Содержание

- 2. After studying Chapter 8, you should be able to: Explain how the definition of "working capital"

- 3. Overview of Working Capital Management Working Capital Concepts Working Capital Issues Financing Current Assets: Short-Term and

- 4. Working Capital Concepts Net Working Capital Current Assets - Current Liabilities. Gross Working Capital The firm’s

- 5. Significance of Working Capital Management In a typical manufacturing firm, current assets exceed one-half of total

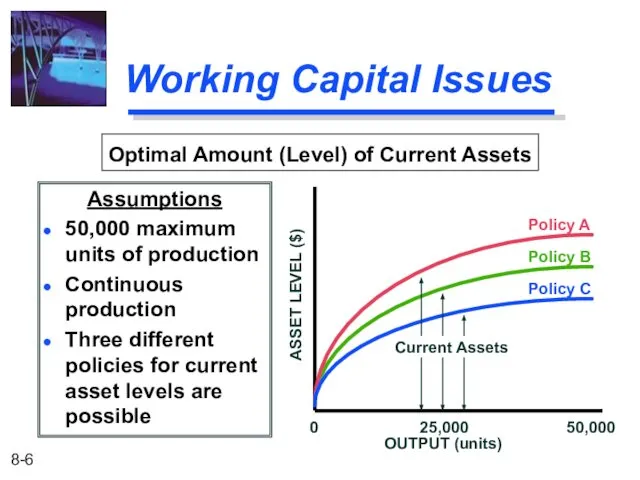

- 6. Working Capital Issues Assumptions 50,000 maximum units of production Continuous production Three different policies for current

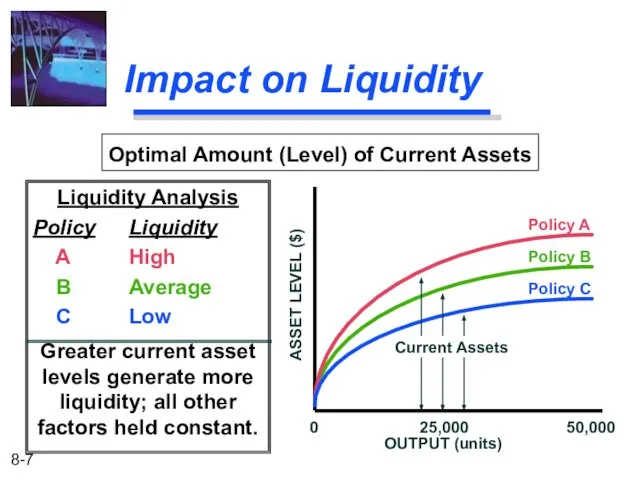

- 7. Impact on Liquidity Liquidity Analysis Policy Liquidity A High B Average C Low Greater current asset

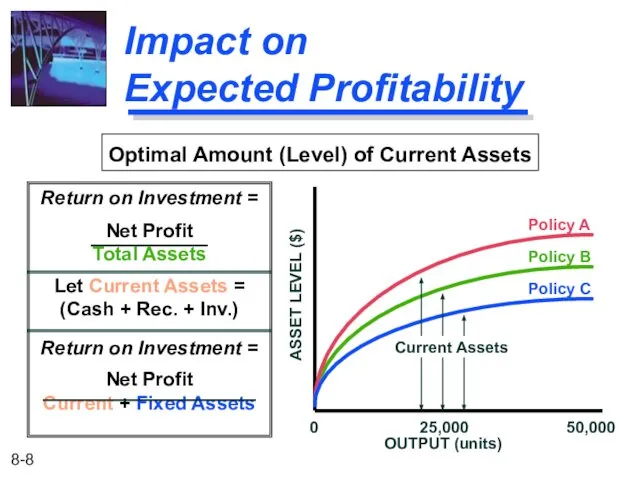

- 8. Impact on Expected Profitability Return on Investment = Net Profit Total Assets Let Current Assets =

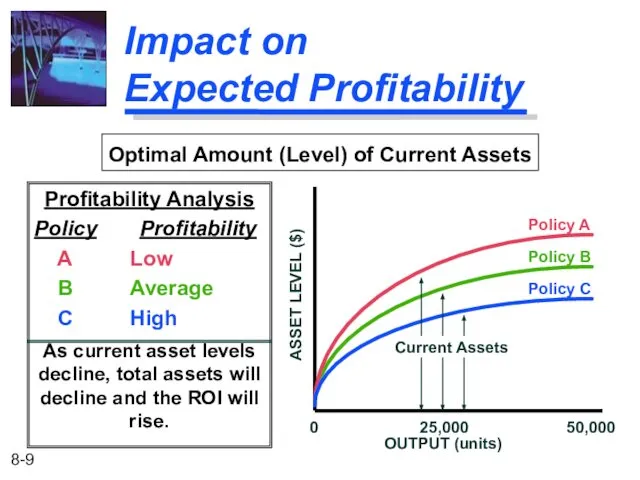

- 9. Impact on Expected Profitability Profitability Analysis Policy Profitability A Low B Average C High As current

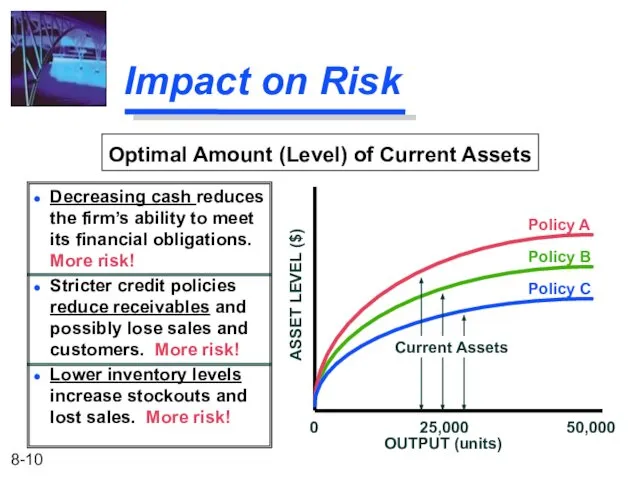

- 10. Impact on Risk Decreasing cash reduces the firm’s ability to meet its financial obligations. More risk!

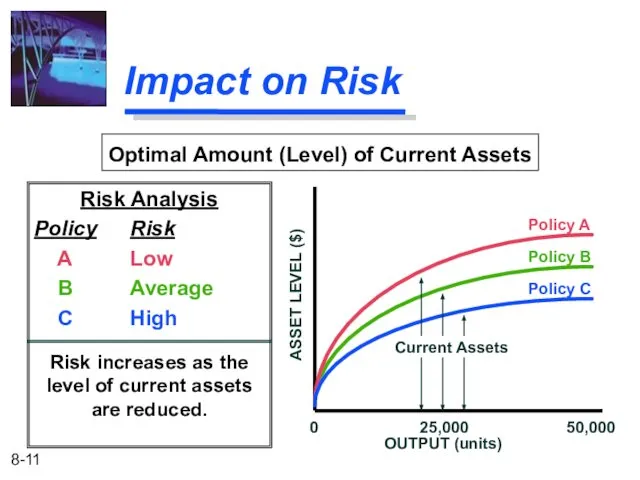

- 11. Impact on Risk Risk Analysis Policy Risk A Low B Average C High Risk increases as

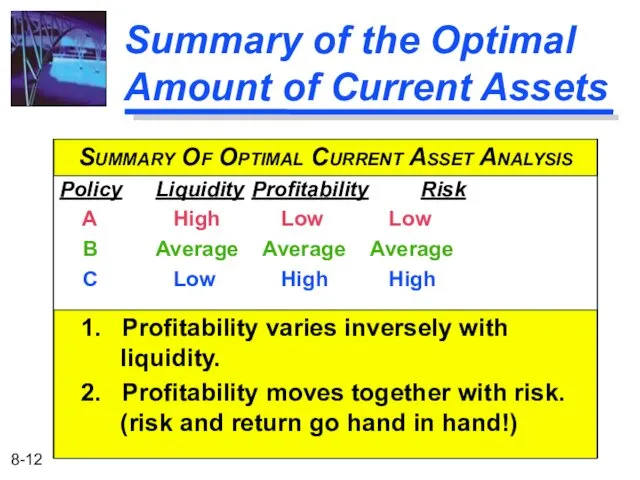

- 12. Summary of the Optimal Amount of Current Assets SUMMARY OF OPTIMAL CURRENT ASSET ANALYSIS Policy Liquidity

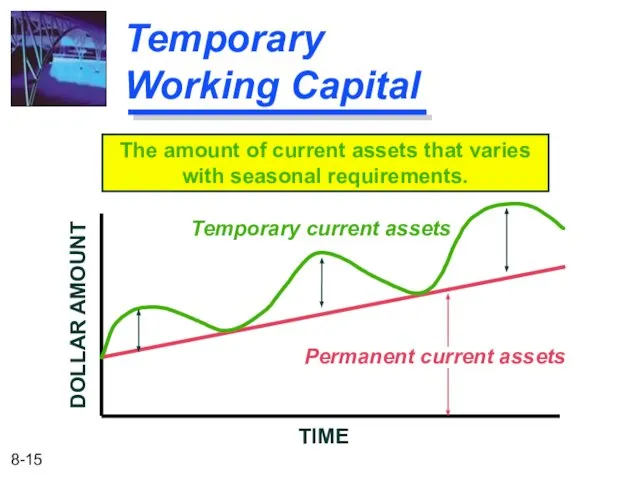

- 13. Classifications of Working Capital Time Permanent Temporary Components Cash, marketable securities, receivables, and inventory

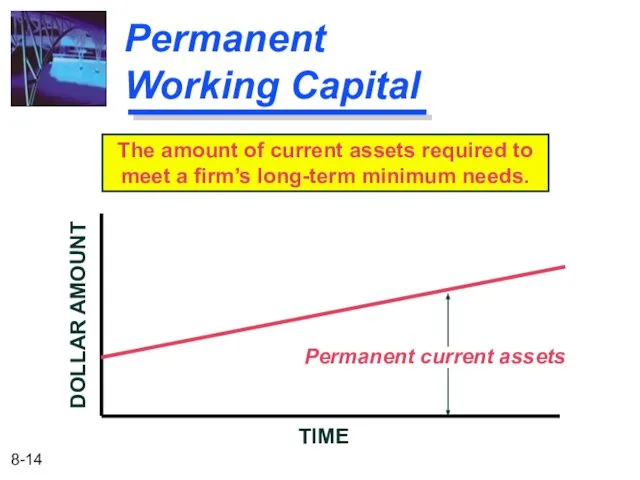

- 14. Permanent Working Capital The amount of current assets required to meet a firm’s long-term minimum needs.

- 15. Temporary Working Capital The amount of current assets that varies with seasonal requirements. Permanent current assets

- 16. Financing Current Assets: Short-Term and Long-Term Mix Spontaneous Financing: Trade credit, and other payables and accruals,

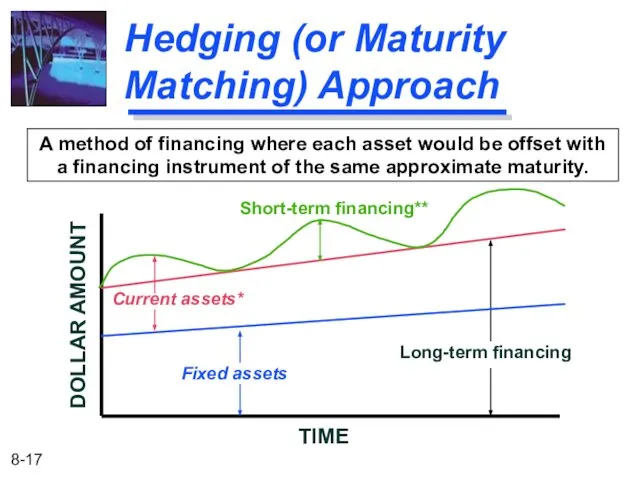

- 17. Hedging (or Maturity Matching) Approach A method of financing where each asset would be offset with

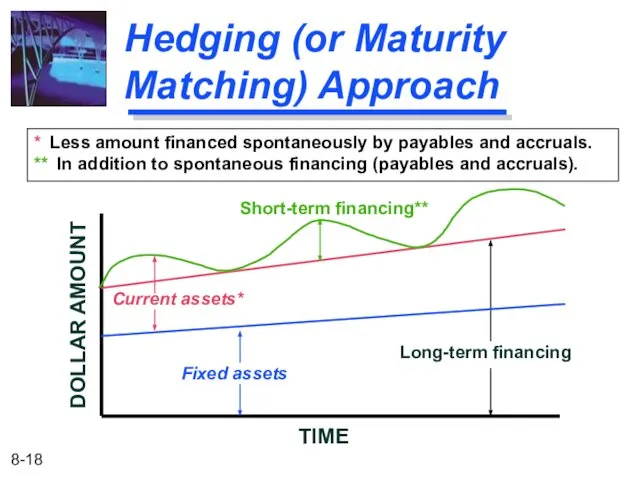

- 18. Hedging (or Maturity Matching) Approach * Less amount financed spontaneously by payables and accruals. ** In

- 19. Financing Needs and the Hedging Approach Fixed assets and the non-seasonal portion of current assets are

- 20. Self-Liquidating Nature of Short-Term Loans Seasonal orders require the purchase of inventory beyond current levels. Increased

- 21. Risks vs. Costs Trade-Off (Conservative Approach) Long-Term Financing Benefits Less worry in refinancing short-term obligations Less

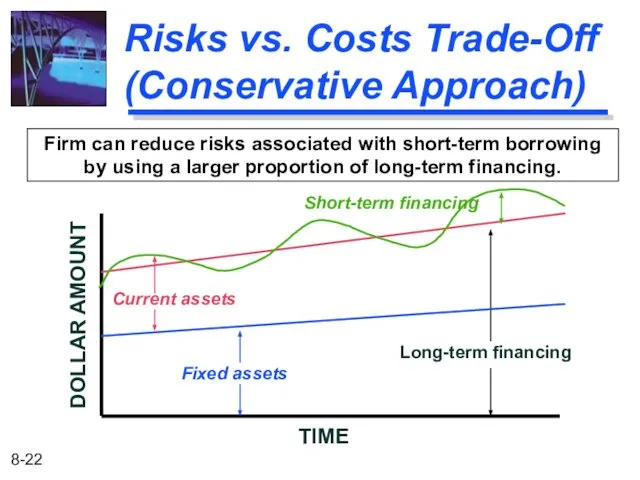

- 22. Risks vs. Costs Trade-Off (Conservative Approach) Firm can reduce risks associated with short-term borrowing by using

- 23. Comparison with an Aggressive Approach Short-Term Financing Benefits Financing long-term needs with a lower interest cost

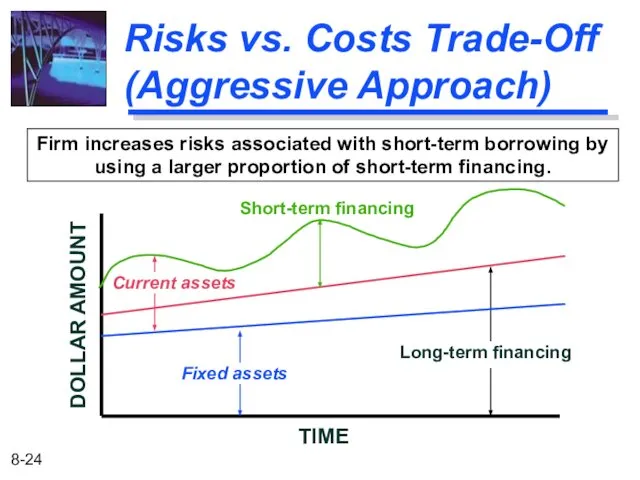

- 24. Firm increases risks associated with short-term borrowing by using a larger proportion of short-term financing. TIME

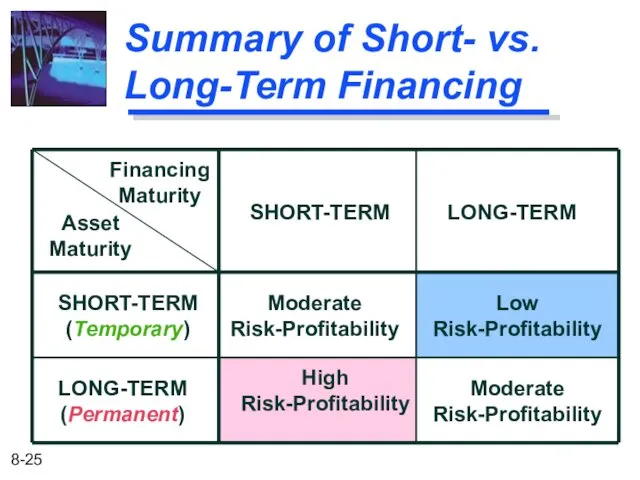

- 25. Summary of Short- vs. Long-Term Financing Financing Maturity Asset Maturity SHORT-TERM LONG-TERM Low Risk-Profitability Moderate Risk-Profitability

- 27. Скачать презентацию

Проектная деятельность в образовании. Управление проектами

Проектная деятельность в образовании. Управление проектами Второй этап работы над проектом: организация групп, роли в команде

Второй этап работы над проектом: организация групп, роли в команде Реструктуризация управления компанией

Реструктуризация управления компанией Трудовая адаптация персонала

Трудовая адаптация персонала Глобальные системы резервирования как эффективные рекламные технологии

Глобальные системы резервирования как эффективные рекламные технологии Организационная культура

Организационная культура Мотивация СМЗ 2.0

Мотивация СМЗ 2.0 Manager`s proffesional skils and personality traids

Manager`s proffesional skils and personality traids Тәуекел менеджментінің базалық тұжырымдамалыры және көрсеткіштері

Тәуекел менеджментінің базалық тұжырымдамалыры және көрсеткіштері Мотивация как функция управления

Мотивация как функция управления Форматы мероприятий

Форматы мероприятий Сутність туристичних формальностей

Сутність туристичних формальностей Мотивация

Мотивация Внедрение автоматизированной подсистемы управления персоналом

Внедрение автоматизированной подсистемы управления персоналом Работа менеджера в организации

Работа менеджера в организации Сущность управленческих отношений в организации

Сущность управленческих отношений в организации Гостиница Базилика

Гостиница Базилика Бизнес процессы. Отдел продаж. Производство

Бизнес процессы. Отдел продаж. Производство Стратегический подход к управлению изменениями

Стратегический подход к управлению изменениями Понятие и характеристика затрат в логистической деятельности

Понятие и характеристика затрат в логистической деятельности Административная (классическая) школа менеджмента

Административная (классическая) школа менеджмента Использование информационных технологий на предприятии оптовой торговли

Использование информационных технологий на предприятии оптовой торговли Задача принятия управленческого решения

Задача принятия управленческого решения Оценка сложных систем в условиях стохастической неопределенности. (Лекция 10)

Оценка сложных систем в условиях стохастической неопределенности. (Лекция 10) Метрологическое обеспечение АЗС

Метрологическое обеспечение АЗС Стили работы лидера

Стили работы лидера Финансовый менеджмент

Финансовый менеджмент 2. Международная Ассоциация Управления Проектами

2. Международная Ассоциация Управления Проектами