляции

Инфляция. Причины инфляции Вкладывай средства в своё будущее

Вкладывай средства в своё будущее Стоп-коронавирус

Стоп-коронавирус Анализ платежеспособности и ликвидности предприятия. (Тема 3)

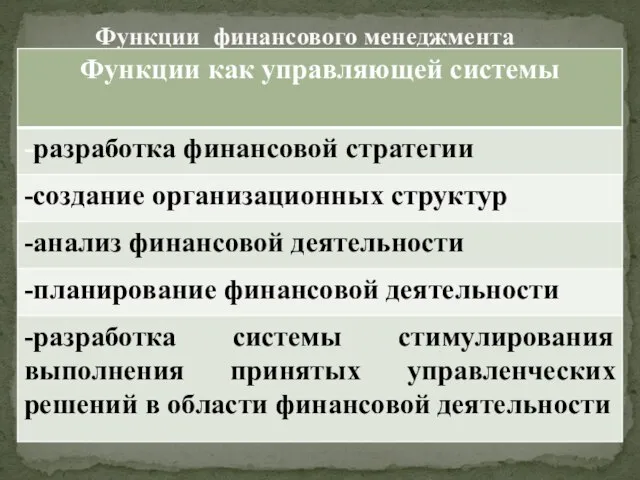

Анализ платежеспособности и ликвидности предприятия. (Тема 3) Функции финансового менеджмента

Функции финансового менеджмента